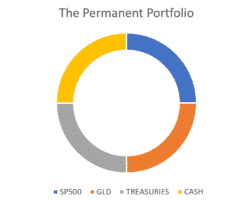

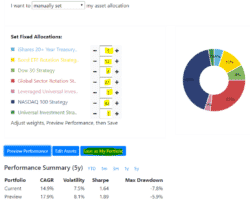

The “US Market Strategy” or how to invest using a crash-hedged strategy.

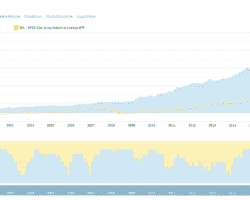

There is no better moment to realize the value of a hedged and diversified investment strategy than now during this difficult coronavirus crisis. Logical-Invest has been developing hedged investment strategies for years with the goal of minimizing risk. Since we have been in a bull market for 11 years now, it has been hard to explain why an investor should not invest 100% of their portfolio in equity. Many investors started to believe that markets … Read more