Volatility Premium – Why we invest in ZIV and not in XIV

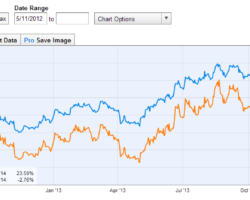

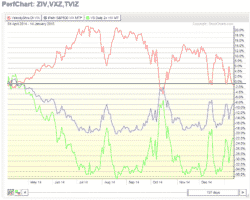

Several times I have been asked why we invest in ZIV (inverse mid-term volatility) and not in XIV (inverse front month volatility) in our Maximum Yield Rotation Strategy and in the “Global Market Rotation Enhanced Strategy” to harvest the volatility premium. Harvest Volatility Premium smartly After all, front month VIX Future contango is about 2-3x bigger then medium term contango. At the moment XIV profits from nearly 9% monthly VIX Futures contango. ZIV profits from about 3% … Read more