A portfolio is more than just a collection of shares. Managing a portfolio effectively require very specific goals, as well as a sound strategy. Portfolio management is both an art and a science, and aims to create the optimal mix of assets to achieve those investment goals.

A very simple example of what a portfolio manager needs to achieve would be to compare the requirements of a someone aged 30 and just starting to save for retirement, and someone aged 70 and recently retired. The 30-year-old would want a portfolio focused on capital growth. They would also have a higher tolerance for volatility, as they would have more time for the market to recover from a large correction. They would, therefore, have a high proportion of their portfolio allocated to high growth stocks.

On the other hand, the 70-year-old would want to own shares with less volatility to protect their capital. They would also want to prioritize earning income over growing capital. They would need to own bonds and dividend paying stocks to generate that income.

Portfolio Management Steps

Goals

The first step is to identify the goal of the portfolio. It may look to aggressively grow capital, minimize volatility or generate income. Portfolios are either managed as a product such as a mutual fund, or for a specific client, either an individual or a pension fund. A fund or product will have generic goals, while a portfolio managed for an individual will have specific goals to meet the financial needs of the investor. These may include buying a house, paying for a child’s education or saving for retirement.

Asset Allocation

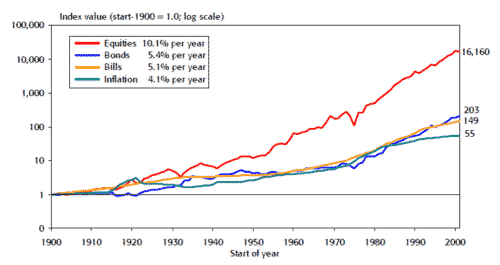

Some assets generate higher returns over time, but with higher volatility. Other asset classes are more stable but earn lower returns. And, others generate higher income levels. Before choosing a single individual security, a portfolio can be optimized to find the optimum level of growth, volatility, and income. The main asset classes are stocks, bonds, cash, property, and commodities.

Security Selection

Finally, the securities within each class are selected to optimize the performance of that portion of the fund. Often a benchmark will be used to monitor the performance of that particular asset class.

Active Vs Passive Portfolio Management

A passively managed portfolio tracks an index with no discretion given to the manager. An index will have a universe of stocks from which it selects securities, a total number of securities and a methodology for weighting each holding.

If a portfolio is actively managed, the fund manager will use their discretion to pick securities and manage positions. They will usually try to outperform or perform in line with a benchmark index. The active component of a portfolio can be invested in a mutual fund or managed as a segregated portfolio. Active funds attract higher fees than passive funds.

These decisions are made at the asset class level rather than for an entire portfolio. A portfolio may have its bond component invested in an index tracking fund, while the equity portion could be invested in an actively managed fund.

A popular method is to use a core/satellite approach where a core holding in an index fund is maintained and complemented with selected stocks or ETFs.

Modern Portfolio Theory

MPT is a hypothesis published by Harry Markowitz. The theory is that a portfolio can be constructed to optimize the expected return for a given level of risk. It is based on the principles of diversification which state that adding securities to a portfolio can reduce the overall volatility. So while the total expected return would equal the average of the expected returns for each stock, the volatility would be lower than it would for each stock.

Computer models can generate an optimal portfolio if a risk level and a list of stocks with risk and expected return are entered. This is known as portfolio optimization.

Ongoing Management

The performance of a portfolio needs to be monitored on a regular basis. As share prices move and earnings models are updated, the expected return for each holding will change. The portfolio will need to be adjusted from time to time to remain in line with its objectives.

Rebalancing

Portfolio management usually requires a periodic rebalancing of asset classes or funds within an asset class. Sometimes capital is moved from funds that have performed well to funds that have underperformed. And, sometimes the opposite is done – this depends if the portfolio has a bias toward momentum or value.

Summary

Portfolio management is usually practiced using a top-down approach. Firstly the asset allocation is determined to find an appropriate balance between expected return, volatility, and income. Once that is determined, individual assets are chosen within each asset class. This discipline is essential to keep a portfolio focussed on goals and to manage risk. This stops investors making impulsive decisions or acting irrationally during market downturns.