Backtest: New adaptive Global Market Rotation backtester

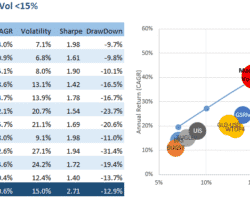

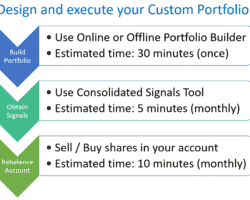

I just want to share a screenshot of the new backtest software, we have written in C# to calculate and backtest the new adaptive logical-invest strategies. This software can be used to calculate the variable allocation for the MYRS, GSRS and GMRS. Since 2017, QuantTrader, this backtest software is now also available for retail and institutional investors, see here. Our backtest software QuantTrader now available Below you see a 2 year graph showing the Global … Read more