One of the advantages of ETFs is that many of them charge very low fees. And if there is a lot of liquidity the bid offer spread is quite narrow. They are also bought and sold on exchanges and thanks to the emergence of discount brokers and cheaper operating models, commissions are low. The lower costs make a new type of investing possible, namely ETF trading. Before the emergence of ETFs, trading baskets of shares or mutual funds was just too expensive to be feasible.

ETF trading covers a lot of strategies and timeframes. One of the most sensible is an ETF rotation strategy which periodically rotates money out of ETFs where momentum has slowed into ETFs showing strong momentum or offer better value. These are rules based strategies which combine elements of investing and trading to lower volatility and improve returns.

Which ETFs should you use?

The basic process with a rotation strategy is to build a universe of potential ETFs to own, and then use a set of rules to use to move money amongst the funds in that universe. In general, you should only use liquid ETFs with low costs for rotation strategies.

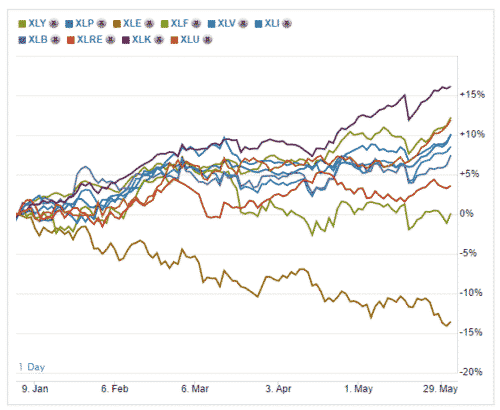

ETFs which track the headline index in each country or the MSCI country series are a good way to get exposure to countries and regions. Sector-specific ETFs like the SPDR sector ETFs are an excellent way to focus on sectors. The chart below shows the one-year performance of these ten sector ETFs. You can see clearly how outperformance and underperformance tend to persist once they start.

Not all ETFs are suitable for rotation systems. Smart Beta ETFs are fine for long term investing, but their risk management models can dampen performance in the short term.

ETFs with small market caps, low liquidity, or high fees can also hurt performance and may not perform as expected. Gimmicky funds which invest in sectors that are hot at the time of launch are best avoided. Often when a specific industry is doing well, ETF issuers will issue funds that invest in that sector. This tends to coincide with the peak in share prices for that industry, and over time the liquidity in the ETF can dry up.

A Very Simple ETF Rotation Strategy

The objective of an ETF rotation strategy is to achieve better returns and lower volatility than a buy and hold strategy. So, as a starting point, let’s look at how you could improve upon the performance of the SPY (S&P 500) ETF. Rather than holding 100% of your portfolio in SPY, you could hold 70% in SPY, and keep the remaining 30% in the sector with the highest momentum.

A basic measure of momentum would be to look at the three-month return. To spread the risk out a little more you could spread that 30% amongst the three ETFs with the best three-month performance. Every month, you would look at the three-month return for the ten sectors ETFs and sell the ones that fall out of the top three, while reinvesting that money in the sector that replaced it.

This is a very simplistic example to illustrate the idea. But it’s also a good starting point from which a more sophisticated strategy can be developed.

More Sophisticated Techniques

Most rotation strategies are based on momentum, but others use valuations, fundamentals data, and even multi-factor models. Rotation strategies tend to work better with quantitative data rather than qualitative and soft data.

Filters can be used to avoid funds that have poor chances of performing well. A simple filter may be to avoid any ETF that is trading below its 200-day moving average as that fund would technically be in a bear trend. Another would be to avoid the most volatile funds in the universe, as measured by the standard deviation of daily returns.

You can also add rules to move into cash when a broad market index or most of the funds in your universe enter a bear market. Moving to cash usually isn’t feasible for a portfolio of shares, but it works well for ETFs because the lower volatility means you can get out of the market earlier in the correction.

The SHY ETF invests in 3-month treasury bills, so you earn some interest while you wait for the market to turn. Or you can use a bond ETF like the TLT fund.

Build or Buy?

If you have the right software or programming tools it quite straightforward to build an ETF rotation system yourself. However, this does take time and commitment – it’s not something you can set up in an afternoon. You’ll have to learn how to backtest a strategy effectively, and then test multiple iterations of your strategy.

The alternative is to subscribe to a service like www.logical-invest.com. The advantage is that you’ll save a lot of time and you get to benefit from a full-time research team who have been developing strategies for years. Some services do everything for you, while others will send you the recommendations and you do the actual implementation yourself.

The examples listed above are very basic. The following links will give you a better idea of some profitable strategies with real world results:

ETF trading is a sensible way to combine active and passive investing. Strategies can be built to improve returns, lower volatility and avoid market meltdowns. And on top of that, you can keep fees to a minimum.