Home › Forums › Logical Invest Forum › Quants: More technical details, facts and discussion

- This topic has 23 replies, 11 voices, and was last updated 7 years, 10 months ago by

Vangelis.

- AuthorPosts

- 10/29/2014 at 1:20 am #12327

Alex @ Logical Invest

KeymasterQuants: More technical details, facts and discussion

11/17/2014 at 4:36 pm #14078Michael

ParticipantHow has the Maximun Yield Rotation strategy performance and drawdown changed in the backtest when the Adaptive Allocation strategy is applied. I’d like to see a backtested comparison between the original strategy and the new strategy.

Thanks,

Michael Kiefer

11/18/2014 at 8:19 am #14097Frank Grossmann

ParticipantYou have the new charts in the latest strategy blog: https://logical-invest.com/new-maximum-yield-rotation-strategy-backtest-charts/

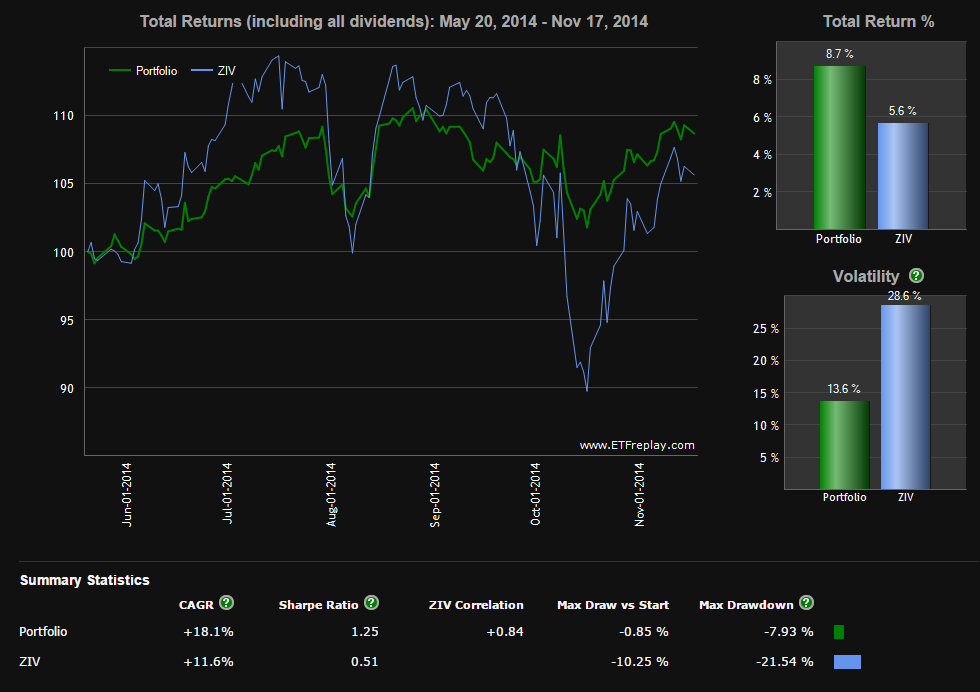

Here is the old chart for MYRS since 2010

The CAGR annual return is nearly the same. 56% for the old MYRS and 54% for the new strategy. The difference is small because in the past ZIV performed well over long periods and if this is the case, then both strategies invest 100% in ZIV. For such periods with a strong trend, rotation strategies with a 100% switch do perform very well and the new strategy will perform about the same because it is also 100% invested in ZIV.

The difference between a 100% rotation and a rotation with variable allocation however is very evident when the trend slows down and goes over in a flat market like it is the case for 2014. In this case a variable allocation does much better. The volatility is reduced a lot and the new Sharpe ratio (1.15 for 2014) is double the old Sharpe ratio (0.61 for 2014). Since about March, the new strategy is holding about 50% Treasuries (EDV). The effect of this can be seen here:

You have better return with a fraction of the volatility. Holding 100% ZIV for 2 weeks in such a volatile whipsaw market is like playing Russian roulette. The chance that the strategy is switching wrong is very high. With the new strategy I feel much safer now. It is a pity, that I can not back-test it for much longer periods with ZIV, but the results correlate nearly 100% with my new Universal Investment strategy which invests with a variable allocation in SPY-TLT. This one can be back-tested until 2002 and also shows much better results during market periods without a strong trend.

