Portfolio optimization: The all new Portfolio Builder

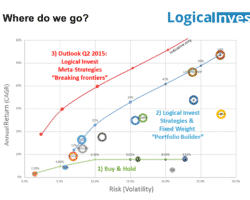

From individual Strategies to Portfolio Optimization Based on the interest of our followers and our own investment philosophy, we have gradually evolved from offering single quantitative strategies towards blends or portfolios of strategies. The way we visualize our own development cycle might be best summarized in a chart: Where are we on this path and where are we heading? We believe we have now a stable set of ‘core-strategies’, which cover a broad spectrum … Read more