Home › Forums › Logical Invest Forum › MYRS Rotation – How?

- This topic has 13 replies, 5 voices, and was last updated 7 years, 5 months ago by

Alex @ Logical Invest.

- AuthorPosts

- 11/01/2017 at 10:08 am #47175

William

ParticipantHi I have just subscribed to the MYRS. I have a question: when it comes to re-balancing between ETFs how is this done? Are we supposed to sell all ETFs at market as soon as we receive the instruction and then re-buy all at market in line with the new allocation? Or should we only sell part of each to re-balance? If it makes any differrence?

Thank You

11/01/2017 at 10:17 am #47182reuptake

ParticipantIt’s better to sell just the part of each other, since that way you pay less fees (2 smaller transactions vs 4 larger ones) and also you’re not risking some sudden price change between trades (OK, you’re actually risking but for smaller amounts)

11/09/2017 at 9:51 am #47362William

ParticipantHi Please can I ask another question.

If I am adding capital to this strategy a bit at a time each month I would effectively be scaling into and averaging into the prices of ZIV and TMF. Is this a problem for this strategy? Is it balanced in a way that it becomes unbalanced if I am averaging in capital?

Also I only just started this strategy 6 days ago and I wonder if there is a timing issue with startign this strategy as i seem to have caught what appears to me as a peak in the value of ZIV and the SP500…

Thank you!

11/13/2017 at 10:33 am #47439Alex @ Logical Invest

KeymasterHi William,

scaling into a strategy when you first start with it is actually very effective – both for your stomach as you get comfortable with it, but also statistically as you “average-in” as you describe, so avoid betting on prices in a single point of time.

Re timing issue: Yes indeed, but everything is expensive and at historical highs – and waiting at the sideline with 100% cash is always a bad idea. What you can do it to go more conservative with your overall portfolio while your confidence in the strategy and markets increases.

11/15/2017 at 6:33 am #47475William

ParticipantThanks and assuming TMF retains its inverse correlation to ZIV I shouldnt be too concerned if I have managed to catch the top of a bull market? Will MYRS perform well in a Bear market?

11/15/2017 at 9:44 am #47484Alex @ Logical Invest

KeymasterThe assumption is that TMF will absorb some losses if/when ZIV goes down, and that’s a fairly yuuuge IF.

Remember, ZIV is shorting the 4th,5th and 6th future of the VIX term curve, so each dollar these increase is a dollar hit to ZIV (ignoring some other effects).

I´m just looking at the Term curve, and you can see in attached chart that compared to Oct 31st the futures went up by about 1.5 (actually 1500, as multiple is thds) – this explains the dip in ZIV. Now, one thing must be clear when investing in inverse / short volatility: If some fecal mass hits the fan, even these medium term futures can go through the roof and resulting losses are theoretically unlimited – the ETF ZIV probably would be terminated and something between 0 and estimated 20% would be payed out. That’s the ZIV part, now to the hedge.

TLT or it´s triple TMF up to our research is the best hedge when shorting volatility (beside some exotic option or future things which normally are out of the reach of retail investors). The a historical correlation of -0.45 to S&P500 comes from two effects: 1) Economic cycle and interest rates, but more importantly 2) “flight to safety” when things go down.

Now, there are three main problems with that:

1) We´re investing in inverse volatility, not the S&P500, and as stated above, there is a yuuge lever (formally beta) between both, e.g. if S&P500 dips by 1% VIX goes up 1% times X, and this X can be exponential, so the above stated correlation which provides a hedge to S&P500 will fall short in extreme movements of the VIX term curve. But again up to our research bonds are the best hedge for retail investors.

2) Correlation is not causality: Means there is no direct cause-effect relation between TMF and ZIV. As in recent days BOTH can go down due to fundamental reasons (rate hike expectation / China/ Japan in our case). How long? Depends :-) Sometimes both can decouple for months, see the correlation chart.

3) The allocation between ZIV and TMF depends on the medium-term optimization the algo is doing. If we´re 80% into ZIV like in the current allocation (because of relatively muted medium-term volatility ), then the 20% TMF are not too much of a hedge if volatility suddenly spikes as the last days).