Best regards

Frank11/20/2014 at 10:30 pm #14175Tom Gnade

ParticipantI don’t see any information on the SPY-TLT strategy. Do you plan to post that soon?

11/20/2014 at 11:08 pm #14176Vangelis

KeymasterIt is already created, just in editing now. You will see it shortly.

01/05/2015 at 10:44 pm #15581Don Krafft

ParticipantWhen volatility increases, eventually the position sizes will be reduced by the equal volatility weight calculation that was given in the paper “Adaptive asset allocation: A primer,” Exhibit 2, by Adam Butler, et al (allocation = 1/n * 1% / [observed volatility of the asset over the past 60 days]).

For the new adaptive allocation strategies, you calculate return and sharp ratio on the weighted combination of two tickers. For the volatility position-sizing calculation, do you use the volatility of the combined two tickers and reduce the position size for each of the two tickers by the same amount? Or do you calculate the volatility for each of the two tickers separately and then reduce the position size of each of the tickers independently?

Thanks very much,

Don Krafft

01/06/2015 at 2:47 am #15582Alex @ Logical Invest

KeymasterDon, thanks for the question. Indeed in the original strategies the equal volatility contribution was like the 1/n approach above, which is very robust, but ignores the covariance between the assets as only volatility at the single asset level is used.

The new adaptive allocation with the modified Sharpe ratio works a bit different, as it is used as criteria at the ranking level already, not a later optimization layer. By scaling up the weighting of volatility though the attenuator, the algorithm basically becomes a volatility ‘minimization’. As the ranking depends on the weighted combination of the assets, the optimization is at ‘portfolio level’. Now, this is a heuristic approach, e.g. there is no assumption made of the expected volatility and covariance going forward, it is a momentum concept. You might have noticed in the screenshots of our new backtesting tool that there is an input field for “volatility limit”, which would be a second layer to target certain volatility levels. However as the modified Sharpe ranking already does a great job in the first step, we are not using the second layer currently to keep things simple

As I noted two days ago in this thread, we’re working on a new core strategy which would always hold several assets, optimizing their weighting by a full fledged minimum (alt. mean) variance optimization, e.g. employing the covariance matrix to optimize volatility at the portfolio level. In this strategy we will also use a volatility targeting layer (at the portfolio level) and offer three different options to choose from.

This is inspired by the great AAA approach by Butler, et al which you mention above. As they highlight in their also great “Dynamic Asset Allocation for Practitioners” series (must-read for a rainy day), the evolution from risk parity to more complex concepts does not necessarily mean better results, as these assume robust input variables like for example the covariance matrix. So our current focus is on how to create an easy-to-digest format for this new strategy with robust and transparent assumptions anybody can follow and gain confidence in.

P.D. Just by the length of my response you see this is one of my favorite topics, happy to discuss further.

01/06/2015 at 12:47 pm #15597Don Krafft

ParticipantThanks very much Alexander. I’ll go back and spend some more time with the “Dynamic Asset Allocation for Practitioner” series. I’m sure we’ll have more discussion.

07/11/2016 at 1:13 pm #34440cheerful

ParticipantHi Alex,

You mentioned about modified Sharpe Ratio during your presentation last year in Silicon Valley. What is it about?

01/31/2017 at 5:35 am #37938reuptake

ParticipantMy question is how can I quantify if it’s better to:

1) Long TMF

2) Short TMV

3) Long 3xTLT on marginI’m using Interactive Brokers, I know my fees and borrowing cost. Still I don’t know how can I calculate what is best option for me. Perhaps there’s no single best answer as it depends on volatility, but one can assume some volatility and check some scenarios.

Update: I’ve just noticed this article (very fresh): http://www.signalplot.com/the-definitive-guide-to-shorting-leveraged-etfs/ but it still not giving me a full answer.

