Home › Forums › Logical Invest Forum › What is the difference between QT Light vs QT Premium?

- This topic has 6 replies, 3 voices, and was last updated 5 years, 5 months ago by

sylpha.

- AuthorPosts

- 07/09/2020 at 10:49 pm #79362

sylpha

ParticipantAs title. Thanks.

07/11/2020 at 6:34 am #79365Vangelis

KeymasterQT Light lets you visualize all Logical Invest strategies, sub-strategies, settings, metrics, etc. It also allows you to issue ‘signals’ (i.e. see current model allocations) at any time, not just on the 1st day of the month.

QT Premium lets you additionally:

1. Import your own symbols

2. Customize pre-existing strategies or create new ones.

3. Mix our (or your) strategies into your own dynamic ‘meta-strategies'(portfolios that dynamically pick and combine strategies).An example would be an investor who likes our Universal Investment strategy (SPY/HEDGE) but wants to replace SPY with QQQ. The could create a custom UIS_qqq_version, backtest it, find robust parameters and then use it to issue their own signals.

08/18/2020 at 9:10 am #79803sylpha

ParticipantI have submitted some question here but seems it’s gone….

Is there any way I can see the latest allocation of a portfolio (e.g. Max Sharpe) using QT Light? Since I do not know the % of allocation of each strategy in the Max Sharpe portfolio so I am wondering how can I check that. Thanks…

08/18/2020 at 9:38 am #79804Alex @ Logical Invest

KeymasterHi Jeffrey,

yes, seems I deleted your question by accident, and also my reply :-)

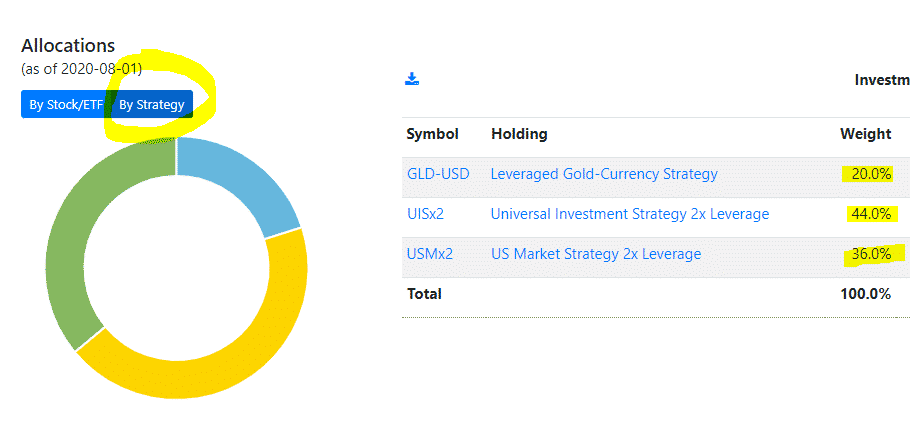

Here again: You can use the Consolidated Signals Window in QuantTrader to replicate the portfolios. Just copy the %’s per strategy which you find in the respective portfolios in the web-app – or try with your own. See below:

08/18/2020 at 9:46 am #79805

08/18/2020 at 9:46 am #79805sylpha

ParticipantHi Alex,

I can only find this in the portfolio detail screen, but it does not tell me the exact % of allocation per each strategy, where can I find the % of allocation in the website? Thanks.

Assets and weight constraints used in the optimizer process:

Bond ETF Rotation Strategy (BRS) (0% to 100%)

BUG Permanent Portfolio Strategy (BUG) (0% to 100%)

Leveraged Gold-Currency Strategy (GLD-USD) (0% to 100%)

Global Market Rotation Strategy (GMRS) (0% to 100%)

Global Sector Rotation Strategy (GSRS) (0% to 100%)

Maximum Yield Strategy (MYRS) (0% to 100%)

Universal Investment Strategy (UIS) (0% to 100%)

Universal Investment Strategy 2x Leverage (UISx2) (0% to 100%)

US Market Strategy (USMarket) (0% to 100%)

US Market Strategy 2x Leverage (USMx2) (0% to 100%)

US Sector Rotation Strategy (USSECT) (0% to 100%)

World Top 4 Strategy (WTOP4) (0% to 100%)08/18/2020 at 10:06 am #79807Alex @ Logical Invest

KeymasterSee here:

08/18/2020 at 10:16 am #79808

08/18/2020 at 10:16 am #79808sylpha

ParticipantThanks!

- AuthorPosts

- You must be logged in to reply to this topic.