So, as we´ve repeatedly stated, before investing in MYRS:

– Make sure you really and deeply understand what it is and how it works – and I mean “really and deeply”

– Do not invest your home and pension into this strategy – it´s meant as a complementing return boost for a well-balanced portfolio – I personally would never ever invest more than 15% of my net worth into this, and I´m not retired yet (well, a bit :-))Answers in short: Yes you should be concerned (that’s a natural process), level depending on your “really and deeply” understanding of, and % allocation to MYRS. And no, MYRS has at least the potential to take your last trouser from you in a bear market, will this happen? Who knows.

Attached the charts, hope to continue discussion.

All the best,

Alex11/15/2017 at 9:52 am #47489Alex @ Logical Invest

KeymasterAnd because the proof of the pudding is in the eating, today is another nice example of above.

See how a 0.76% drop in SPX triggers a 23% increase in VIX spot, a 2.9% increase in the March 18 VIX future – while TLT (TMF) go nicely up by 0.9% (2.7%) – so at least up to now off-setting the 2.53% drop in ZIV.

BUT if today is the dooms day some have been waiting for, this will probably not hold. If still alive will post the same after close :-).

11/15/2017 at 10:26 am #47493William

ParticipantSO if there is an unprecedented Black Swan event they can terminate ZIV right at the bottom of its value and we crystallise a huge loss right at the moment it would probably be great to jump into ZIV?

Would this have happenned to ZIV if it existed on Black Monday and/or 2008?

11/16/2017 at 10:47 am #47515Alex @ Logical Invest

KeymasterExactly, that might be a highly profitable game – if world end is postponed again, as yesterday. Either buy ZIV, or directly short the mid-term VIX futures after a big jump. Again, this is not for the faint-hearted!

Let´s say VIX 4th month futures are around 19 before the event, then suddenly jump to a level of +30. If you bet this was not world-end, then you might short at 30, wait till they come back to a level of 20 and make tons of money.

Whats the problem? They might not come back, but further climb – see levels of 50 in 2008, and then move sideways for some time: Then you are eating into margin, and if not properly backed as you bet too much, even get a margin call – out, finito, hasta la vista. :-)

Here link to synthetic data for Vix curve and deritvate ETFs back to 2004, the best source to by knowledge, but always take with a grain of salt: http://investing.kuchita.com/2014/10/23/ziv-historical-data-and-pricing-model-since-vix-futures-are-available-2004/

And below chart with 4th month future, VIX spot and ZIV, so you see the difference. In 2007/8 indeed ZIV would have dropped from levels of 60 to 10, minus 83% leaving you with 17$ out of 100$ invested.

And also todays quote around 10:30 am EST so you see the nice reversal from yesterday – if calm continues and Vix curve comes down then ZIV will be back to prior levels – if.