But am I right that (given “low” borrowing cost)

1) Long TMF is better only when TLT is going up without much corrections?

2) Short TMV is better in ranging market and downward market?

3) I don’t know under which conditions TLT is better than 1) or 2)…01/31/2017 at 1:17 pm #37957Vangelis

KeymasterThere are many online resources that discuss leveraged ETFs and how they behave vs normal ETFs.

Most of the time it is most efficient to short the inverse levereged ETF. In this case shorting TMV. There is an exception and that is if TLT goes straight up.02/01/2017 at 4:45 am #37988reuptake

ParticipantThanks for an answer. I know that there’s a lot of articles regarding leveraged and non-leveraged ETFs, but I haven’t found one that could give any kind of formula, rather than general guidelines like “if your borrowing costs are low [but how low?], it’s most of the time better [but what does it mean “most of the time”] to short TMV than going long TMF”.

02/01/2017 at 5:14 am #37989Vangelis

Keymasterhttps://papers.ssrn.com/sol3/papers.cfm?abstract_id=1404708

http://www.q-group.org/wp-content/uploads/2014/01/Madhavan-LeverageETF.pdfLeveraged ETFs experience decay and do not track, long term, their corresponding ETFs at the stated multiplier. So TMF does not return 3 times the returns of TLT over two or three years. The decay is larger as the leverage gets bigger. The decay gets larger for inverse etfs. So the decay of -3x instrument is biggest than all others (-2x,+2, etc). That being said, it is volatility that causes this decay. If an ETF’s price path is 100,101,99,101,99,101,100 the +3x equivalent will not end up at 100 (0%) and will end up loosing money. If the ETF’s price path is 100,101,103,104,105, the +3x equivalent will not return 3x (ie 3×5% = 15%) but actually more than that. See the second paper for more info.

02/01/2017 at 7:09 am #37992reuptake

Participant“Leveraged ETFs experience decay and do not track, long term, their corresponding ETFs at the stated multiplier. So TMF does not return 3 times the returns of TLT over two or three years. ” yes, I understand this. I looks like it’s not that easy to calculate the decay, maybe I’ll do some backtesting, how it performed in different market regimes. I found one backtest on the web, it says that using 3xTLT give 3.1% better results (long term) than TMF, so if my costs are lower than that it may be worth to rather use leverage on TLT.

PS. What bothers me a bit is that in all those articles there’s a mantra: “Leveraged funds are not for long term investment”. And if I have MYRS and Nasdaq100 in my portfolio I will have constant, long term investment in TMF. Sometimes it’s bigger, sometimes it’s smaller, but nearly for all time there is some allocation to it (I have to check if there was any period of time in which both of those two strategies were not invested in TMF at all, I doubt it). And then we know that in the long term TMF is not performing better than TLT. So it’s more a painkiller for a portfolio (reduces short term volatility) than a cure. But that’s a bit different topic, I have discussed it before.

03/01/2017 at 6:51 am #38951Petr Trauške

ParticipantHello Alex,

I have inquiry according to excelent Interactive Seminer, which you provide last time. Would it be possible to publish link so it can be accessible source at any time?

My second question is: Do you recommend frequency of rebalancing portfolio in 14 days or in month cycle. I am using your predefined strategies.

My third question is:

I use within the Custom Builder Portfolio Strategy “Lev 2: Max 15% Volatility”. Which period is the best for rebelancing for optimal allocation – monthly, 14 days or on daily basis with using of QUANT Trader or leave for a constant ratios defined in the Custom Portfolio Builder for the duration of such investments, e.g. 5 years?

In the case of using QUANT trader at the monthly rebalancing of the lookback period which recommends that you set – 6 months (126 days) or three months (63 days) for optimal adjustment of individual items in the strategy of “Lev 2: Max 15% Volatility”.Thank you for you response.

Regards

Petr

03/01/2017 at 12:25 pm #38962Alex @ Logical Invest

KeymasterHi Petr,

glad you liked the Seminar, we need to more of these – we enjoy them as well, but sometimes get lost with our long to-do list. So push us please!!

