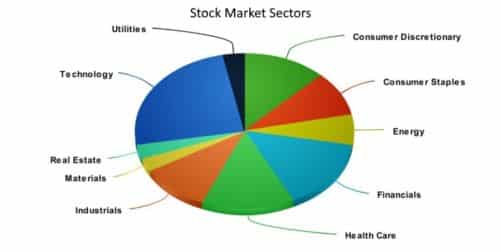

The stock market and all general market indices, including the S&P500, can be divided into 10 sectors. State Street SPDR, the issuer of the SPY exchange traded fund also manages ETFs for each of each sector. SPDR is usually pronounced as ‘spider’ or ‘spyder.’

Companies in different sectors tend to outperform and underperform at different times during the business cycle. This comes down to whether they are considered growth stocks or defensive stocks, and other factors such as dividend yield and valuation. The individual sector ETFs all have expense ratios of 0.14%, which is slightly higher than the SPY fund.

Financial sector (XLF)

The financial sector spdr trades under the code XLF. Financials account for approximately 14% of the SP500 index.

There are 65 companies in this ETF, with the largest being Berkshire Hathaway at 11%. Other large holdings include JP Morgan, Wells Fargo, Bank of America and American Express. Most of the large holdings are banks, but not all the holdings are banks. There are also insurance companies, stock brokers, payments companies and private equity companies in the sector.

Utilities (XLU)

The utility sector consists of electricity, gas and water companies, including Nextra Energy, Duke Energy, and Dominion Resources.

Utility companies may not be very exciting, but they do pay higher dividends than most other stocks and have fairly predictable earnings. This sector spdr trade as XLU and has a weighting of 3.2% in the index.

Consumer Discretionary Stocks (XLY)

The consumer discretionary sector consists of retailers, restaurants, hotels and automobile and apparel companies. These are companies that do well when consumer spending rises but suffer during recessions and periods of uncertainty.

Major holdings include Amazon, Home Depot, Comcast, Disney, Starbucks and MacDonald’s. XLY accounts for 12.4% of the index.

Consumer Staples (XLP)

The consumer staples sector consists of companies that make products that people buy regardless of the state of the economy. These include food, beverages, household goods and personal products. These companies have more stable earnings as sales don’t fluctuate with the economy. The sector is therefore considered defensive.

Notable holdings include Proctor and Gamble, Philip Morris, Coca-Cola, and WalMart. This sector accounts for 9% of the index.

Energy Stocks (XLE)

Companies in the energy sector are involved in exploration, extraction, processing and marketing of oil and natural gas. Energy stocks are highly correlated to the energy price, demand for oil and gas and to geopolitical issues.

The largest holdings include Exxon Mobile, Chevron, Schlumberger and ConocoPhillips. The sector accounts for 6.4% of the S&P500 index.

Health Care Stocks (XLV)

The health care sector consists of any companies involved in healthcare. This includes pharmaceutical and biotech companies, healthcare insurers and hospital operators. Most of the companies in the healthcare sector are considered defensive as healthcare spending is not dependent on the state of the economy.

Large holdings include Johnson and Johnson, Pfizer, Merck and United Health. The sector makes up 13.8% of the index.

Industrials (XLI)

The industrial sector consists of the aerospace, defense, construction and general manufacturing industries. This is one of the most diverse sectors, though most of these industries profits are closely connected to economic activity.

The largest holdings are General Electric, 3M, Boeing, Honeywell and Union Pacific. The XLI ETF accounts for 10% of the S&P500 index.

Tech Stocks (XLK)

The technology sector consists of electronic, software, telecommunications and information technology firms. The sector is highly geared to the economy and to innovation. While the sector has grown remarkably over the past 30 years, companies tend to trade at high valuations which make them vulnerable during market corrections.

Notable holdings include Apple, Microsoft, Facebook, Google, AT&T, Intel, and Cisco. At 24.5%, the tech sector is the largest in the index.

Materials Stocks (XLB)

The materials sector includes firms that mine or produce chemicals, construction materials, metals, paper, packaging, and timber.

The largest companies in the sector include Dow Chemical, du Pont, Monsanto, and Praxair. The materials sector is the smallest in the S&P500 index and accounts for 2.8 %.

Real Estate (XLRE)

Real Estate companies can be divided into real estate investment trusts and real estate developers and managers. These company’s fortunes are closely tied to interest rates and property prices. Many of them pay good dividends.

Large holdings include Simon Property Group, American Tower Corp, Crown Castle International and Public Storage. This sector accounts for 3% of the index, and the real estate ETF is the sector spdr with the highest dividend yield.

The chart below plots the performance of all 10 SPDRs over 5 years, along with the S&P500 index.

Sector Rotation

Sector ETFs are useful for rotation strategies such as the one’s we offer on this site. There are generally two approaches to sector rotation. The first is to continuously rotation into the sectors with the highest momentum, while the second involves rotating funds from sectors that have performed well to sectors that have underperformed. Both strategies can be traded profitably at different times.