Harvesting Contango: How To Build An ETF Rotation Strategy With More Than 50% Annualized Returns

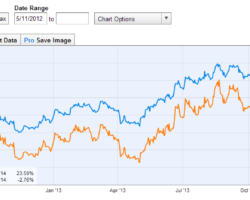

In this paper I want to explain the readers how the Maximum Yield Rotation Strategy of www.logical-invest.com is built. This strategy harvests the so called Contango. Harvesting Contango by investing in inverse volatility This Strategy harvests contango and achieves very high returns investing in inverse volatility. From 2011 to today the annual performance was more than 70% per year. Year to date the performance is 40.9%. The Sharpe Ratio (Return/Risk) of 2.12 is a “DREAM VALUE” … Read more