We often we concentrate on U.S. indexes and Treasuries and miss the bigger picture in our investments. Here are some interesting charts of the Commitment of Traders to remind us of the current state of the market and keep track of our investments.

Keep in mind that unlike equities, forex and commodity prices do have a strong impact on the real economy and imbalances are hard to bear by the respective economies, thus affecting our investments.

Commitment of Traders (COT) help to track investments

The bottom pane shows Commitment of Traders (COT) data. Here is a bit of info on the COT, see a definition at the end of this article.

1. Commitment of Traders: The Australian Dollar – Not too far from ’09 crisis levels at -35% from peak.

2. Commitment of Traders: Canadian Dollar – Below ’09 levels due to Crude collapsing.

3. Commitment of Traders: The Euro – Massive QE, Grexit, etc.

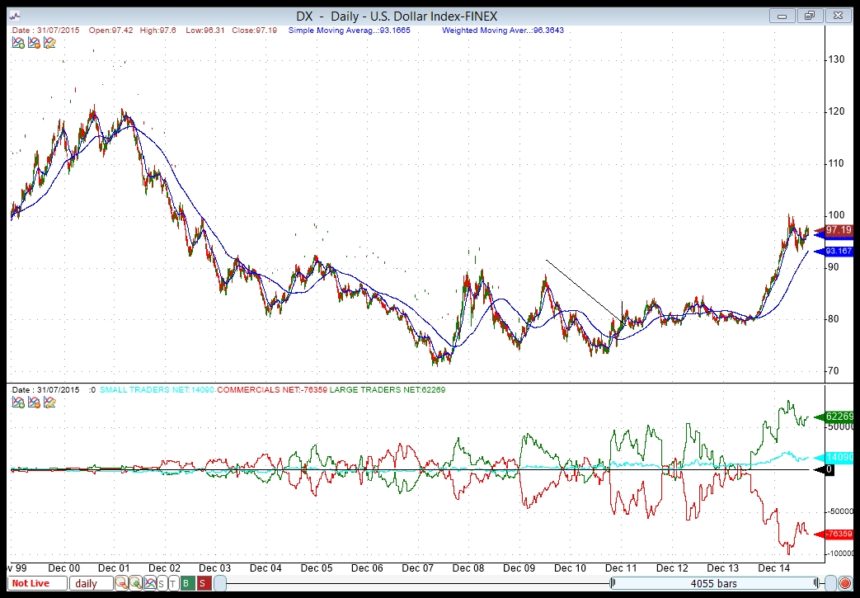

4. Commitment of Traders: The Dollar Index – Above ’09 crisis levels.

5. Commitment of Traders: Oil – Who would have guessed this… Below $50 while no visible crisis in sight…

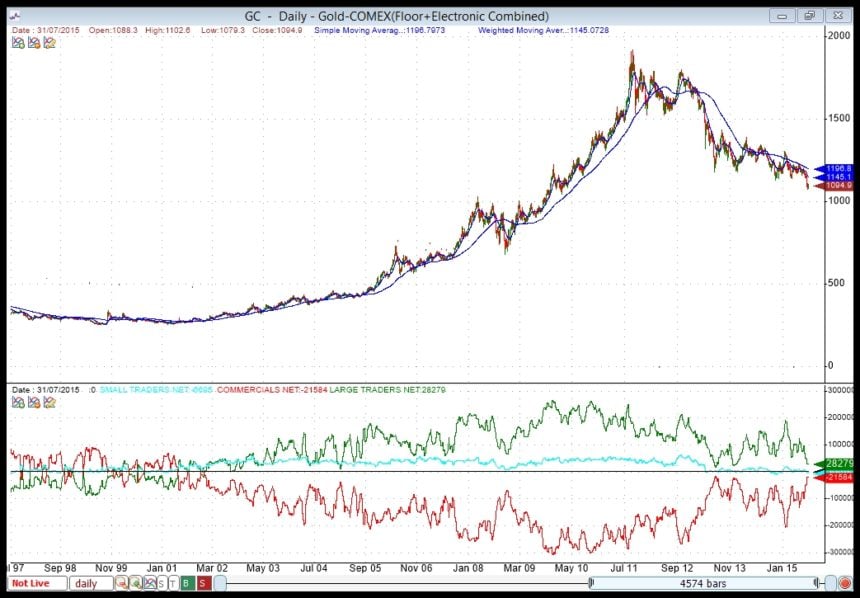

6. Commitment of Traders: Gold – Like most commodities on a downtrend with no hint of being used as a safe-heaven.

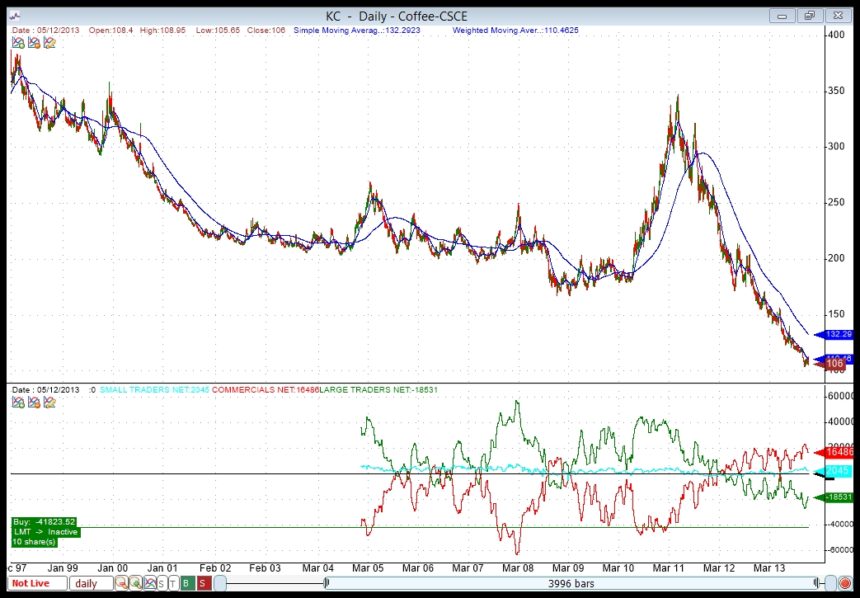

7. Commitment of Traders: Coffee – Just an example of commodity extreme pricing.

Definition of Commitment of Traders, COT:

The weekly report details trader positions in most of the futures contract markets in the United States. Data for the report is required by the CFTC from traders in markets that have 20 or more traders holding positions large enough to meet the reporting level established by the CFTC for each of those markets.1 These data are gathered from schedules electronically submitted each week to the CFTC by market participants listing their position in any market for which they meet the reporting criteria.

