Performances

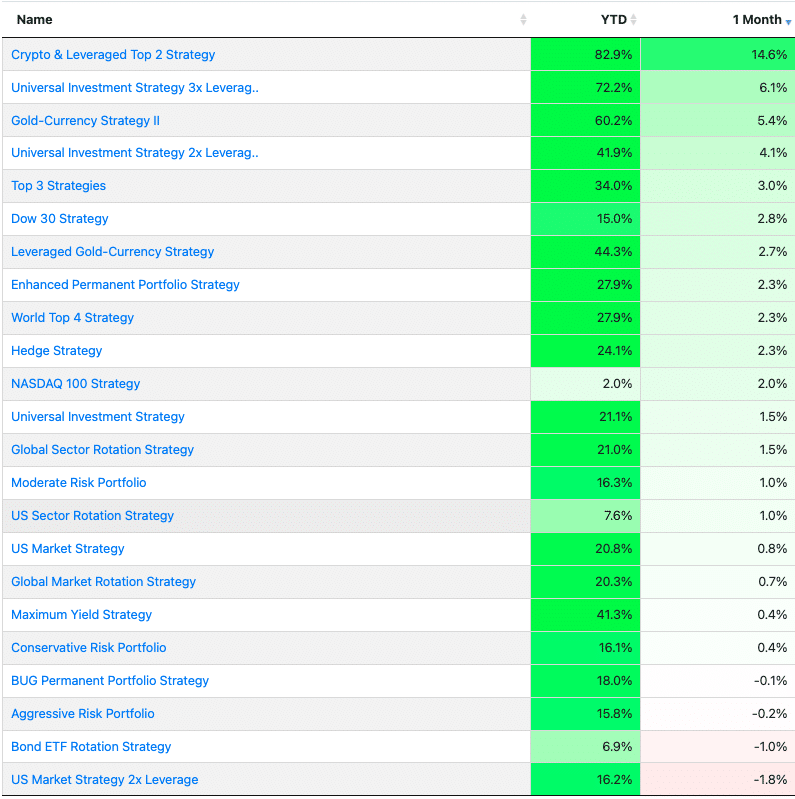

YTD performance through November – ranked by 1 month return :

Top Performers: The Crypto & Leveraged Top 2 Strategy turned out 14.8% in November alone and leads with 82.9% YTD returns. The Universal Investment Strategy 3x Leverage follows at 6.1% MTD and 72.2% YTD.

Gold Strategies: The Gold-Currency Strategy II posted 60.2% YTD with a 5.07 Sharpe ratio.

Risk-Adjusted Winner: Our favorite Top 3 Strategies achieved 34.0% YTD with only 14.2% volatility and a 3.94 Sharpe ratio.

Average Performance: Our strategies average 28.9% YTD.

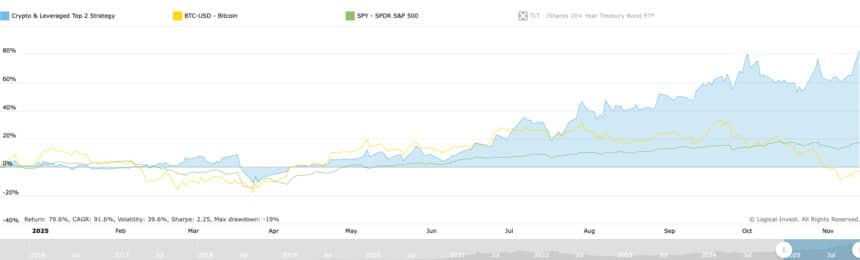

Crypto & Leveraged Top 2: Rules-Based Rotation

The Crypto & Leveraged Top 2 Strategy rotated out of crypto and into SPXL and AGQ before Bitcoin’s decline, avoiding the 17% drop while capturing equity strength and silver’s surge.

The strategy rebalances twice monthly using our Modified Sharpe Ratio across Bitcoin, Ethereum, SPXL, TMF, and AGQ. No predictions needed, just systematic ranking and execution.

Market Summary

The 43-day government shutdown ended November 12th when President Trump signed the funding bill. The deal funds most agencies through January 30th. We expect another round in late January.

The S&P500 has partially recovered from a short correction in mid-November and stayed almost flat for the month while NASDAQ slightly underperformed (QQQ, -1.6%).

Fed: December Cut Unlikely

The probability of a December Fed rate cut has fallen to 22% according to FactSet economists, down from 97% in October. September’s payroll gains of 119,000 jobs—more than double forecasts—shifted expectations.

The December 9-10 FOMC meeting will be critical for January positioning.

Bitcoin and Silver Diverge

Bitcoin fell 17.28% in November, briefly dropping below $80,000 before recovering to around $90,000. Bitcoin ETFs recorded $3.48 billion in outflows, the second-largest monthly outflow since launch.

Silver spiked to $56.72 per ounce on November 28th and has gained an outrageous 95% year-to-date, outpacing gold’s large gains (+58%). There is a chance that physical silver maybe in short supply which may explain part of the price movement. Keep in mind also that according to some analysts, silver is a ‘late-bloomer’ meaning it moves after Gold. You can look into this more by researching the Gold-Silver ratio timeline compared to the price of Gold.

Looking Ahead

Key events for December and January:

- Fed meeting December 9-10

- Government funding expires January 30th

- Year-end tax-loss harvesting and rebalancing flows

Stay in the Market – Follow a Strategy

November showed why systematic strategies matter. While Bitcoin fell 17%, our Crypto & Leveraged Top 2 rotated into strength and now sits at 82.9% YTD.

As always, we’d love to hear your thoughts in our forum.

Sincerely,

The Logical-Invest.com Team