1) Links to Seminar, these will be valid permanently:

On our site:https://logical-invest.com/webinar-etf-rotation-momentum/

Directly on Youtube: https://www.youtube.com/watch?v=d_YpwxuJkhc2) Generally all strategies and portfolios of strategies should be rebalanced monthly. Only if you trade Maximum Yield, then this should be rebalanced every two weeks. If you have a portfolio of different strategies, with one being Maximum Yield, then rebalance the Maximum Yield ETF every two weeks, but the overall portfolio only once a month.

3) Same as I explain in 2). Best is to rebalance everything once a month, e.g. keep strategy ETF at their allocation %, and make sure the allocation between strategies is also close to the target. If you use the “Consolidated Signals” page, then everything is done in one step, just use the “Total Weighting” column, which is considering the allocations of ETF within Strategies as well as the weighting between strategies.

For the QT process, the lookback period depends on the portfolio setup you´ve choosen. We´ve explained different settings here: https://logical-invest.com/forums/topic/showing-off-the-best-strategies-and-portfolios/#post-38652. If you want sent me your “QuantTrader.ini” files by emial, and I have a look at your specific portfolio – or we can do over Skype.

Hope this clarifies,

All the best,

Alex06/01/2017 at 12:53 pm #42221Branislav Blagojevic

ParticipantHello,

I am new to QuantTrader and wonder what would be the best general strategy to pick to put majority of money.

Is it Strategy of strategies?Thanks,

Branislav06/02/2017 at 2:52 am #42262Vangelis

KeymasterHello Branislav,

We are not advisors and cannot give specific advice. That being said, a strategy of strategies helps diversify across assets AND strategies, so it would help limit losses arising from single ETF or strategy ‘failure’ events. As you become familiar with QT you can modify (make a copy first) the Strategy of strategies to fit your particular needs: You could for example limit max allocations to more aggressive strategies such as MYRS or change the attenuator to make the algo pick more conservative strategies. Our BRS and BUG strategies are often chosen by more conservative investors but you do have to consider the tax on ETF dividends that apply if you are European or non-U.S.

Hope this somewhat helps.04/17/2018 at 5:30 pm #51646urghan2

ParticipantPS. What bothers me a bit is that in all those articles there’s a mantra: “Leveraged funds are not for long term investment”. And if I have MYRS and Nasdaq100 in my portfolio I will have constant, long term investment in TMF. Sometimes it’s bigger, sometimes it’s smaller, but nearly for all time there is some allocation to it (I have to check if there was any period of time in which both of those two strategies were not invested in TMF at all, I doubt it). And then we know that in the long term TMF is not performing better than TLT. So it’s more a painkiller for a portfolio (reduces short term volatility) than a cure. But that’s a bit different topic, I have discussed it before.

[/quote]

I’m not actually sure how this goes but was thinking the same. In case I buy a position of a leveraged fund and make a small rebalance every month, thus holding at least a part of the original position for quite a long time, at some point it should have negative impact on portfolio. How long is it ok to hold a leveraged fund? Should I rotate the whole position in and out of the portfolio at least once in 2-3 months? I assume we use first in first out, so for example if in january I buy 100 shares of ABC, in february I sell 30 shares of ABC (of the original position), and in march I buy again 30 shares of ABC, I assume that in the end I have 70 shares of original + 30 shares of new position = 100 shares total position of ABC. And those 70 shares that are from the original position, are decaying quickly.

