The Logical-Invest monthly newsletter for June 2015

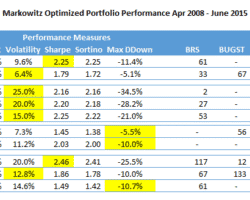

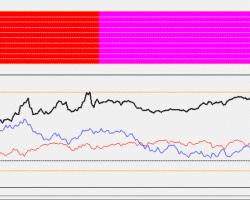

This is the monthly monthly Logical-Invest newsletter for June 2015. From now on this newsletter will replace the individual comments for the single strategies. The newsletter includes a strategy performance overview which can help you to switch between strategies. The same table is available if you login to your logical invest account at “My Account” and select the strategy performance menu. The table on the website is a dynamic table and will be updated every day. This way … Read more