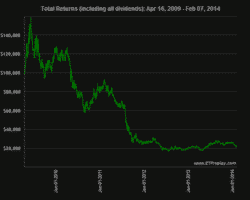

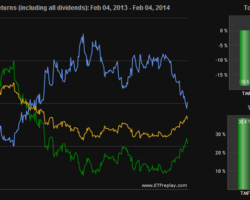

The new always hedged BUG Strategy backtests

New always hedged BUG Strategy backtests The old BUG strategy behavior during the Corona crash: You see that the crash happened in between two rebalancing’s. As we have been in a 100% bull market scenario in February, the March strategy allocation was 40% Emerging market bonds and 20% Convertible bonds. Both are equity like bonds. The inflation protected TIP bond was not a strong enough hedge. As the crash happened very fast, there was no … Read more