As a follow-up to the changes implemented last month in response to the delisting of UGLD and ZIV we are implementing again some changes:

- New 2x leveraged Universal Investment Strategy

- New 2x leveraged US Market Strategy

- New Portfolio configuration & reoptimization

To keep the newsletter manageable we’ve detailed these changes in a separate post.

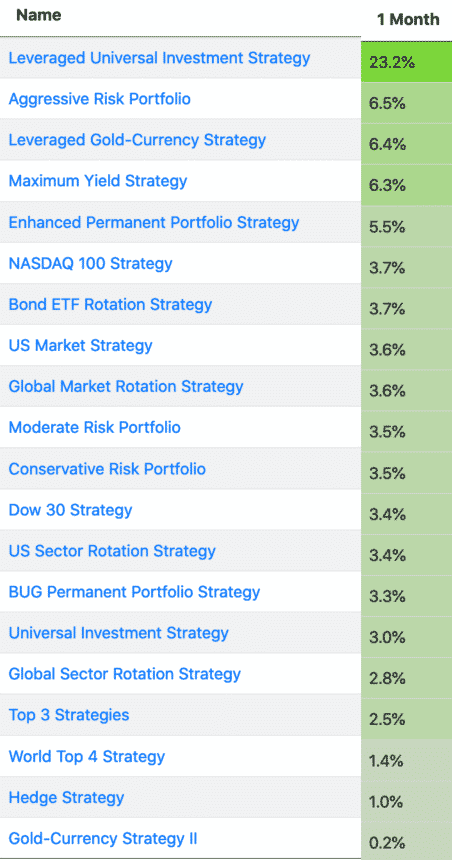

All strategies positive.

Another good month for LI strategies and portfolios, most returning 3-5% for the month of July.

