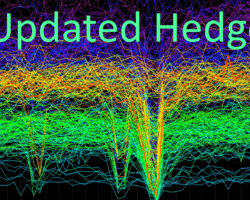

Enhancement of the Treasury hedge in our strategies

For many years, most of our strategies used long term Treasuries (TLT, TMF) as a hedge against market corrections. These Treasuries have been a safe haven asset with negative correlation to the stock market and have been used successfully to reduce the risk/volatility of our strategies. With rising rates and inflation, long term treasuries lose a part of their value as a safe haven asset. Their hedging value depends mainly on the speed interest rates … Read more