Chat, Analyze, Trade: Building Strategy Rules with ChatGPT

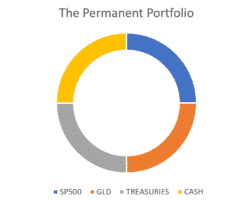

How I Got the AI to Create, Code, and Backtest a Quant Portfolio in Python Without Writing a Single Line of Code! I wanted to explore the new capabilities of the Advanced Data Analysis module, available in the GPT-4 options. I provided ChatGPT with historical daily prices for SPY, TLT, and GLD, and asked it to devise a trading strategy with a strong Sharpe ratio. Simple enough, right? Here’s the prompt I gave to GPT, … Read more