04/18/2018 at 2:34 pm #51658Vangelis

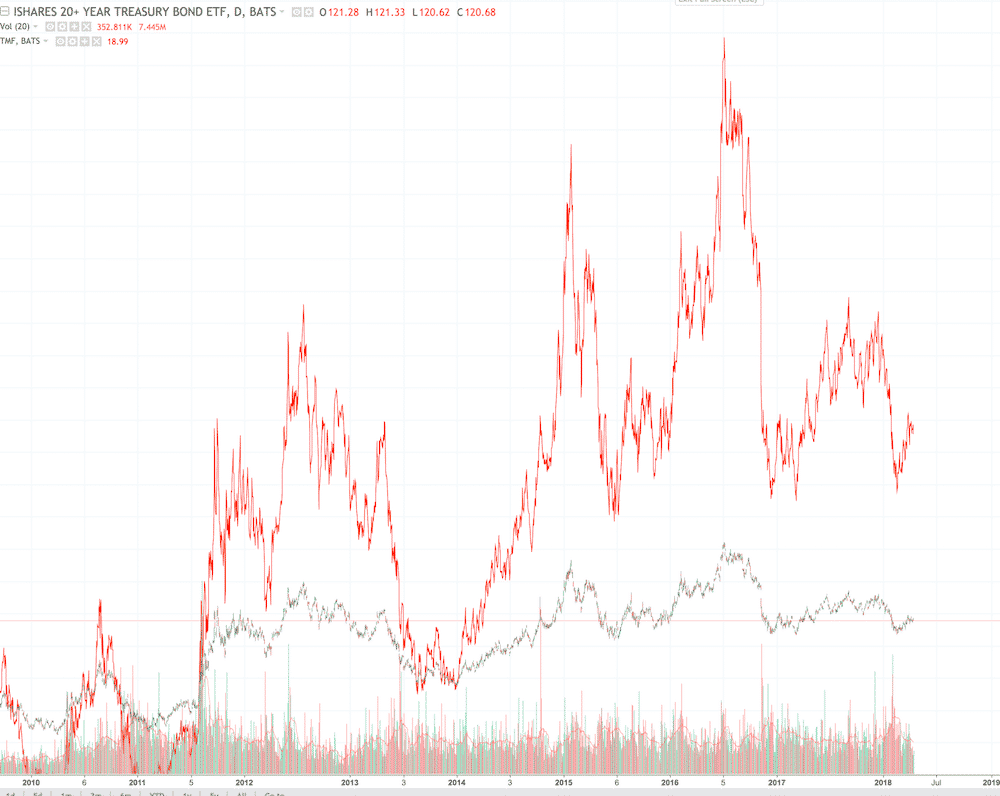

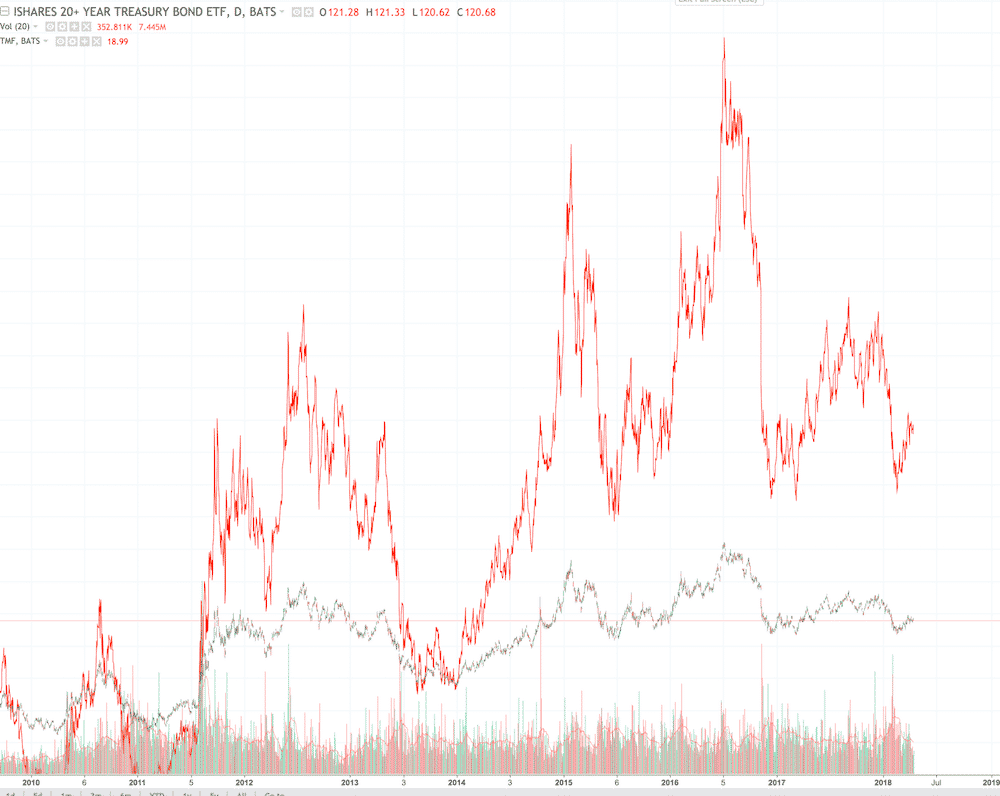

KeymasterLeveraged funds have decay and do not track the underlying at the quoted multiplier. TMF in the long run will not perform 3x the TLT. That just means that it may perform 2.3 or 1.5 times the underlying, depending on the path. When someone says it is not recommended to hold leveraged funds it is meant in the context of expecting to make 3x or 2x the underlying. This is not what we expect with TMF. We use it as a hedge. Best is to look at a graph between TLT and TMF.

04/19/2018 at 6:24 am #51674

04/19/2018 at 6:24 am #51674Petr Trauške

ParticipantHello Alex,

how can I set up limit max allocations to more aggressive strategies such as UIS 3x leveradged, MYRS in QT esspecially UIS 3x leveradged in this time to reduce risk ? I hope that invested in UIS 3x leveradege in this time is without any greater risk. I would reduce this UIS allocation in my portfolio to max. 20 % in QT.

Thanks

Petr

05/01/2018 at 11:33 am #52146urghan2

ParticipantHi.

Can you please open up a little bit of the concept of cross-correlation and how do you use it in your stock/ETF selection/exclusion? I’m not familiar with the concept.

Thanks!

05/01/2018 at 12:22 pm #52149urghan2

Participant[quote quote=51658]Leveraged funds have decay and do not track the underlying at the quoted multiplier. TMF in the long run will not perform 3x the TLT. That just means that it may perform 2.3 or 1.5 times the underlying, depending on the path. When someone says it is not recommended to hold leveraged funds it is meant in the context of expecting to make 3x or 2x the underlying. This is not what we expect with TMF. We use it as a hedge. Best is to look at a graph between TLT and TMF.

[/quote]

Hi.

