Forum Replies Created

- AuthorPosts

urghan2

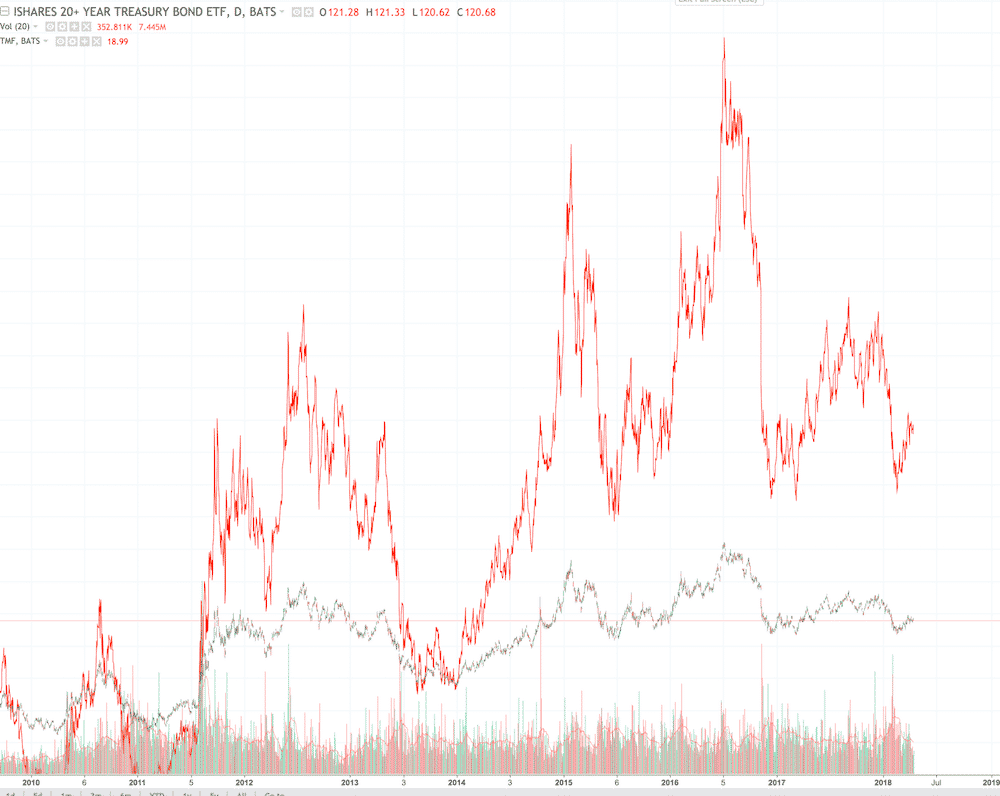

Participant[quote quote=51658]Leveraged funds have decay and do not track the underlying at the quoted multiplier. TMF in the long run will not perform 3x the TLT. That just means that it may perform 2.3 or 1.5 times the underlying, depending on the path. When someone says it is not recommended to hold leveraged funds it is meant in the context of expecting to make 3x or 2x the underlying. This is not what we expect with TMF. We use it as a hedge. Best is to look at a graph between TLT and TMF.

[/quote]

Hi.

I read those two papers you mentioned above. Thanks! Still doesn’t quite get the idea of how gamma risk affects strategy performance when using monthly rebalancing and longer periods. Does it? Or does it even out itself? Maybe in the context of LI strategies?

urghan2

ParticipantHi.

Can you please open up a little bit of the concept of cross-correlation and how do you use it in your stock/ETF selection/exclusion? I’m not familiar with the concept.

Thanks!

urghan2

ParticipantPS. What bothers me a bit is that in all those articles there’s a mantra: “Leveraged funds are not for long term investment”. And if I have MYRS and Nasdaq100 in my portfolio I will have constant, long term investment in TMF. Sometimes it’s bigger, sometimes it’s smaller, but nearly for all time there is some allocation to it (I have to check if there was any period of time in which both of those two strategies were not invested in TMF at all, I doubt it). And then we know that in the long term TMF is not performing better than TLT. So it’s more a painkiller for a portfolio (reduces short term volatility) than a cure. But that’s a bit different topic, I have discussed it before.

[/quote]

I’m not actually sure how this goes but was thinking the same. In case I buy a position of a leveraged fund and make a small rebalance every month, thus holding at least a part of the original position for quite a long time, at some point it should have negative impact on portfolio. How long is it ok to hold a leveraged fund? Should I rotate the whole position in and out of the portfolio at least once in 2-3 months? I assume we use first in first out, so for example if in january I buy 100 shares of ABC, in february I sell 30 shares of ABC (of the original position), and in march I buy again 30 shares of ABC, I assume that in the end I have 70 shares of original + 30 shares of new position = 100 shares total position of ABC. And those 70 shares that are from the original position, are decaying quickly.

- AuthorPosts