The Logical-Invest newsletter for January 2023

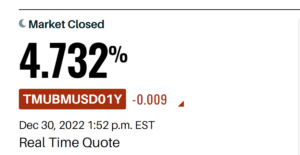

We wish you a happy, healthy and prosperous new year! Here are a few thoughts on investing for 2023! 4.7% annual return Risk-Free At the moment you can buy a 1-year Treasury and get 4.7% guaranteed return for the next year.Think about that. It’s as if you hired a manager that promises a 4.7% return and guaranteed not to loose any money, all through 2023. Would you believe him? Consider the fact that 2023 looks … Read more