When you enter an order to buy or sell a share or ETF on an online trading platform, you will quickly discover that there is more than one type of buy or sell order you can enter. In fact, even in the days before online trading, there were various order types. However, the development of trading algorithms and competition between brokers has led to numerous new and complex order types.

This can be both a blessing and a curse. Some of the available order types can be very useful. On the other hand, the extensive choice can lead to investors over-complicating their trading. Investors also need to manage their orders carefully and always be aware of what active orders are in the market, and any orders that may be triggered.

Limit and Market Orders

Traditionally there were two basic types of orders; limit orders and market orders. A limit order instructs the broker to trade at a specific price or better. A market order instructs the broker to trade at the best price available at that moment. In general, you would use a market order to buy or sell a share immediately and avoid the risk of the price moving higher or lower. You would use a limit order if you are only prepared to trade at a specific price.

A market order has no field for the price, whereas if the order type is changed to limit (below) a price field will appear. Limit orders also have a field to specify how long the order should be valid. The most common period would be ‘Day’, in which case the order expires after the close, or GTC which stands for ‘Good till Cancel’.

Stop Orders

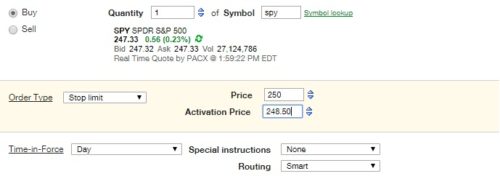

Stop orders are used to enter and exit positions. A buy stop order is triggered when the price rises above the activation level. A sell stop is triggered when the price falls below the activation level. Usually, a stop order will be executed as a market order, but stop limit orders can also be used. A stop limit order has an activation price and a limit price: The order is entered when the activation level is breached, but only executes if the market then trades at the limit price.

In the screenshot below, an order to buy at $248.50 will be entered if the price rises to $250.

Trailing Stop Orders

A trailing stop is a stop order that moves with the price. In the case of a long position, the trailing stop would be an order to sell. The stop activation level would move higher every time the price makes a new high. The activation level will either be a fixed distance below the high or a percentage of the highest price. The objective is to hold a position until the trend reverses, and also to protect profits.

Trailing stops are very popular, but should only be used with certain strategies. They are well suited to momentum strategies but can limit the performance of ETF rotation strategies.

Conditional Orders

Technology now allows investors to enter a series of orders that are linked to one another. For instance, two orders can be entered to exit a position either at a target price or at a stop loss price. If either order is executed, the other order will be canceled. Below are some of the most common conditional order combinations:

- OCA: One cancels another, as per the example above.

- OTA: One triggers another. A stop buy order can trigger a limit sell order when executed.

- OTT: One trigger two. A stop buy order can trigger a stop sell order and a limit sell order when executed.

- OT/OCA: The first order executed triggers a second and third order. The second order executed cancels the third order.

Conditional orders are not without their risks. It is possible for orders to be executed before they are canceled which can leave an investor with unwanted positions.

Market on Close Orders

A market on close order is an order to execute a trade when the market closes, at the market price. Effectively that means the trade is executed at the day’s closing price. This is useful for ETFs with low liquidity, as there will usually be more liquidity around the close.

The order types mentioned above are the ones commonly available on most online trading platforms. There are other even more complex options, but for long term investors, the above are more than sufficient. Before making use of a sophisticated order, you should make sure you understand how it works 100%. It is very easy to end up with an unnecessary loss when you mistakenly cancel an order, or enter a duplicate order.