The Logical-Invest newsletter for May 2020

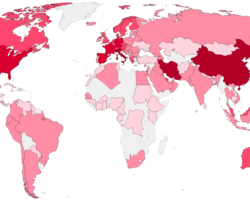

Back to normal? All strategies came in positive for the month with a range of returns from a low of +2.8% to a high of +14.5% for the Maximum Yield strategy. Year-to-date figures are mixed but reasonable around a mean of -2%. The S&P 500 is down -9% while emerging markets (EEM) are down -19%. Looking at the table above, it does not reflect a world where whole economies are frozen, cities are in lockdown, … Read more