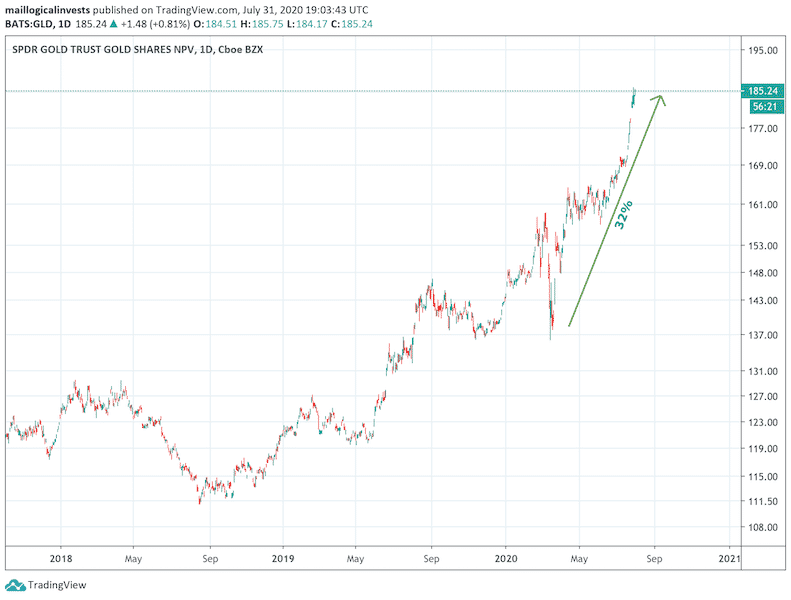

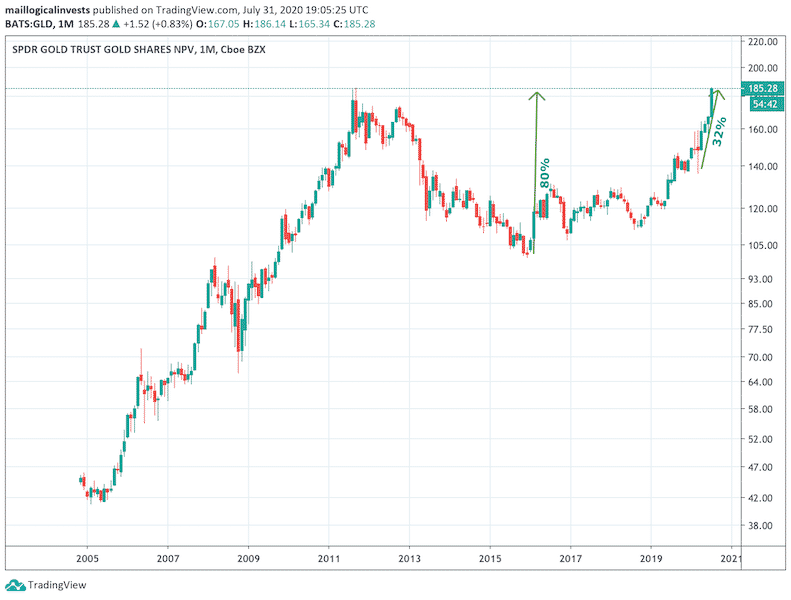

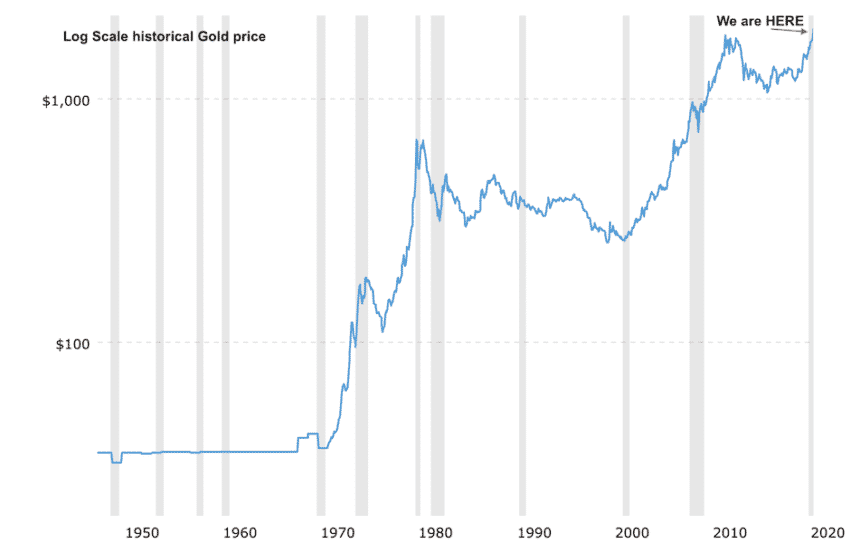

July’s notable mover was gold (+10.8%) as it spiked up $2 short of the all time high of $2000 (see charts at he end). Many of you have noticed that recently LI portfolios had large allocations to gold. This was due to the HEDGE sub-strategy, which is included in most of our portfolios, picking GLD to partially hedge risk. Unfortunately HEDGE chose cash for July. Why is that ? Doesn’t Hedge pick the best performer from TIP, TLT, GSY and GLD?

HEDGE in cash for July

For the most part HEDGE picks the best risk-adjusted performer but it also considers mean reversion. So when an asset’s price increases very rapidly the algo is trained to temporarily ‘punish’ such behavior and pick the next best asset. History shows that these large moves often revert back. Obviously this is not always the case.

Still performances were more than satisfactory even without the larger gold allocation.

The Leveraged Universal Investment strategy continues on…

The Leveraged Universal Investment Strategy, which did carry a leveraged position in gold (150% GLD, 40% TMF and 10% SPXL), surged by 21%. Usually such numbers come from strategies that eventually ‘blow up’ but UIS 3x has been around since 2015 as it was first publicly introduced in a Seeking Alpha article. It now stands at a historical performance of +225% (from April 2015).

