Home › Forums › Logical Invest Forum › News/Announcements

- This topic has 15 replies, 7 voices, and was last updated 6 years, 6 months ago by

Alex @ Logical Invest.

- AuthorPosts

- 11/03/2017 at 11:42 am #47247

Vangelis

KeymasterNews and announcements.

11/03/2017 at 11:45 am #47248Vangelis

KeymasterThere is a problem with intraday Yahoo data. It seems the format has changed since November 1st 2017 and QunatTrader cannot download intraday data. We are working on a solution.

11/17/2017 at 10:16 pm #47553Don Krafft

ParticipantIt appears that the Yahoo data is no longer available. Have you confirmed that the problem is just a format change?

Thanks,

Don Krafft

11/30/2017 at 6:07 am #47815Petr Trauške

ParticipantYahoo data is not still avaible. How long do you expected this situation ? For this time I use Portfolio Builder.

Thanks

Petr

11/30/2017 at 7:13 am #47820Vangelis

KeymasterWe found a solution and moved away from Yahoo data. Both QuantTrader and the Consolidated Excel sheet use IEX for last price data.

11/30/2017 at 7:31 am #47831Alex @ Logical Invest

KeymasterWe’ve created a new download page for QuantTrader updates, please see here.

12/05/2017 at 3:44 am #48034Petr Trauške

ParticipantThanks Alex, Vangelis.

Petr

11/12/2018 at 7:55 am #56080Howard

ParticipantHi, how do we look at the historical etf allocation for each strategy in the new portal? Tks

11/12/2018 at 8:09 am #56084Alex @ Logical Invest

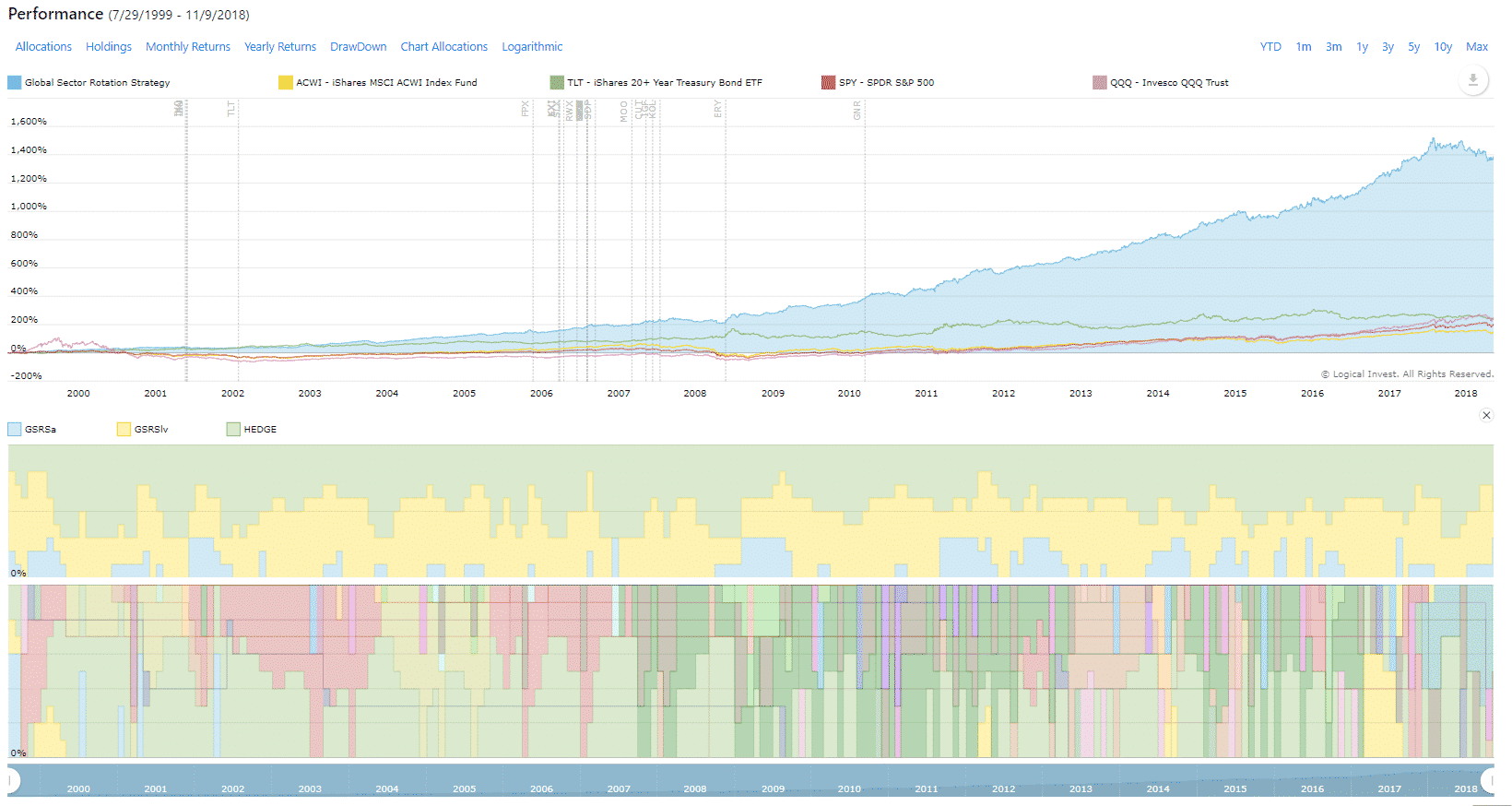

KeymasterWe changed the former list to a graphical visualization. Simply click on “Allocation” or “Holding” in the graph to see the allocations at strategy and/or ETF level.

