5 Simple Rules for the Intelligent Investor to Follow

By Ani Stepanyan, Contibutor

• How to improve your existing portfolio management

• When to buy and sell assets

• How to behave during market volatility

• How often revisit your portfolio

• Do Due diligence check of stocks to invest in

Philosophical Approaches of Investing Giants

Investing gurus have built up their fortune by curving the right investing architecture, setting up investment rules and monitoring closely their timely execution. This article throws a glance at the most prominent investing figures of all times who shaped trends in the markets. So, what are the rules they followed throughout their investing career?

1. Set a Goal & Prioritize:

When it comes to investing, hire only a professional expert who can explain clearly your risk/reward , disclose the fees and offer you the most suitable financial investment with the minimum fees. Younger people may want to keep more liquid assets, if they are planning to purchase a new property soon. Middle-aged people can target a growth strategy, while senior investors may want to maximize investment income return to ensure their secure retirement. Whether you want to save your income in IRA or 401K account, a robo-advisor can analyze your spending and saving preferences and offer you a plan based on your transaction history. It then provides a feedback on fees, taxes, diversified portfolio types and cash sums.

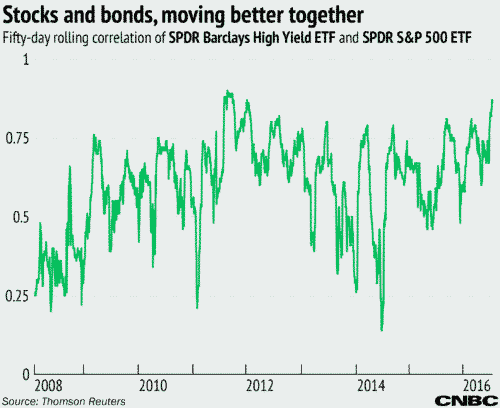

2. Stocks or Bonds:

As you might have noticed, different asset classes perform differently under various cycles in the economy. When we see unemployment rate in drawdown and interest rate rising, we have little worries about the expanding economy. Thus, stocks will rise, too. As Jim Chanos, the guru of short selling, once said, “Bubbles are best identified by credit excesses, not valuation excesses.” However, things differ during a weak economy. Bond ETFs may rise in value as a more reliable type of investment .

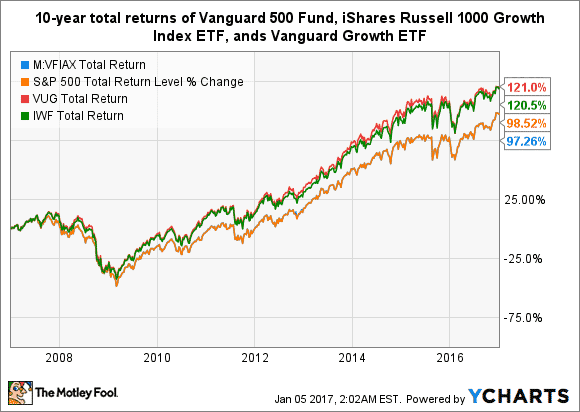

3. Which stocks to buy?

Do as Warren Buffett does. Buy only the stocks, which you would still like to have in 30 years’ time from now assuming the markets would close down tomorrow. Experts advise to combine all three schools for evaluating the real efficiency of your investment. The technical analysis will give you an insight on stock market trends. The fundamental analysis relies on economic theories and quantitative finance to predict future movements in stock prices. The third school of thought supports market efficiency hypothesis and proves mutual fund performance and ETF investing have better chances over individual stocks in terms of growing the invested money. Philip Fisher was the most prominent follower of buy-and-hold approach. In 1955, he acquired the shares of Motorola Company, which he predicted to be a potential success. Growth-oriented business management was the key for his investing decisions.

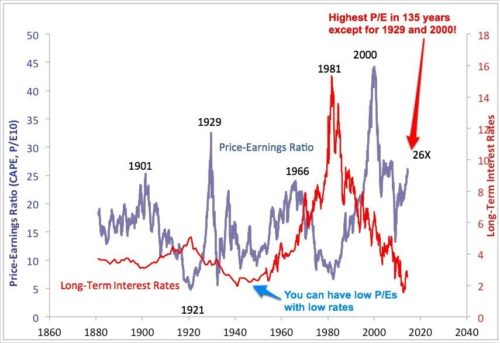

4. Invest with Logic:

Curbing your emotions and not jumping in when everyone buys and selling when markets sell off is the most intelligent step to take. Think of buying a property. Will you ever buy a house when the prices hit the peak and the market is overvalued? Well, if your answer is rather waiting until the market cools itself down; then apply the same investing strategy for stocks. Buy low, sell high. Investing strategies hint us to use logical reasoning and accurate computation instead of solely relying on your investing intuition. John Templeton is a vivid example of holding this strategy. In 1939, he invested the lowest bids in 100 companies on the edge of bankruptcy. Finally, he ended up selling most of them with tangible profit. Valuable data analysis technique and diversification helped him build up his fortune.

Source: Business Insider

http://www.businessinsider.com/stock-market-drop-2015-8

5. Use market volatility:

Market volatility is seen by many as a source of potential risk and disaster, but it can help you hunt for the neglected and undervalued assets. As Benjamin Graham coined in his book “The Intelligent Investor”, always focus on value investing. Financial analysis is the key point to assess the company’s performance and make market volatility earn profits for you. The technique of ETF investing is surely of a great help as it invests in uncorrelated portfolios. Among the most successful investors of all times is Bill Ackman who grew $50 million capital into $12 billion. He was able to predict accurately the recession of 2008.

How Can Robo-Advisors Help?

Robo Advisors use special algorithms to manage asset allocation. Wealth managers possessed $74 trillion AUM in 2014. The share of robo-advisors nowadays makes 10% of total wealth management which is foreseen to reach $8 trillion assets in total. Investors’ interest in Robo Advisors is expanding more and more. The launching of Artificial Intelligence is competing to keep the costs low and maximize the returns. Robo Advisors can help you narrow down your guess work and index tracking error. If you need your protfolios reveiewed annually, it’s reasonable to trust the latest achievement in the financial technology. The companies currently relying on this technology claim that their clients assets boost 2% higher returns per year. A recent survey showed that 49% of investors including high net individuals would consider to trust a part of their assets to robo-advisor management.