All the best,

Alex11/17/2017 at 2:39 pm #47551Derrick

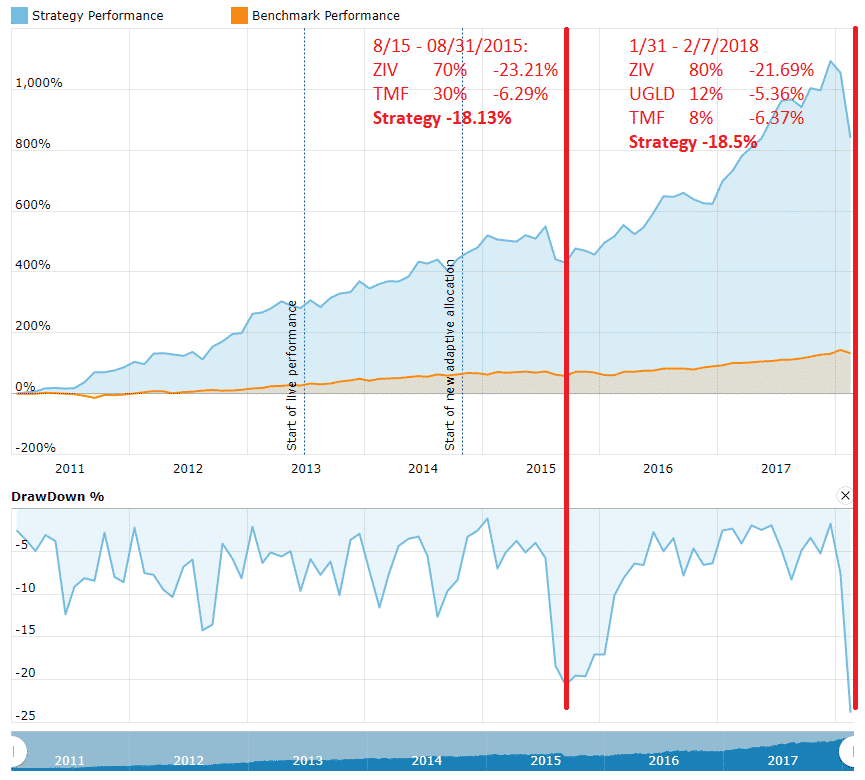

ParticipantAlexander I read your comment about ZIV in 2007/2008 losing 83% and was curious so I downloaded the synthetic data you linked. What I wanted to know was the largest loss in a rolling 2 week period (since that’s the re-balance period for MYRS). As you can guess the last 2 weeks of Oct. 2008 ZIV lost 27% according to the synthetic data. However the 3 preceding 2 week periods it lost about 7%, 5.5%, and 15%, so it was a large drop but somewhat gradual. My understanding is that if this strategy works the way its designed you might take a lot of those first 3 losses in September/October, but when it drops 27% the last 2 weeks of Oct. you would have a very small allocation to ZIV. While this would be difficult to trade through it isn’t anywhere near the same as losing 83% of course. But here is the interesting part for me at least. I was trading MYRS the end of August 2015 and apparently the rolling 2 week loss on ZIV was slightly worse than Oct. 2008 at about 28-30%. ZIV was at 70% allocation at the time because the drop was actually more sudden than in 2008 (the preceding periods were positive). MYRS got whipsawed and took some time to recover from the 2015 shock, but I’m happy I was able to stick with the strategy. It’s not so much a problem if ZIV has large losses, but matters more how suddenly they occur. Just thought this might be some helpful context for your comment. Would be interested in your thoughts. Thanks. -Derrick

11/22/2017 at 12:23 pm #47643Alex @ Logical Invest

KeymasterHi Derrick, thanks for the comment, fully agree.

The danger indeed is not so much when volatility builds up over several weeks, but rather the sudden drops from macro-events like in August 2015. In this case the lookback period and bi-weekly rebalancing does not allow the strategy to rebalance to bonds, thus the hedge is not much of use. On the other hand, trying to rebalance quicker or making the system more responsive with shorter lookback results in whipsaw, where you sell cheap and buy-back high.

I just wanted to highlight that these risks are part of short-volatiliy strategies, thus the allocation should be in a safe proportion to overall account and net worth.

01/26/2018 at 2:34 am #49395Anonymous

Inactive[quote quote=47484]So, as we´ve repeatedly stated, before investing in MYRS: – Make sure you really and deeply understand what it is and how it works – and I mean “really and deeply” – Do not invest your home and pension into this strategy – it´s meant as a complementing return boost for a well-balanced portfolio – I personally would never ever invest more than 15% of my net worth into this, and I´m not retired yet (well, a bit :-))

Answers in short: Yes you should be concerned (that’s a natural process), level depending on your “really and deeply” understanding of, and % allocation to MYRS. And no, MYRS has at least the potential to take your last trouser from you in a bear market, will this happen? Who knows.

Attached the charts, hope to continue discussion.

All the best, Alex

[/quote]While I agree with most of your points, I wonder why you are scared of your own strategy. 15%? Come on. While no one can predict the future, the long term results do not offer a shred of evidence that this strategy will cause a portfolio to crumble beyond financial ruins if one is invested for a long term duration, say 5 to 10 or more years. This strategy does not use XIV because of that reason so ZIV is the better ETF. Plus, the two week rotation using your algorithms should help ease the pain of a sudden large market drawdown. I’m not sure I see the real fear, even a 2008 event, which I remember the strategy doing extremely well and making huge gains during the back testing results using EDV.