11/12/2018 at 9:05 am #56086

11/12/2018 at 9:05 am #56086Howard

Participantgot it thanks

11/13/2018 at 3:38 am #56143Kai Jiang

ParticipantHello, can somebody tell me what holding price is in portfolio Allocations section on the new site? They look random to me. The price for UGLD is listed as $7.87?. Should it be open price of the holding on the first trading day of the month? Please correct me if I am wrong. My main concern here is that the monthly performance calculations are not working properly or there is some issue with current pricing data feed. And I have to stick with the old spreadsheet.

Holding Weight Amount Price Shares

CA – 6% $6,000 $42.83 140

ESRX – Express Scripts 6% $6,000 $94.87 63

EUO – ProShares UltraShort Euro 4% $4,000 $24.56 162

FOXA – Twenty-First Century Fox 6% $6,000 $44.62 134

GLD – SPDR Gold Trust 12% $12,000 $114.48 104

NLR – VanEck Vectors Uranium & Nuclear Energy ETF 27% $27,000 $52.53 513

SBUX – Starbucks 6% $6,000 $56.01 107

TLT – iShares 20+ Year Treasury Bond ETF 27% $27,000 $113.35 238

UGLD – VelocityShares 3x Long Gold ETN 6% $6,000 $7.87 762

Total 100%11/14/2018 at 1:44 am #56153Vangelis

KeymasterThanks for pointing this out. It has been fixed.

11/15/2018 at 12:19 pm #56185R D HATHCOCK

ParticipantVangelis,

I have a question about the hedge. I have added VXX into the QT for UIS 3x. It is selected 90% of the time over 3 years. Have you looked into that as a hedge?11/19/2018 at 2:51 pm #56260Vangelis

KeymasterIn principal we avoid going long VXX as it is a long time looser (graph goes to zero). We actually base MYRS on this fact by investing in it’s almost opposite, ZIV. I did try VXX in UIS 3x and if you do not change the settings (DR algo and add VXX as last ETF) the software assumes VXX is the hedge (DR algorithm always includes allocation to the hedge) so it always includes it in the allocation. If you shift the algo to SR and use top 2 ETFs you will get different results.

Adding VXX was not a disaster. I would expect much worse. It actually helps in recent history. It would be interesting looking into it more. I also tried VXZ with not such good results.

Soon we will be able to include any reasonable custom strategy that you build (ie, 3xUIS_VXX) in our webapp. All we would need is a XXX_Strategy.ini file from you and we could track it on our online app.12/02/2018 at 3:10 pm #56516Kai Jiang

ParticipantCan we use decimal number for holding weight column? Otherwise total weight of conservative and aggressive risk portfolio for November looks like 102%.

Strategy locations of Moderate Risk Portfolio

NAS100 – NASDAQ 100 Strategy 38%

GLD-USD – Gold-Currency Strategy 22%

USSECT – U.S. Sector Rotation Strategy 40%Why there is no ETF holdings (EUO/GLD) from Gold-Currency Strategy?

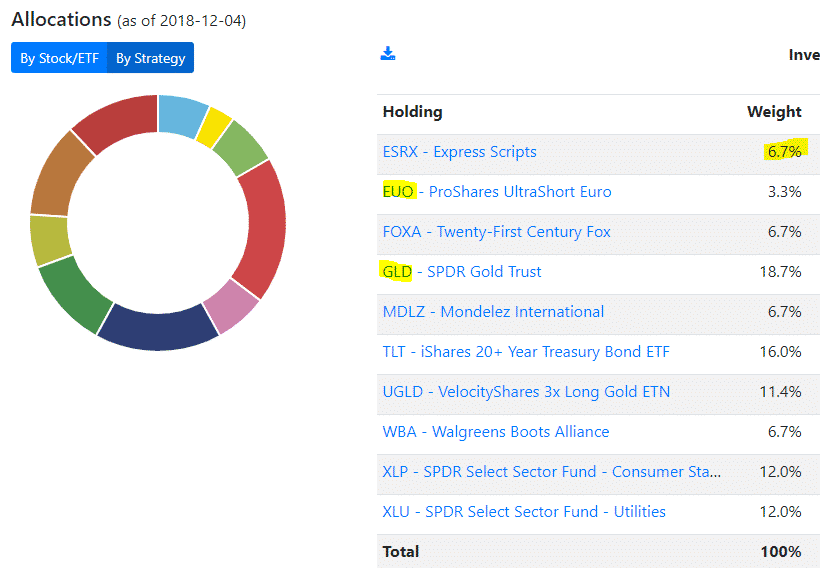

12/05/2018 at 5:47 am #56560Alex @ Logical Invest

KeymasterThanks for the comment, have added one decimal to the holding.

Here the updated allocation viw for the moderate portfolio, see the holdings of GLD and EUO:

- AuthorPosts

- You must be logged in to reply to this topic.