As you perhaps know I have invested all my money in my own strategies, and I and my family (the best wife of all and 4 nice children) are living from the return of these investments. So, I just cannot afford to lose much money in market corrections. Therefore I always try to improve the strategies to lower the risk of major losses through hedging.

Timed Hedging

The new “Timed hedging” is a major improvement of the rotation strategies. It increases the Return to Risk ratio of all strategies a lot. Timed hedging allows you to reduce the downside risk or the volatility of your investment by about 1/3rd without affecting the performance of the strategies.

An excellent way to reduce the volatility or risk of your investment is hedging with Treasuries. Treasuries are most of the time negatively correlated to the stock market and still have a long term positive return. In my strategy emails, I will from now on always give an indication on how you can hedge the current strategy investment.

There is a good possibility that 2014 will be a more choppy market than 2013. The 32% performance of the US stock market is just crying for some corrections, even if the economy outlook is still very positive.

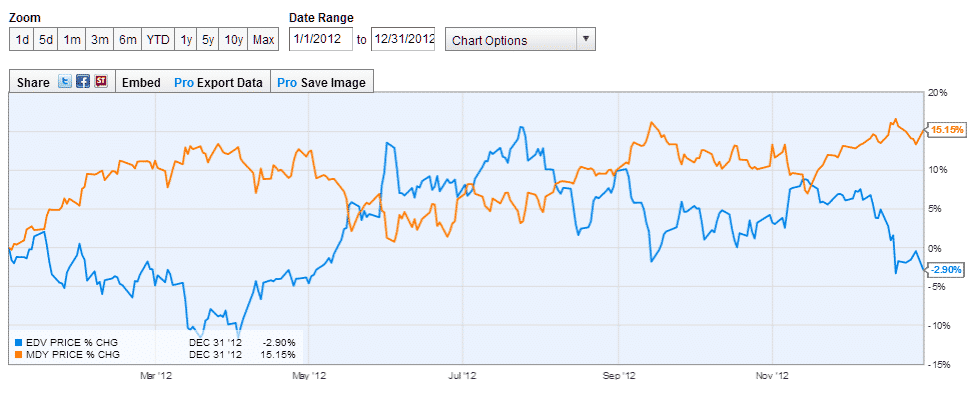

In a normal year like 2012 without tapering, the stock market (MDY – orange) and Treasuries (EDV – blue) have nearly perfectly mirrored charts.

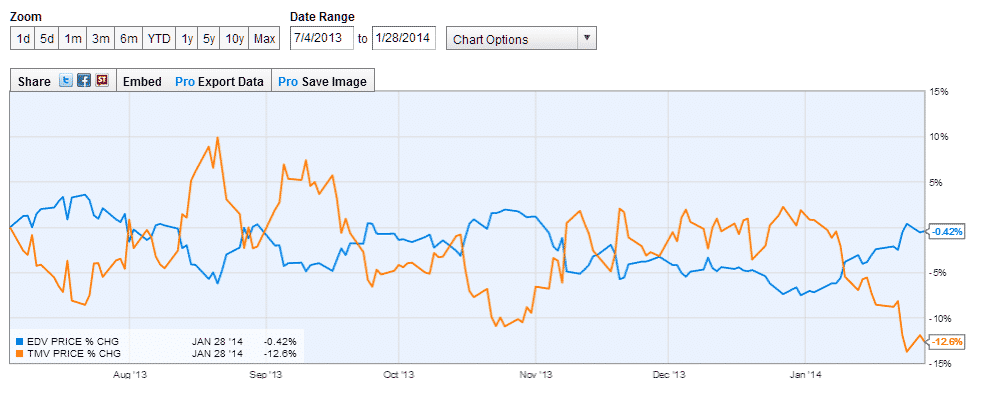

2013 was a special year with extremely fast rising treasury yields during the summer period. This had the effect, that long duration ETFs like EDV lost up to 20% for the whole year. Since the beginning of 2014 treasuries show again a normal negative correlation of about -0.5 to the stock market (SPY).

Since hedging with Treasuries is an extremely simple and effective way to reduce volatility I have added a hedging proposal to all my rotation strategies (except the Bond Rotation Strategy).

