The Logical-Invest newsletter for May 2019

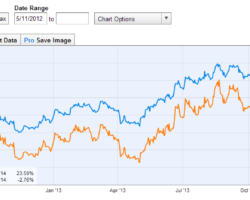

Recovery priced-In At the start of the year, markets were driven higher because of the more dovish Fed (see our previous newsletters “Thank You Fed I & II“). This is now priced in. On top of that markets pushed higher on hopes of a US-China trade agreement. This has now been partially priced-in as well. We are now in a situation where the S&P500 has completely reversed last year’s correction and has a year-to-date performance … Read more