Can The Power of Passive Investing Trigger Active Again?

Until the late twentieth century passive investing was not a viable option. Anyone who wanted to invest had to buy individual trading stocks. But in the early 1970s, elaborated academic models made index stocks gain more and more attraction in the media, which encouraged Jack Bogle, the founder of Vanguard, to launch the first indexed mutual fund, in 1975. and kick start the passive investing strategy. This strategy grew in popularity thereafter, and between 2000 and 2014, the amount of money invested in index mutual funds more than quintupled. The more recent rise of exchange-traded funds (ETFs), which are indexed to a broad market or a sector but trade daily like stocks, has indeed accelerated the trend.

According to U.S. statistics, over the periods of 10 years or more over 80% of active asset management firms hardly beat the benchmark or passive managers. Moreover, almost half of them did not even survive the competition for the given period. One of the reasons behind this is the progress in stock trading information and research sphere, which enables to use online trading software to reveal undervalued stocks in the market. Thus, the probability to find hidden gems is getting more and more scarce in the information era of 21st century. Also, SEC regulation forces companies to make fair disclosure of their statements. So, what is the perspective of active investing to beat the saturated market?

Another potent force is the trading volume, e.g. NYSE transactions rose 500-fold from 3 million to 1.5 billion over the past 50 years. These developments brought about the emergence of algorithmic trading and artificial intelligence models which further hinder active stock pickers from discovering pricing errors, picking up winning stocks and outperforming the average return consistently.

Passive Investing Holds The Lead

The strongest argument in favor of passive investing has always been the low cost factor or expense ratio for passive investors. In most cases, index fund costs dropped as low as 0.1-0.2% p.a. leaving little room for competition. Another argument is the simplicity and minimum time required to analyze different segments or asset allocation models within the market when investing long term. Passive investing sounds more appealing to those who simply prefer buy-and-hold strategy of S&P 500 index fund or any other high yield ETF replicating the market.

Equity | Expense | Total | PERF as of | 1 Year | Since INCEP | INCEP DATE |

SPDR S&P 500 ETF | 0.11% | USD 196,988.65M | 30 Sep 2016 | 15.43% | 9.16% | 22 Jan 1993 |

SPDR Dow Jones Industrial Average ETF | 0.17% | USD 11,854.28M | 30 Sep 2016 | 15.46% | 7.13% | 14 Jan 1998 |

Source: Spdrs website

In 97% of times, investors derived smaller capital gains from stock funds of large- and mid-sized companies compared to stock market index, whereas small-cap stocks ran behind in 77% of cases. However, it is difficult for outperformers to beat the market 3 years in row. Empirical studies show that passive investment strategies succeed even better in stable bear markets.

S&P 500 Historical Chart

Source: https://fred.stlouisfed.org/series/SP500

Investment Decisions: When Is The Best Time To Switch To Active Investing?

Actively managed investment can be beneficial when flexibility and hedging for constant buying and selling are priorities. Another question you may need to consider is whether a particular market is transparent enough for passive strategies, or whether a active strategies with an assigned investment manager might perform better. For example, you might need active investment ideas from an expert advisor, if you opt to go for investing in emerging markets ETFs like in BRICS, as these markets comprise a little less than 50% of Global GNP, yet only 9% of world equity. Or while choosing how to invest in stock market by picking up small-cap niche stocks where the liquidity can be bothersome, it is an urge to turn to advice to spot gems in rough waters.

Forecast On Passive And Active Investment

According to Morningstar data passive funds now comprise a third of mutual fund investment in the US investment industry. Active funds, on the other hand, have declined steadily since 2013, despite total assets rising 14% up to $9.8trillion over the same period.

