TMF is by far not so good as TMV short for hedging portfolio. Here is the 12 month comparison. While all treasuries had quite big losses of about -7%, a shortTMV position was flat over the year. I think for IRA accounts the better and saver way of hedging would be a part of the investment in the Bond rotation. This one should make 10-15% per year and is also good for hedging portfolio.

Hedging Portfolio with different instruments in comparison

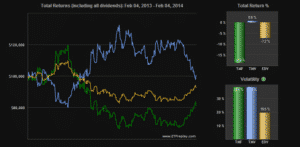

Below chart:

EDV -7.2%

TMF -18.2% (divide by 2 because TMF=2xEDV) -9.1%

TMV 0.6% /2 = 0.3% = -0.3% because you are short TMV

Conclusion: If you can short, then use TMV for hedging. If not, then better do not hedge or use the Bond Rotation Strategy for hedging portfolio.

You can employ this hedging portfolio with our Sleep Well Bond Rotation Strategy, here a summary or look at the recent performance:

Our high yield Bond Rotation Strategy is one of our core investment strategies. The strategy invests on a monthly basis in two of four different bonds as hedging portfolio. This is the perfect strategy if you are looking for a safe long term investment and if you want to sleep well even during turbulent financial markets and be covered by hedging. The extremely low volatility (risk) of this strategy is only 7.9% which is about 3-4x less than the S&P500 volatility.

The 4 Bonds are:

- CWB – SPDR Barclays Convertible Bond

- JNK: SPDR Barcap High-Yield Junk Bond (4-7yr)

- PCY: PowerShares Emerging Mkts Bond (7-9yr)

- TLT: iShares Barclays Long-Term Trsry (15-18yr)

The strategy is a very conservative approach to maximize your portfolio return and on the same time minimize the risk of losses. During the 2008 financial crisis the S&P500 lost more than 50%. This strategy ended the year 2008 even with a solid gain of 10% compared to a loss of -36.8% for a S&P500 investment. The reward to risk ratio (Sharpe Ratio) of this Strategy is 1.58 compared to 0.27 for a S&P500 investment. Since 2008 you made 3x more money with this strategy compared to an average S&P500 investment and this with much less risk.