The Logical-Invest newsletter for October 2023

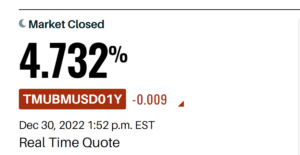

September has turned out not to be a great month for equities, with the S&P down 4.7%. However, this is not particularly worrisome, as the index is still only 10% off its all-time high and has a respectable 13% YTD performance. Economic Stress There are other factors worth mentioning, as we observe unusual activity in the markets. It’s best to consult some charts. Just looking at the index below, it is unclear whether the S&P … Read more