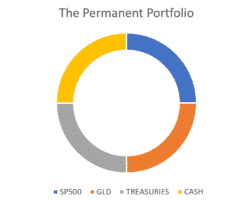

Enhancing Harry Browne’s Permanent Portfolio strategy using ETFs and monthly rebalancing

Enhancing Harry Browne’s Permanent Portfolio The Permanent Portfolio is a simple, diversified portfolio You can construct it using 3 ETFs: SPY, TLT and GLD We enhance it by allowing variable allocations and monthly rebalancing We offer a free subscription so you can implement it in your own account including 401k or IRA What is the Permanent Portfolio by Harry Browne Harry Browne’s intention was to find a solution for the money “you need to take care … Read more