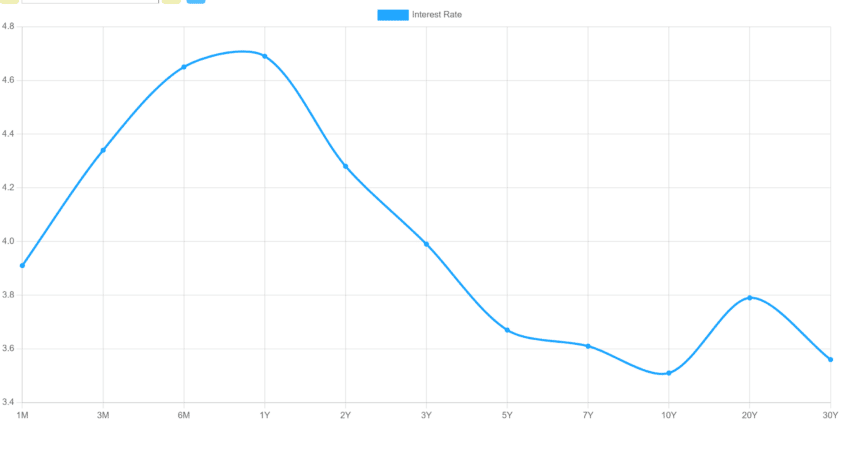

The treasury curve is a graph that shows the relationship between the yield on government bonds and the time to maturity of those bonds. Typically, the yield on longer-term bonds is higher than the yield on shorter-term bonds, resulting in a upward-sloping curve. This is because investors typically demand a higher rate of return to compensate for the additional risk of holding the bond for a longer period of time.

Inverted yield curve

However, there are times when the yield curve becomes inverted, meaning that the yield on longer-term bonds is lower than the yield on shorter-term bonds. This can happen for a variety of reasons, but one common cause is a change in inflation expectations. When investors expect inflation to rise in the future, they may be willing to accept a lower rate of return on longer-term bonds in order to protect the purchasing power of their money.

Inflation is the rate at which the general level of prices for goods and services is rising, and it is measured by the consumer price index (CPI). When the inflation rate is higher than the interest rate on a bond, the purchasing power of the money received from the bond will be eroded over time. For example, if a bond has a yield of 2% and the inflation rate is 3%, the purchasing power of the money received from the bond will be reduced by 1% each year.

Inflation expectations play a key role in the treasury curve, as investors will adjust their expectations for future inflation based on a variety of factors, including the actions of the central bank. The central bank is responsible for setting interest rates, and it can use these rates to influence inflation and inflation expectations. For example, if the central bank raises interest rates, it can help to curb inflation by making borrowing more expensive and therefore reducing spending.

When the yield curve is inverted, it can be a sign that investors are expecting the central bank to raise interest rates in the future in order to curb inflation. In this case, the yield on shorter-term bonds may be higher than the yield on longer-term bonds because investors expect the central bank to act quickly to raise rates. This can lead to a situation where the yield on shorter-term bonds is higher than the yield on longer-term bonds, resulting in an inverted yield curve.

Is it bearish for the economy?

In general, an inverted yield curve is considered a bearish sign for the economy, as it can indicate that investors are expecting economic growth to slow in the future. However, it is important to note that the relationship between the yield curve and the economy is not always clear, and there can be other factors that cause the yield curve to become inverted. For example, changes in global economic conditions or shifts in investor sentiment can also affect the yield curve.

Overall, the treasury curve and the yield on government bonds are important indicators of economic conditions and investor sentiment. An inverted yield curve can be a sign that investors are expecting the central bank to raise interest rates in the future, and it can indicate that the economy may be slowing down. It is important for investors and policy makers to monitor the yield curve and understand the factors that can affect it in order to make informed decisions.

Fro a different look at yield harvesting take a look at our Maximum Yield strategy.

We have a variety fo investment strategies that work in different economic environments. See the latest performances:

https://logical-invest.com/app/testRank