The report provides a breakdown of aggregate positions held by three different types of traders: “commercial traders,” “non-commercial traders” and “nonreportable.” “Commercial traders” are sometimes called “hedgers”, “non-commercial traders” are sometimes known as “large speculators,” and the “nonreportable” group is sometimes called “small speculators.”

As one would expect, the largest positions are held by commercial traders that actually provide a commodity or instrument to the market or have bought a contract to take delivery of it. Thus, as a general rule, more than half the open interest in most of these markets is held by commercial traders. There is also participation in these markets by speculators that are not able to deliver on the contract or that have no need for the underlying commodity or instrument. They are buying or selling only to speculate that they will exit their position at a profit, and plan to close their long or short position before the contract becomes due. In most of these markets the majority of the open interest in these “speculator” positions are held by traders whose positions are large enough to meet reporting requirements.

The remainder of holders of contracts in these futures markets, other than “commercial” and “large speculator” traders, are referred to by the CFTC as “nonreportable.” This is because they don’t meet the position size that requires reporting to the CFTC. (Thus they are “small speculators.”) The “nonreportable” open interest in a futures market is determined by subtracting the open interest of the “commercial traders” plus “non-commercial traders” from the total open interest in that market. As a rule, the aggregate of all traders’ positions reported to the CFTC represents 70 to 90 percent of the total open interest in any given market.2

Since 1995 the Commitments of Traders report includes holdings of options as well as futures contracts.

I’m not sure if that makes me feel better or worse! :)

Also not sure if it helps, but you are not alone with this feeling. Me and some 40 million investors in China A Shares also feel quite uncertain right now. :-)