All assets up

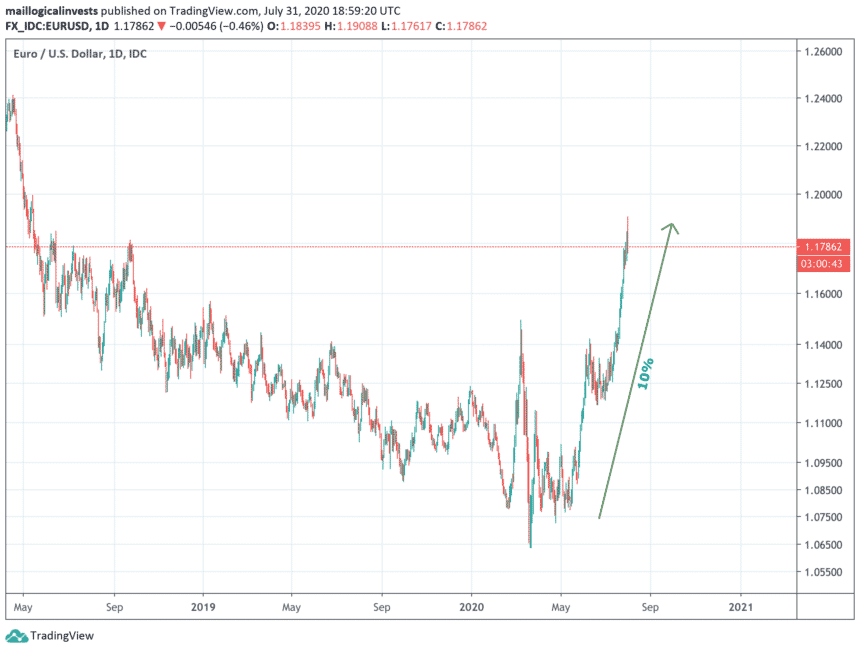

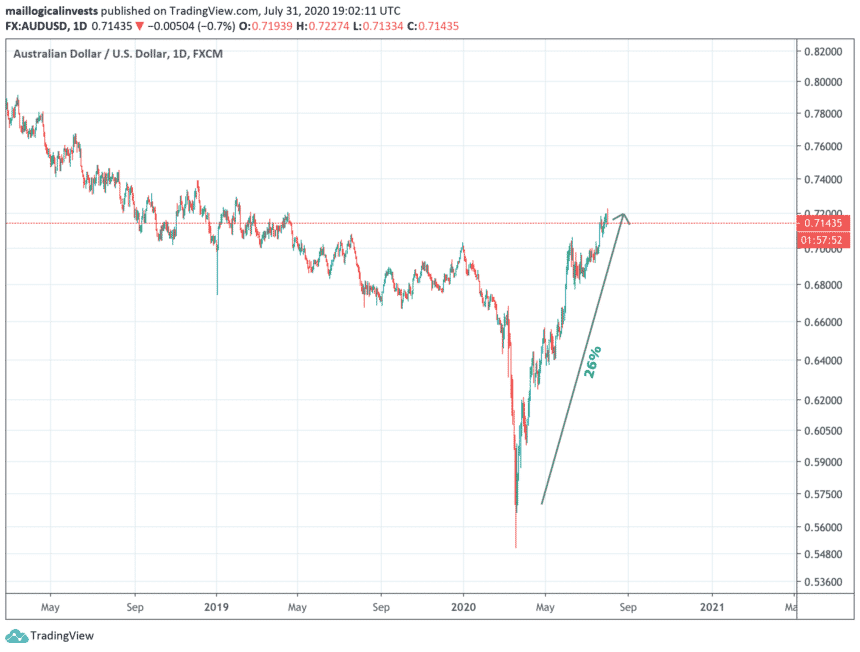

It was not just gold. Most asset prices rose in July benefiting investors with domestic. foreign equity or bond exposure. The most important move came from the Euro rising up by 5%. Seen in a broader context these moves lead us back to the he dollar Index.

