‘Hell on Fire’: The 3x leveraged Universal Investment Strategy

Summary:

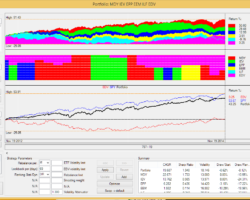

-Aggressive leveraged version of our previously published Universal Investment Strategy

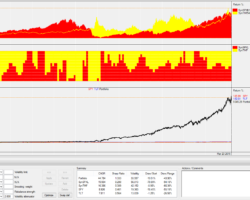

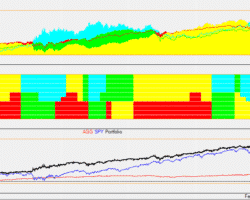

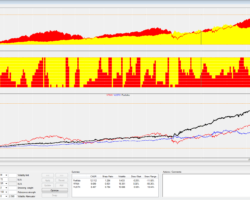

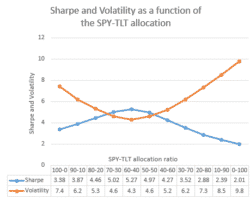

-Variable SPY-TLT allocations dynamically adapted to the market conditions.

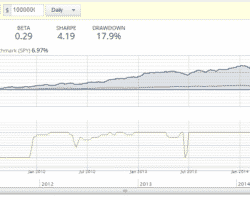

-45% annual return with a Sharpe Ratio of 1.3 since 2002.

Due to its simplicity and low correlation to the S&P 500, there is a continued interest in the UIS version that uses 3x leveraged ETFs: ETF SPXL (Direxion Daily S&P 500 Bull 3X Shares ETF) and TMF (Direxion Daily 30-Year Treasury Bull 3x Shares ETF). Following the suggested nomenclature by Al from AAII SV – and to honor their interest, we call this version “Hell on fire”, which alludes to the high risk/return profile of the strategy. We will show ways to blend this strategy in a well-balanced and risk-optimized portfolio as to overcome the generally negative perception of private investors towards leveraged ETF.