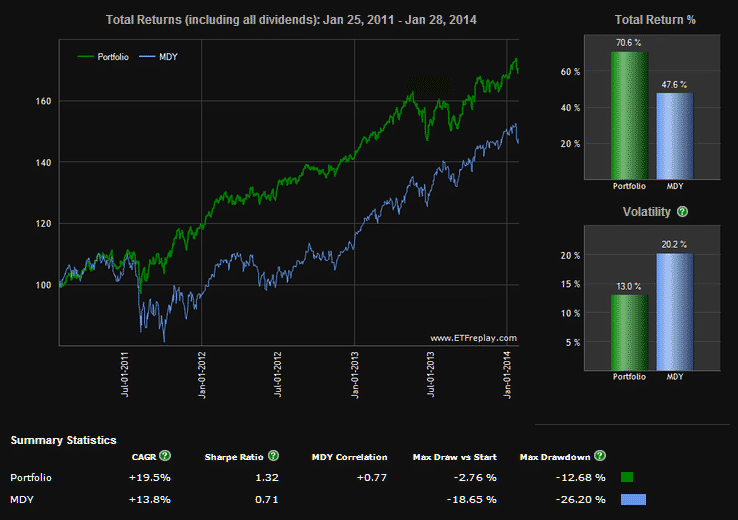

To show you the effect of hedging, here is a backtest of the S&P 400 midcap ETF MDY hedged with long duration Treasuries. The hedged portfolio is composed by an 80% MDY long and 20% TMV short position.

The green chart is the hedged MDY portfolio and the blue chart is the MDY only portfolio. You immediately see, that the volatility of the green chart is very much reduced. The Return to risk ratio goes up from 0.71 to 1.32 and the maximum drawdown is reduced from 26% to 12%. But there is not only reduced volatility, but also a much higher return of 70% compared to 47% for the non-hedged portfolio.

So in this case, even with the negative effect of tapering in 2013 which can be seen in the chart, it is absolutely clear, that hedging would have been very good for such a portfolio. In my strategy emails, I will however not always advise to hedge, but I will try to time the hedging, so that such drawdowns like in June-July 2013 should not happen.

In order to hedge a portfolio, the best is to use long duration Treasury ETFs like EDV, because they make bigger moves. You can use EDV to hedge, but I prefer to short TMV. TMV is an inverse -3x leveraged +20 year duration ETF. If you short TMV, then you again have something like a positive acting +3x leveraged ETF.

I don’t like at all inverse stock market ETFs like SH as a hedge. Even worse are VIX ETFs like VXX. They both have very strong long term down trends. SH, the inverse S&P 500 ETF had a -15% down trend, and VXX a nearly -54% down trend during the last 3 years. Such strong down trends will wipe out most of the profits of your portfolio. Long duration Treasuries however make long term profits even with tapering.

There are several reasons, shorting TMV is the much better hedge then just buying a normal +20 year Treasury like TLT or EDV.

The most interesting reason is the huge time decay TMV shows. If you look at the chart below, then you see the blue chart which shows EDV for the last 7 month. The performance is nearly zero (-0.42%). It is the same for TLT for this time period. TMV however has a -12% performance due to the huge time decay which results of the continuous rebalancing. Now, the nice thing is, that if you short TMV, this -12% loss turns into a +12% gain. This gain adds to the normal positive yield of long term Treasuries.

Another reason to use TMV is, that it is bad to use too much of your capital as a hedge, because normally you do not make money with the hedge, but with the other part of your investment. Here a 20% investment in TMV is sufficient to provide a good hedge. You have 80% left for your normal investment which may be a stock market ETF like MDY or even an inverse volatility ETF like ZIV.

I like also TMV, because it does not pay dividends, so you do also not need to pay taxes on these dividends.

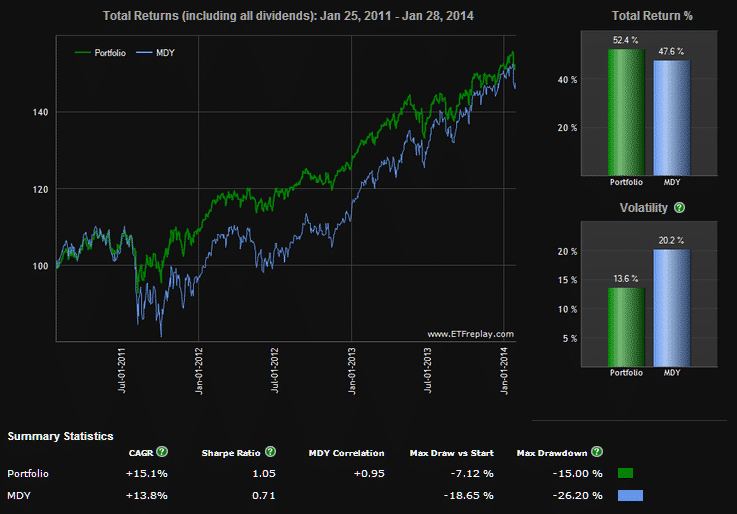

If you cannot short TMV, you may buy TMF the +3x leveraged +20 years Treasury ETF or EDV to hedge your portfolio. Here you see the same backtest with portfolio composed of 80% MDY and 20% EDV. It is also much better than a 100% portfolio, but TMV just gives you stronger hedging and a better performance at the same 20% portfolio weight.

Looking at our strategy rankings, you see that even with ongoing tapering, Treasuries had a strong comeback. They are again in the top ranks of our strategy ratings and the correlation to the S&P 500 index, which I show also in my ranking tables is negative again.

