Continuing our effort to provide training and education for new users of our portfolio backtesting software QuantTrader, here a new series of video tutorials.

A complete walk-through of the main functionalities for building a Meta-Strategy

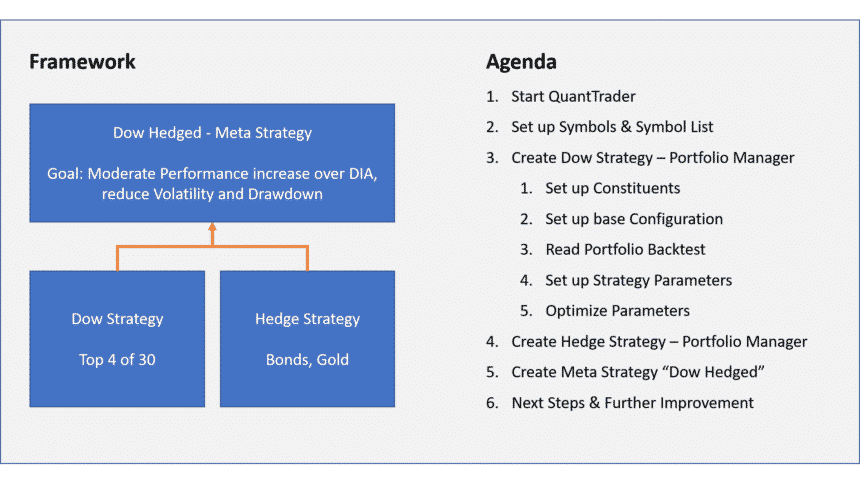

Here the framework of the Hedged Dow Jones Meta-Strategy created during the process, and the detailed agenda of the 9 video clips:

QuantTrader “under the hood” – Explained with practical examples

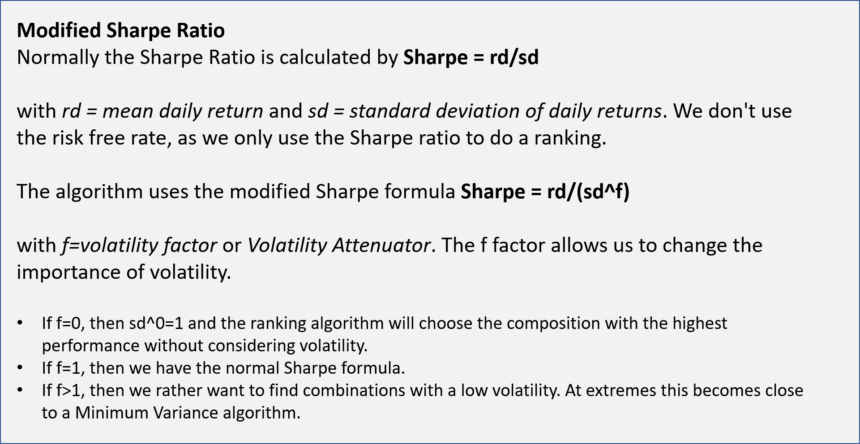

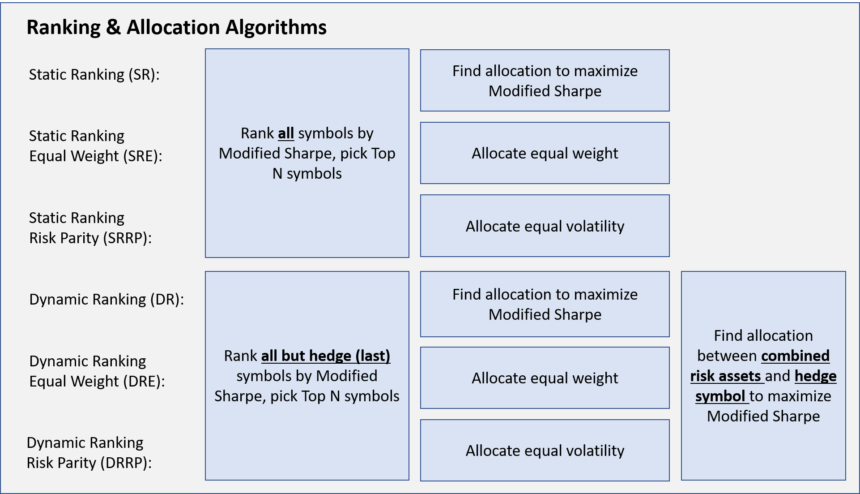

In section 3.4 Setting up Strategy Algorithms and Parameters we explain the calculation of the “modified Sharpe Ratio”, how to properly select the volatility attenuator and show the differences between the six ranking and allocation algorithms:

Tutorial videos in detail:

The videos are available as a YouTube Playlist, so you can follow the overall process or chose topics of your interest. The tutorial is targeted to first-time and beginning QuantTrader users, with detailed explanation on each single step so you can replicate the process while watching. Further tutorials for our more advanced QuantTrader users are in preparation.

Tutorial Intro: Objective, Framework and Agenda

1. Starting QuantTrader & loading data

2. Setting up symbols and stock-lists

3.1 & 3.2 Using Portfolio Manager to create and configure the “Dow Jones” strategy

3.3 Interpreting the Strategy Backtest Window

3.4 Setting up Strategy Algorithms and Parameters

3.5 Optimizing Strategy Parameters

4. Using Portfolio Manager to create and configure the “Hedge” strategy

5. Creating the final “Dow Hedged” Meta-Strategy

Please post follow-up questions or doubts either in the forum, or in the comment section of the YouTube videos. I plan to prepare another video answering the main questions. If you have not yet subscribed to QuantTrader, you can get a free one month trial simply registering at our site, then download the backtesting software.

Enjoy watching, excuse my heavy “kraut accent”, and please tell me how many “ahm’s” you count in total.

Looking forward to a vivid discussion as always,

Alexander Horn