Outperforming SPY?

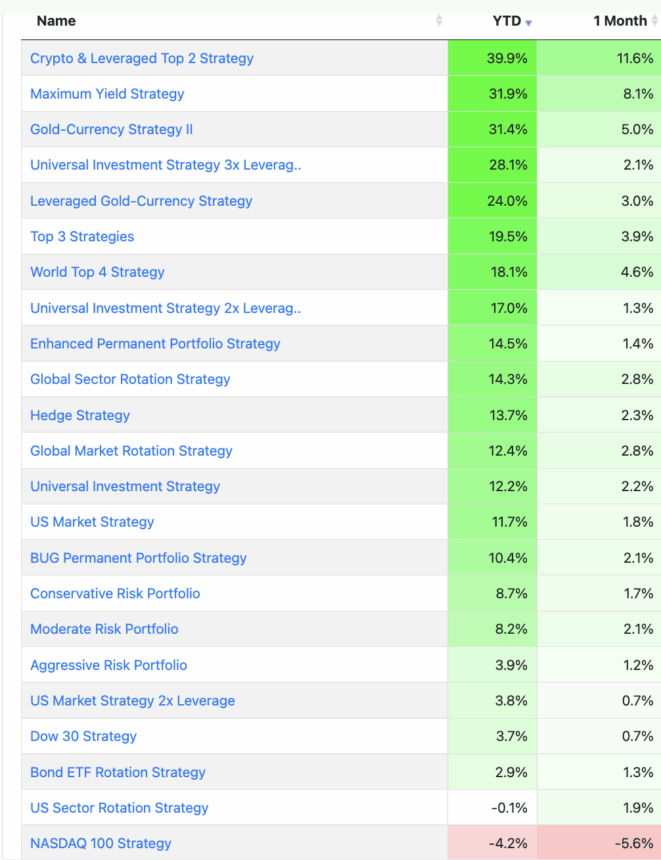

As of the end of August, SPY is up a respectable 10.7% for the year. The median return across our 23 base strategies is over 13%.

This isn’t the result of one lucky pick; it’s broad-based outperformance, signaling a significant change in the market’s character.

Has the 15+ year U.S. outperformance changing?

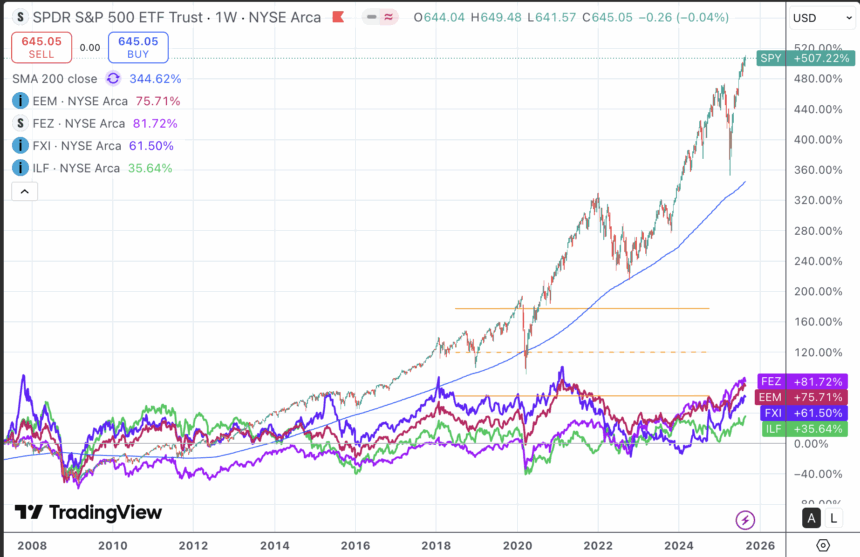

For the better part of a decade, a simple truth has dominated investing: holding the S&P 500 was the winning strategy. Since the lows of the 2008 crisis, U.S. large-cap stocks have been in a relentless bull market, vastly outperforming nearly every other global index.

As the chart above shows, SPY has returned over 500% since that period, leaving asset classes like Emerging Markets (EEM), Europe (FEZ), China (FXI), and Latin America (ILF) far behind.

This dynamic meant that while our diversified strategies may have provided superior risk-adjusted returns, on a pure return basis, it was difficult to keep pace with the single-asset portfolio holding just the U.S. market.

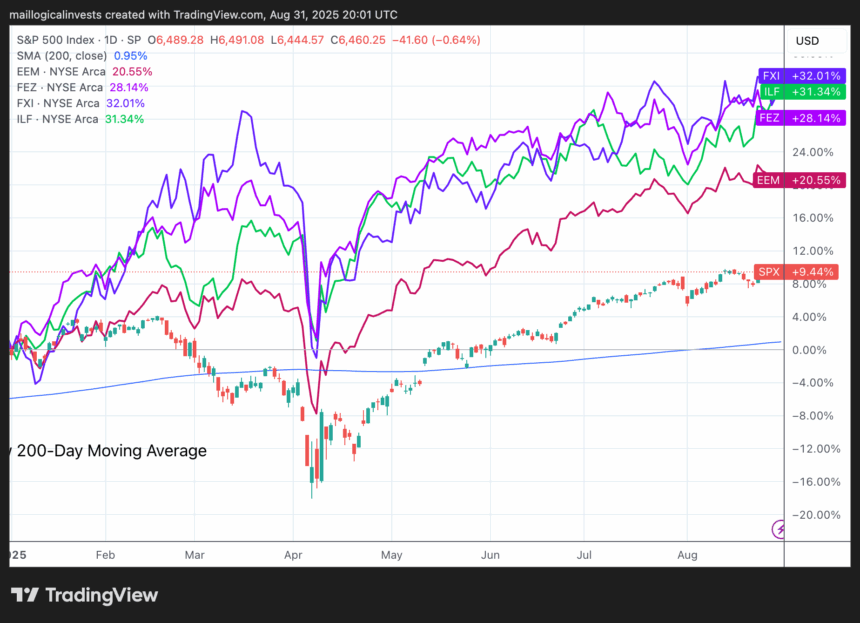

Foreign markets picking up?

2025 has been marked by constant concerns over U.S.-imposed tariffs and their potential to damage foreign economies. However, the markets tell a different story: foreign stock indices have outperformed the U.S. by a wide margin, gaining two to three times more. China is up 32% year-to-date, while Europe has gained 28%. Only part of this outperformance can be attributed to the depreciation of the U.S. dollar against currencies such as the euro.

Going back to strategies

This year, our models have found significant strength in areas where the S&P 500 has little to no exposure:

- Cryptocurrencies: Our Crypto & Leveraged Top 2 Strategy has been the standout leader, capturing the boom in digital assets with a +39.9% YTD return.

- Volatility: The Maximum Yield Strategy has capitalized on market volatility shifts to gain +31.9% YTD.

- Gold & Currencies: The Gold-Currency Strategy II, a classic hedge against uncertainty, is up +31.4% YTD.

Conclusion: Built for a Changing World

U.S. market dominance may be giving way to a more complex global environment where leadership rotates between different assets and regions. We don’t really know. A rules-based, adaptive, and globally diversified approach may help protect, inform and grow your portfolio.

As always, we’d love to hear your thoughts in our forum.

Sincerely,

The Logical-Invest.com Team