The Logical-Invest monthly newsletter for December 2018

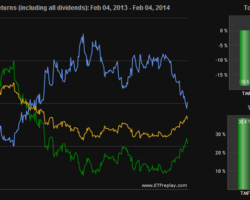

Logical Invest Investment Outlook December 2018 The graph below is from a recent Bloomberg article entitled “A Brutal Global Market in 2018 Has Just One Champion“. That one champion, according to the article, was Treasury bills. It goes on to say: “By one simple measure, this is the worst cross-asset performance in more than a century“. Below you can see 89% of all assets had negative performances year-to-date (as of Nov. 22). This may be an exaggeration … Read more