The Logical-Invest newsletter for November 2021

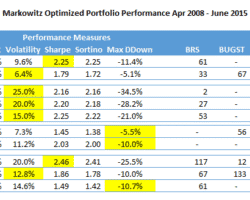

Everything is green again October was an exceptional month for our strategies. Our newest and most aggressive one, the Crypto and Leveraged Top 2 returned an exceptional 45% for the month. Our non-crypto leveraged strategies also had a good month as equity (SPY +7%), bonds (TLT 2.5%) and gold (GLD 1.5%) returns were all positive. For October, our long running Universal Investment Strategy 3x Leveraged strategy returned 13%, our US 2x Market strategy 11% while … Read more