Stocks are one of several asset classes investors can invest in. They also happen to be the asset class that has produced the highest returns historically when compared to bonds, real estate and commodities. For that reason, most long-term investors keep the largest portion of their savings in stocks. The stock market basics you need to know to get you started are covered in this article.

What is a share?

A stock, or share, is a share of the ownership of a publicly listed company. Owning a share in a company gives the owner the right to:

- Attend general meetings and vote on major issues. One ordinary share is worth one vote.

- Dividends which are a share of profits passed on to shareholders.

- Receive annual reports.

- Be paid a liquidation dividend in the case that the company being wound up.

Stock Exchanges

Stocks are listed on Stock Exchanges. These days, most stock exchanges are entirely digital, while in the past trade was conducted by brokers on a floor. This was known as an ‘open outcry’ market. To buy or sell shares on an exchange an investor trades through a stock broker which is a member of the exchange. Even if a client trades online, the order is entered via a stock broker’s website, and the broker routes the order to the exchange. The stock broker charges commission or brokerage to execute the client’s order.

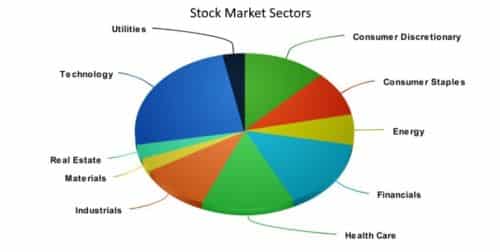

Sectors

We can divide listed companies into sectors and then into industries:

- The financial sector consists of industries like banks, insurers and asset managers.

- The utility sector consists of electricity, gas and water companies.

- The consumer discretionary sector consists of retailers, media companies, and apparel companies.

- The consumer staples sector includes food and beverage companies as well as companies that create products consumers need, like household products.

- The energy sector consists of oil and gas exploration and production companies, as well as integrated power firms, refineries, and other operations.

- The health care sector includes any companies involved in healthcare.

- The industrial sector consists of aerospace, defense, machinery, construction, and manufacturing companies.

- The technology sector includes electronics, software and IT firms.

- The materials sector consists of mining, refining, chemical, paper and packaging companies.

- The real estate sector comprises real estate investment trusts and property development and management firms.

Size

Listed companies are also classified by size, which is measured by market capitalization. A company’s market capitalization is the total value of all the issued shares. A large-cap is a company worth more than a $10 billion, mid-caps are worth $2 billion to $10 billion, and small-caps are companies worth less than $2 billion. Small caps are sometimes further divided into micro-caps and nano-caps.

Smaller companies are usually riskier, but also have more room to grow. It’s easier for a $1 billion company to grow into a $2 billion company than it is for a company to grow from $100 billion to $200 billion.

Listing

The process whereby a company lists on an exchange is called an IPO (Initial Public Offering). During an IPO, shares are sold directly to investors before they begin trading on the exchange. When shares are traded on the exchange that is known as the secondary market, as the shares have already been sold by the company.

A private placement occurs when a company sells new shares directly to investors. Companies conduct private placements to raise new capital.

Investment vehicles

Investors can invest in stocks directly, or indirectly. Direct ownership means buying shares in one’s own name. Alternatively, an investor can buy an exchange-traded fund (ETF) or invest in a mutual fund, a pension fund or a structured product. This is indirect ownership.

Funds are either actively or passively managed. The manager of an actively managed fund makes active decisions on what shares to buy and when to buys them. A passively managed fund manager will manage a fund by matching the holdings of an index.

Earnings

Every three months listed companies release their financial results which include an income statement and balance sheet and management commentary. Earnings per share (EPS) is the key number in these results, which is the company profit divided by the number of shares. This number gives shareholders an indication of how profitable a company is and whether profits are growing.

Dividends

Shareholders are paid a portion of the earnings as a dividend, while the company reinvests the remainder. Until you sell a share, the only real benefit you receive is dividends.

Trading vs. Investing

An article covering stock market basics wouldn’t be complete without an explanation of the difference between trading and investing. Trading has a shorter time frame than investing and decisions are based on supply, demand, market sentiment and volumes. Investing focuses on the underlying business of a company and its profitability, and requires more time.

Fundamental analysis vs. Technical analysis

Fundamental analysis emphasizes the business, it’s market and the economic environment. As such analysts use fundamentals to make investment decisions. Technical analysis is concerned with the behavior of share prices and volume, and as such is used for trading more often.

Investment Styles

There are numerous approaches to investing in stocks. Some of the most popular are value, growth, and momentum. Growth investors look for companies that are growing earnings rapidly, and likely to do so in the future. Momentum investors look at price momentum on the basis that when share prices rise rapidly, they should continue to rise for the next 6 to 12 months. Value investors focus on the price of the share relative to its earnings or intrinsic value. Income investors focus on dividends to create a steady income stream.

Now that you know some of the stock market basics you are ready to learn about ETFs.