The Logical-Invest newsletter for September 2020

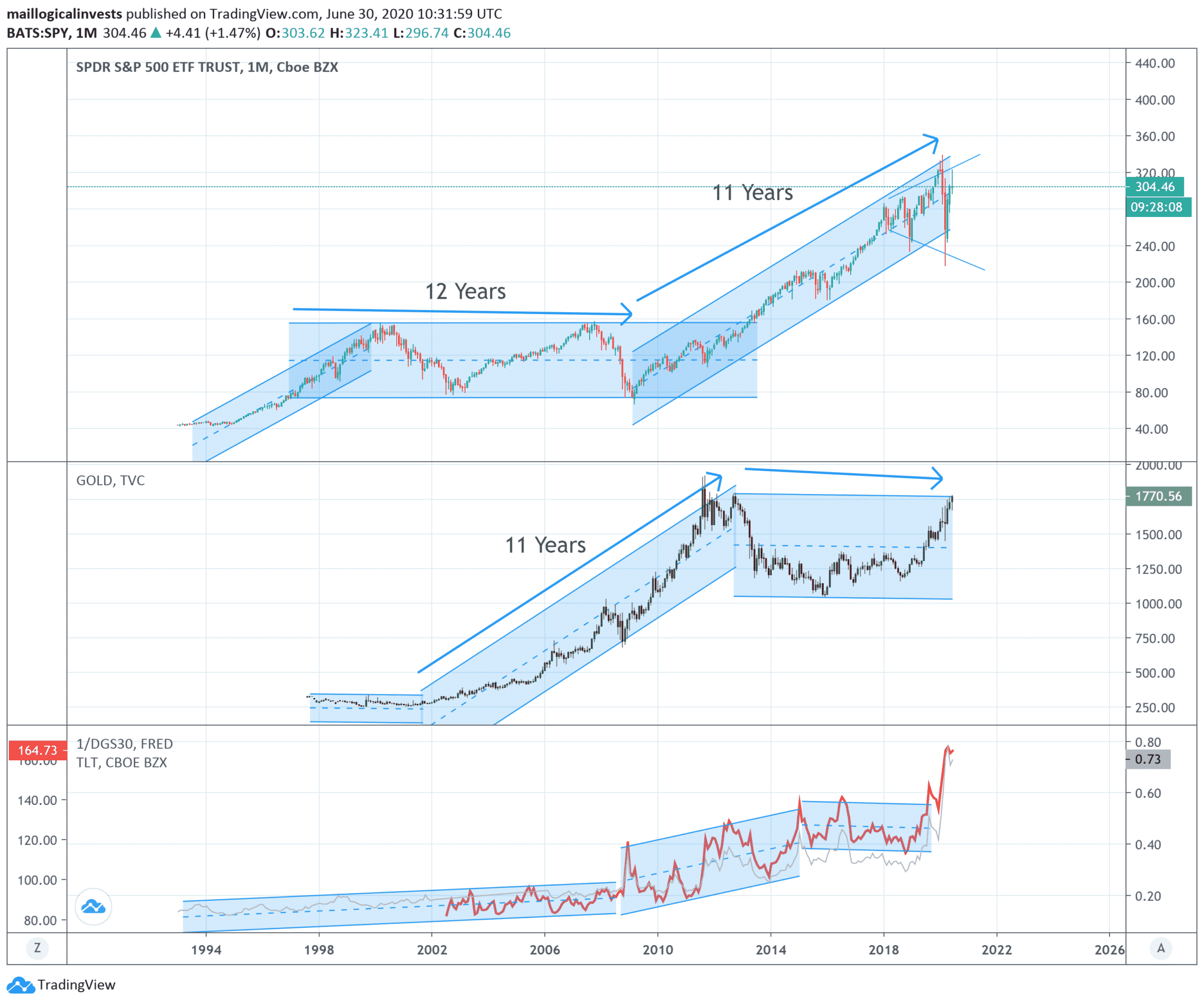

The S&P 500 moves higher August was positive for the U.S. equity market (SPY +7%) and very negative for long term Treasuries (TLT -5%) as yields were hit by the FED’s decision to pursue a ‘flexible’ 2% inflation target. Gold remained flat (GLD -0.3%), just below it’s all time highs. Our strategies were split around zero some posting moderate gains and some moderate losses. The under performance of most strategies vs the SP500 is due … Read more