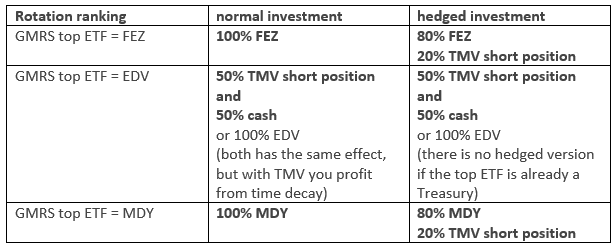

Examples on how to invest:

You see that as long as you hedge, you always keep 20% of your capital in a short position of the -3x leveraged TMV Treasury. Timed hedge means that you stop hedging if the correlation of Treasuries to the stock market (SPY) gets positive.

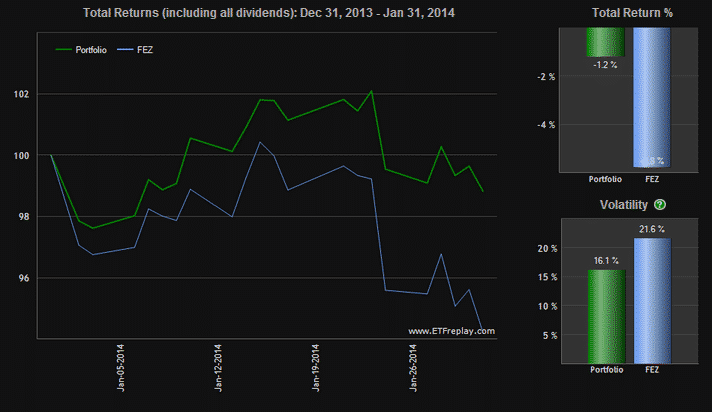

To show you the effect of hedging, here is the January FEZ chart with the current market correction (blue) and the chart of the hedged portfolio (80% FEZ + 20% TMV short). The effect of the hedge is easy to see.

I consider this additional timed hedging as a major improvement of the strategies, but after all, you are free to decide if you want to hedge or not. All the strategies should also provide good positive long term returns without hedging. However you may sleep better with less volatility in your investments.

Good morning frank. Will u be advising in ur next monthly update in regards to the hedging I’m current ly 50/50 ziv. Fez do u think its time for the hedge or should I wait not sure if I should at this present time thanx dominic Sent from AOL Mobile Mail

Great stuff. How and at what times do you decide that the correlation of Treasuries to the SPY is positive of negative?

I just calculate the 20 day correlation to SPY every month. Just now it is for example about -0.7 for EDV or TLT

Frank, I use etfreplay as you did in the article above. I created a portfolio of MDY 80% with TMV short 20% and ran it for the same time period 1/25/2011 to 1/28/2014 as you did. I get a different performance result. 52.5 % return, with 12.9 volatility. What am I doing wrong as you got 70.6% return and 13% volatility? Thank you by the way for another great article.

You need to rebalance the portfolio monthly. This way you always sell the the high ETF and buy the low ETF. Rebalancing increases the performance and it is needed for short positions, because without rebalancing they would lose more and more value over time.

-0.7 for EDV would imply that you calculate the correlation directly on the prices and not on log(return) as one would normally do, see e.g. http://www.followingthetrend.com/2012/08/how-to-build-correlation-matrices/. If using this method the correlation is currently (03-Jan – 31-Jan) around -0.497 vs -0.713.

Do you think this makes a difference for the hedging?

Did you backtest your rotation systems with timed hedging?

At first I thought, how can this system hedge MDY and improve performance at the same time? Then I realized it’s the rebalancing that does the trick.

Hi Frank, do you have a set rule as per when you rebalance your portfolio? (is it on a fixed day every month? do you add a monthly drift to the date?).

I have also sent you a separate question with Seeking Alpha with regard to one of your articles (basically: when you rebalance a portfolio, how do you assess the weight to allocate to ETFs?) Thanks. Alex

I would only rebalance if the ratio changes by a minimum percentage. If 80%-20% for example goes down to 85%-15%, then it makes sense to rebalance.

It makes no sense to rebalance monthly if the 80-20 ratio has not changed by some percents.

Regards

Frank

Thank you for the responses.

I will be waiting for your next articles.

Great article, Frank.

I was wondering if you see this as a semi-buy and hold strategy or something to be added to a timed strategy.

Also, what do you think of using this strategy with E-mini futures (for example, buy one contract of ES and about invest about 20% of its value in a short TMV position)?

Best,

Alex

Yes, these is a good strategy. You just need to rebalance from time to time.

Frank,

This is a nice addition to your strategies. Do you exit the TMV position if the SPY/TLT correlation becomes > 0, or add a stop and wait to see if it goes negative again?

Regards,

Dave

Yes, I check Treasury correlation to SPY semi monthly and I would exit my TMV position if correlation becomes bigger than 0