Shorting Volatility: Comparison of ZIV replacements in MYRS

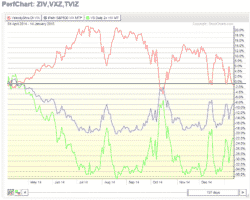

Here is a comparison of different ZIV replacement ETFs in the MYRS strategy, shorting volatility. Going long ZIV is the most simple way to execute the strategy. ZIV is in fact an inverse ETF, so even if ZIV does not have leverage, ZIV needs to be rebalanced daily. Rebalanced ETFs in general have losses. These losses become bigger with higher volatility. Shorting Volatility the smart way On the chart below you can see the quite poor ZIV performance … Read more