I tell my friends that I can’t wait for another long term pullback. That’s when these strategies are theoretically supposed to really out perform the market. I switched to 3x UIS to have even more aggressive stance. The only fear I have is how TMF will perform. That’s the wild card. I already know what ZIV and SPXL will do.

If I constantly feared losing everything, then I might as well not invest at all or just put all my money in SPY and let it ride forever, but that wouldn’t be outperforming anything.

I’m a believer in these strategies ever since I stumbled upon Frank back in 2013. After reading all the white papers I felt very comfortable with him and his thought process for using

Algorithm trading. After all, isn’t that the whole point of emotion free investing?Your site offers all kinds of strategies based on risk factors and everyone should choose wisely. I happen to like the most aggressive ones, feel comfortable with the team behind them, take on the stomach churning rises and falls, and have loved every minute of it. I really love those strategies that keep it simple, trading only two ETFs make rebalancing a snap.

Keep up the good work.

02/07/2018 at 1:31 am #49902Anonymous

Inactive[quote quote=49395]

So, as we´ve repeatedly stated, before investing in MYRS: – Make sure you really and deeply understand what it is and how it works – and I mean “really and deeply” – Do not invest your home and pension into this strategy – it´s meant as a complementing return boost for a well-balanced portfolio – I personally would never ever invest more than 15% of my net worth into this, and I´m not retired yet (well, a bit :-)) Answers in short: Yes you should be concerned (that’s a natural process), level depending on your “really and deeply” understanding of, and % allocation to MYRS. And no, MYRS has at least the potential to take your last trouser from you in a bear market, will this happen? Who knows. Attached the charts, hope to continue discussion. All the best, Alex

While I agree with most of your points, I wonder why you are scared of your own strategy. 15%? Come on. While no one can predict the future, the long term results do not offer a shred of evidence that this strategy will cause a portfolio to crumble beyond financial ruins if one is invested for a long term duration, say 5 to 10 or more years. This strategy does not use XIV because of that reason so ZIV is the better ETF. Plus, the two week rotation using your algorithms should help ease the pain of a sudden large market drawdown. I’m not sure I see the real fear, even a 2008 event, which I remember the strategy doing extremely well and making huge gains during the back testing results using EDV.

I tell my friends that I can’t wait for another long term pullback. That’s when these strategies are theoretically supposed to really out perform the market. I switched to 3x UIS to have even more aggressive stance. The only fear I have is how TMF will perform. That’s the wild card. I already know what ZIV and SPXL will do.

If I constantly feared losing everything, then I might as well not invest at all or just put all my money in SPY and let it ride forever, but that wouldn’t be outperforming anything.

I’m a believer in these strategies ever since I stumbled upon Frank back in 2013. After reading all the white papers I felt very comfortable with him and his thought process for using Algorithm trading. After all, isn’t that the whole point of emotion free investing?

Your site offers all kinds of strategies based on risk factors and everyone should choose wisely. I happen to like the most aggressive ones, feel comfortable with the team behind them, take on the stomach churning rises and falls, and have loved every minute of it. I really love those strategies that keep it simple, trading only two ETFs make rebalancing a snap.

Keep up the good work.

[/quote]So a week after posting this, the VIX takes the biggest one day leap ever and now one can truly understand why 15% could be a good idea. This market can get crazy in a hurry. Keep up the good work.

02/07/2018 at 7:39 am #49913Alex @ Logical Invest

KeymasterAllow me to re-post this from another post, maybe a bit of light in troubled waters:

I can surely understand the frustration looking at my own account!

This probably took all by surprise, but here is the thing: As many followers will recall, we were in a similar situation in August 2015 – when some stepped out, and missed the recovery and right part of the chart in 2016 and 2017.

Indeed this marks a new max drawdown for MYRS from the top on Jan 8th. But the move is so far well within the historical volatility range of MYRS. If the VIX term-curve keeps on coming down this might look much better at the rebalancing day end of next week. Stepping out at current lows is not recommended.

- AuthorPosts

- You must be logged in to reply to this topic.