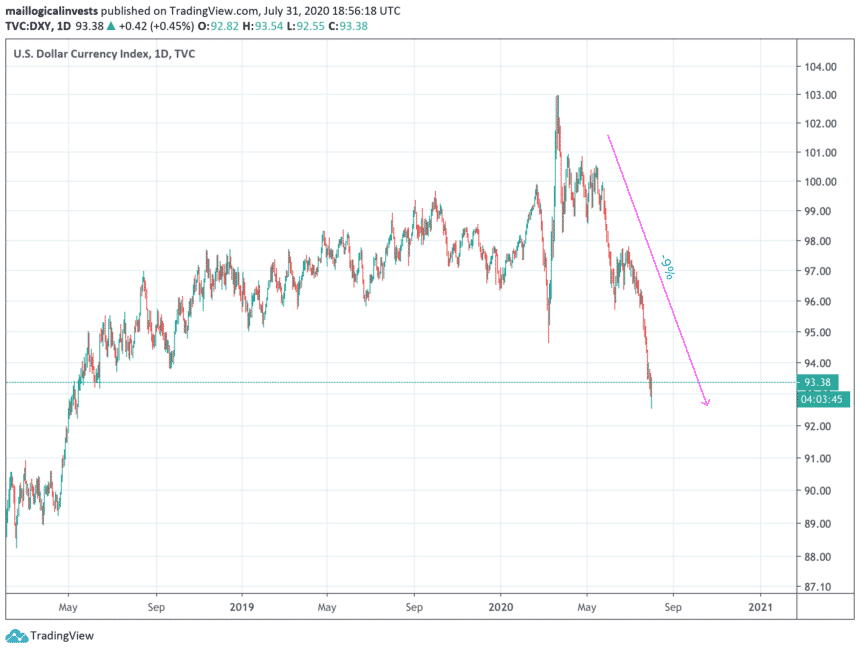

A small death for the dollar.

Were we discuss the elephant in the room: The dollar index

Gold up +10.8%

Emerging markets +8.3%

SP500 +5.9%

Europe (FEZ) +2.9%

Treasuries (TLT) +4.4%

Silver +34% (!)

Even cryptocurrencies are up:

