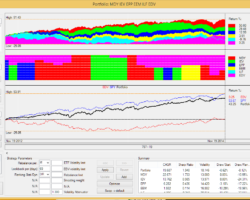

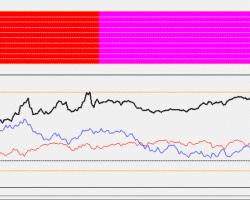

Risk Management using Timed Hedging – Avoid DrawDowns

As you perhaps know I have invested all my money in my own strategies, and I and my family (the best wife of all and 4 nice children) are living from the return of these investments. So, I just cannot afford to lose much money in market corrections. Therefore I always try to improve the strategies to lower the risk of major losses through hedging. Timed Hedging The new “Timed hedging” is a major improvement … Read more