I read those two papers you mentioned above. Thanks! Still doesn’t quite get the idea of how gamma risk affects strategy performance when using monthly rebalancing and longer periods. Does it? Or does it even out itself? Maybe in the context of LI strategies?

05/01/2018 at 2:10 pm #52154Vangelis

KeymasterIn the context of LI strategies things are simpler. TLT is used as a hedge for many of our strategies (the most basic being the UIS strategy). What the hedge is supposed to do is to limit drawdown in a crisis. If you hold a portfolio that looses 50% of it’s value, you will have to gain 100% just to break even. So in long term investing, both empirically and quantitatively, it is of outmost importance to limit losses rather than to chase after high returns. The easiest way to limit losses is to hedge with an anti-correlated asset, such as Treasuries or Gold (and to of course diversify both in assets and strategies). So if the market fell by 50% in a period of few days, chances are that TLT (as a safe-heaven) would rise maybe 10, 20 or even 40%. Holding both would limit portfolio losses, which in the long run results in higher compound returns.

TMF is used for the same purposes in our riskier strategies. It just “boosts” the hedge since 10% of portfolio in TMF is almost like buying 30% TLT. Whether TMF tracks exactly at 3x or 2.4X the TLT is of less importance. What is very important is that SPY and TLT, Equities and Treasuries, remain negatively correlated in the medium term so that a 2008 like crisis would result in Treasuries moving up and softening the blow.

That said, if you were to trade UIS using SPY/TLT or SPXL/TMF or shorting SPXS/TMV it maybe better to short SPXS/TMV as you would gain a little extra return from the decay of both ETFs, although you would have to factor in borrowing costs. Hope this helps clarify. - AuthorPosts

- You must be logged in to reply to this topic.