The new reviewed Bond Rotation Strategy

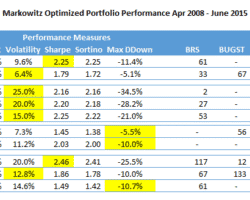

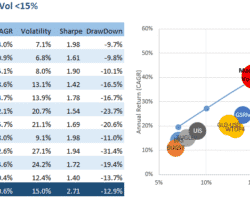

From the next strategy email on, the Bond Rotation Strategy will also use adaptive ETF allocation, to make is more suitable as IRA or 401k Investment Strategy. This new technique allows a 30% higher Sharpe (return to risk) ratio. Together with this change we have also changed the ETF selection from the old: AGG – iShares Core Total US Bond (4-5yr) BOND – PIMCO Total Return ETF CWB – SPDR Barclays Convertible Bond HYLD – AdvisorShs Peritus … Read more