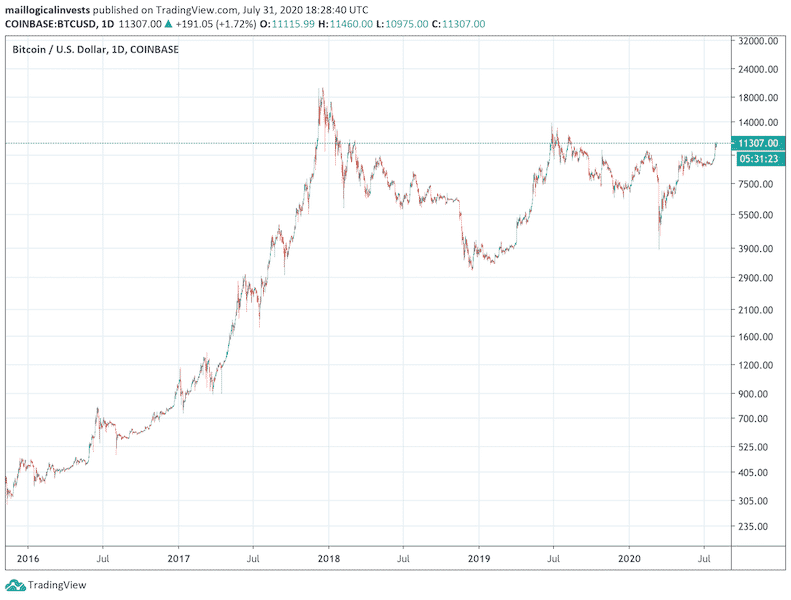

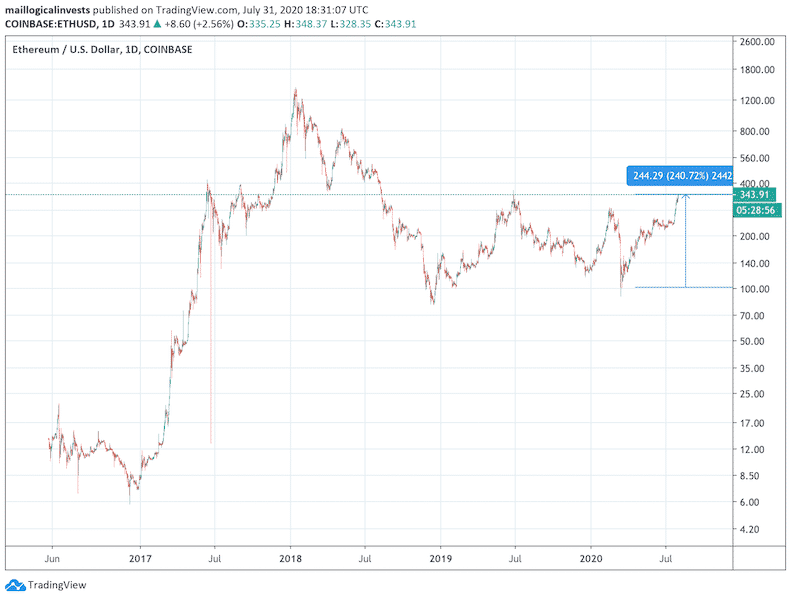

BTC +28%

ETH +55%

This first chart to look is the dollar index:

Other major currencies: Euro and Australian Dollar:

Below, the old fashioned hedge against ‘fiat devaluation’: Gold

Zooming out…

…we see gold is finally breaking out of a multi-year support level. This is a major event from a technical standpoint which has been underestimated by mainstream media. In my recollection since the 2008 crash I have always encountered gold perma-bulls touting it s the ultimate asset.

Now that it has finally proven itself and reached a multi-decade high, the media frenzy that should accompany the move is somewhat muted. This is good news for those that believe in gold as it signals the move may not be over yet.

The threat of purchasing power loss

Non-U.S. investors using LI strategies have enjoyed an extra boost to returns as they have been invested mostly in $USD based ETFs. In other words by investing in US based ETFs they had to change local Euros to U.S. dollars. For Europeans investors that translates to an extra average return of 20% (assuming starting on 2014 when EURUSD was around 1.40).

How do we avoid losing purchasing power if the US Index starts a long term bear market? Do we hedge with another currency, do we buy gold? Is it ok to still invest in U.S. bonds and equity?

The practical and risk-aware answer to this problem is TAA: Tactical Asset Allocation portfolios. TAA’s are portfolios that diversify using multiple asset classes like equity, bonds, commodities, real estate, etc . In contrast, non-TAA portfolios concentrate in one asset class. For example stock-picking portfolios invested in Nasdaq stocks or bond portfolios picking across duration.

Two famous early TAA models are the Permanent Portfolio (1/4 gold, 1/4 equity, 1/4 bonds, 1/4 cash) and Ray Dalio’s All Weather Portfolio.

Logical Invest portfolios are Tactical Asset Allocation portfolios

Most Logical Invest strategies are Tactical Allocation models as they diversify across asset classes. Some are simpler and some are higher degree TAA’s diversifying across assets and strategies. History show that TAA do best when the US dollar is bearish or at least neutral. When the U.S. dollar rises (say in 2015) TAA’s underperform.

So instead of buying an anti-inflationary asset like gold and seriously risking your entire portfolio, the easy and sensible way to protect from cash devaluation is putting cash into a TAA portfolio.

Our portfolios range from the simpler and forever-free Enhanced Permanent Portfolio to the dynamic, strategy-of-strategies Top 3 portfolio.

Crypto-currency updates.

Here are the long term charts for the main two crypto-currencies: Bitcoin and Ethereum. You will notice the same theme here as in gold: A possibility of a breakout to higher highs.

Please join the forum and discuss the recent changes in the markets, our portfolios and LI strategies.

Stay safe.

The Logical-Invest team.