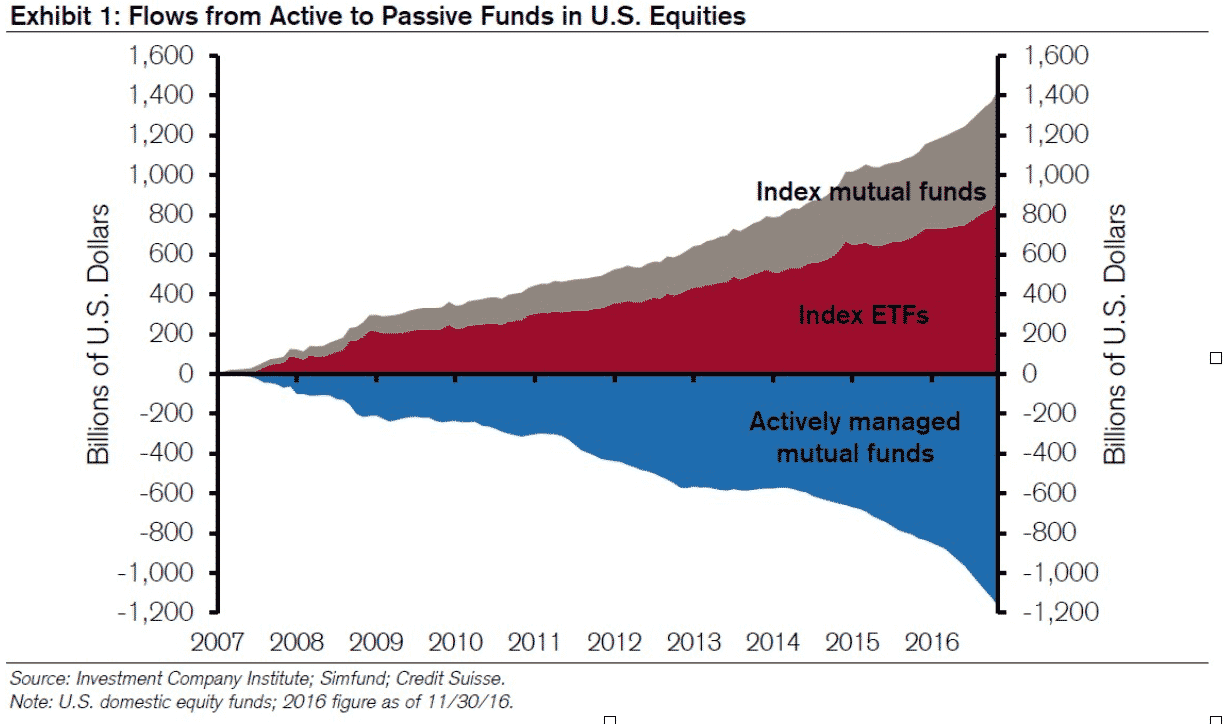

As the chart shows, according to Credit Suisse report, in the last 10 years there has been a $2.6 trillion swing between active and passive investment funds comprising $1.2 trillion in net outflows from actively managed equity mutual fund investment, versus $1.4 trillion in net inflows into passive index funds and ETF investing.

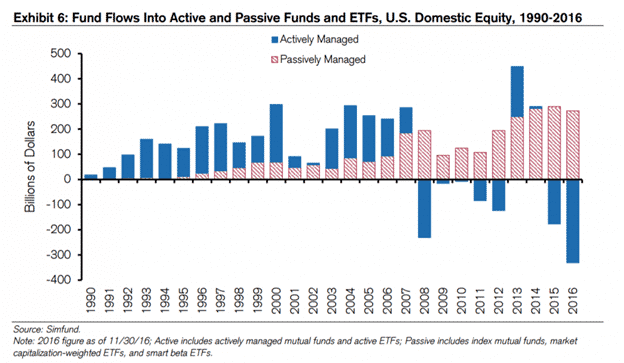

In 2016 alone, investors pulled $340bn from active managers in the U.S., while allocating $504bn to passive investments such as ETFs, according to Moody’s. Asset management companies best placed to benefit from this shift are BlackRock, Vanguard, State Street, to name a few.

According to the most recent forecasts, the quickly growing passive investing market will overtake the active investing fund industry in the US by 2024. Passive funds will account for more than half of the assets in the US investment industry within the next seven years, and the index-tracking funds can become the dominant force for US institutional investors even sooner, by 2021, according to Moody’s Corporation new research.

Active vs Passive Investing – Bottom line

Among the advantages of active investment are flexibility, risk and tax management but certain limitations apply, such as company-specific investment risk and higher expenses conditioned by stock market trading costs. Meanwhile, passive investment funds are preferred for their low fees, good transparency, and tax efficiency. However, one could opt for active management during times of high market volatility and overall market risk.

Although passive investing remains controversial topic in the financial world, portfolio management specialists have predicted 2017 to be a comeback year for active managers, due to the anticipated rise in interest rates in the US. This in turn could mean lower returns for passive indexes. If that is the case active fund management will recover and a renaissance in active funds may come.

Whats next to get started with your passive investment?

Research our tactical asset allocation strategies and easy to implement investment portfolios. In line with the stated above, all of them use cost effective ETF or Mutual funds, and are rule based without any emotional component. Try all our offers for free during one month – and stay invested for free in any of our lazy portfolios.