Forum Replies Created

- AuthorPosts

Ritter

Participant[quote quote=40995]Hi Ritter- Just out of curiosity, what does the “E” signify in your #MYERS ZIV TMF strategy (ZIV PLUS screenshot)? How does it differ from the canned #MYRS ZIV TMF in Frank’s downloads? Gordon

[/quote] Hi Gordon sorry I don’t think I got a notification that I had a comment…But you didn’t miss much :-) I think I just added the E to make it stand out while I was messing around with it and using Myrs as a bench mark!Ritter

ParticipantAlex posted the screen shots now!

Ritter

ParticipantHa ha I can only imagine! I emailed you the screen shots can you post them up please. No idea why but they dont stick when I do it!

Ritter

ParticipantHi Ivan I just sent them to Alex to post for me as for some reason I am not able to do it and out of time to keep trying :-) Hopefully they will be up soon! Let me know what you think !

NB I did read the post you wrote with the excerpt of the curve review and wanted to give my humble opinion on it but Frank answered it very well. However in short having worked on Quant based stuff for a while I am really impressed with QT and how far I can go without writing a single code. All their systems are pretty logical (excuse the pun) Sure they have some secret sauce but they still run on fairly broad parameters which is the opposite of curve fitting. I wouldnt worry what the odd internet genius has to say about it! Just get on with making a sensible return! :-)

Ritter

ParticipantI am short on time in between flights but Alexander has been bullying me a bit lately to post my thoughts on a possible improvement to the MYRS strategy. I should add a disclaimer and saying that I use QT to balance out less riskier assets in my vanilla portfolio so this may not suit all…However in my uninformed opinion I believe that this improvement has potential to reduce risk. It certainly has had no negative effect on the drawdown and Sharp is up.

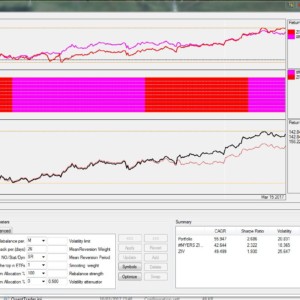

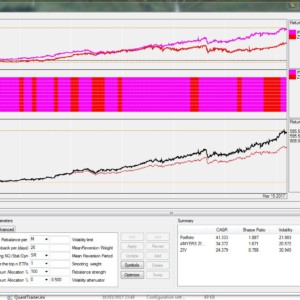

In essence you set it up as a small meta block. Each 14 days it will choose between MYRS and ZIV only. Basically the trend and momentum will decide whether to hedge or not. The first screen shot shows how precisely it avoided the Bond pull back around the Trump election it covers the last 12 months. That was a pretty period but going back 5 and more years it seems to stick see attached. Now remember that my own overall assets have several other hedges and non correlating assets which is what motivated me to set this one up.Hope it makes sense!

[Edit by Alex, here screenshots, click to enlarge:]

Ritter

ParticipantHi Frank and Vangelis,

Happy new year!!

As you know I have modified some of your strategies to suit the fact I am using them in a meta strategy in the Quant software. What is an easy way of transferring my meta strategy from the old version to the new one. Will I have to export/Import each sub and then the overall?

Joachim

Ritter

ParticipantGoing to reply to myself and say that as I started using the optimizer tool on ZIV-UUP-FXY or FXF etc I noticed that I get a very small area with light grey and white and rest of it very dark or black IE not much room for error and as its only over 5 years I would say its too risky.

Instead I have included the symbol ZIV as a standalone in the Meta strategy as a diversifier with good effect.

Ritter

ParticipantOk so I have been playing around with a currency alternative to the ZIV-TMF. I like the original set up but I am concerned that the inverse relationship might be temporarily suspect.

I used Yen and UUP as the hedge to ZIV: I have no way of testing ZIV further than 2011. Alex or Frank do you guys have a formula for that?

leveraged version x2 uup and x2 FXY a good sharpe for this product at 1.9 and 35 Cagr I also used the unleveraged version which has a 1.7 Sharpe and 29 CAGR Perhaps a more sensible choice.

I used the initial parameters from ZIV-TMF and optimized it. I settled on 60 days look back (62 gave a 4% bonus in the unleveraged version so I ignored that). Vol is 0.500 Mean rev -200 6 days

Please critique it so I can learn!

All the best Joachim

Ritter

ParticipantHi Alex,

Why did you choose the StoXX over Global Sector rotation out of curiosity?

In all honesty I am having a bit of a problem with TMF as a hedge. I know we had a chat about it the other day, but seeing how it behaved today when the result from the election came in I would say perhaps (and I don’t know yet) my concerns that when you have two very expensive products the inverse relationship is much harder to explore and today it was gold that reacted the best to the situation. Perhaps a sub strategy with Gold, shorter bonds etc might be worth exploring.

J

- AuthorPosts