Home › Forums › Logical Invest Forum › Why is UISx3 Switching to Mostly Gold on 1 April 2019?

- This topic has 3 replies, 2 voices, and was last updated 6 years, 4 months ago by

Alex @ Logical Invest.

- AuthorPosts

- 03/30/2019 at 1:18 pm #62047

RB

ParticipantHi,

Two questions, please:

(1) Can you shed any light on why the UISx3 strategy is switching to 70% UGLD on 1 April 2019? What are the main reasons behind the switch to gold? After the recent drop in interest rates, I would expect rates to bounce back up (at least temporarily), in which case gold would probably go down.

(b) A hypothetical question: Say I invest $10,000 in UISx3 today. Twenty (20) years from now, the account balance is $500,000 (or some very high $). When the new strategy signals come out every month, won’t the buying/selling of such high $ cause substantial moves in the market price of UGLD, SPLX, TMF, etc? If I buy 10 shares of UGLD, the market will ignore me. But if I buy 4,000 shares of UGLD, I may receive horrible prices due to moving the market.

Thanks,

Ron03/30/2019 at 3:24 pm #62084Alex @ Logical Invest

KeymasterHello Ronald,

thanks for the question, which allows me to get a bit deeper into the topic.

1) From a fundamental point of view I’m with you, the expected further reduction in rates has already been priced in, and probably rates bounce back. This indeed would hurt gold prices, but more so long term bond prices.

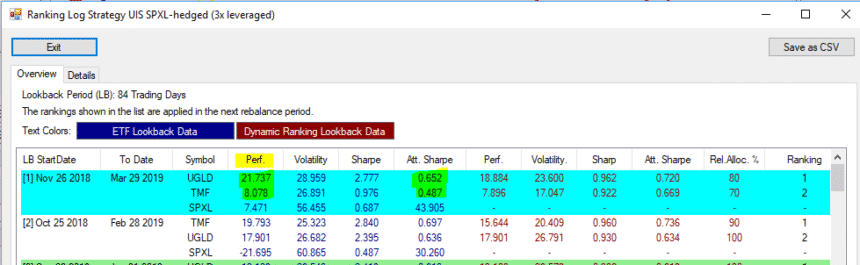

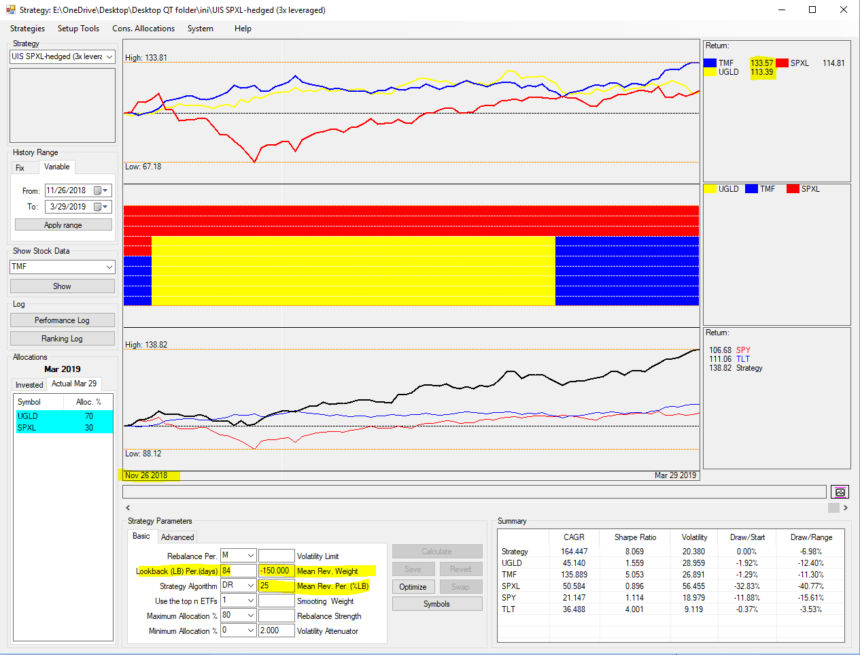

2) From a technical perspective, our algo for the UIS3x gives a fairly strong weight on the mean reversion part, that is what went up heavily is expected to give back. Which is the case for TMF, which went up more than 33% since Nov 26 (start of the lookback of 84 days), but the most part of that has been in the month of March. Our algo reduces the return of the last 21 days from the return of the full lookback of 84 days, so in sum Gold looks better.

I attach two screenshots from QuantTrader, first the price curves for the lookback period, and second the ranking registry, note the performance column shows the net of the 84 days – 21 days performance.

To your second question: When looking at volumes and liquidity of ETF always keep in mind these ETF are backed-up by bonds and physical gold. So any strong price movement would be immediately arbitraged away by the market or the market makers. So even with an order of $5 million you should not be able to make the market if you place it as limit order and have a bit of patience.

04/23/2019 at 1:28 pm #63203RB

ParticipantHello Alexander,

A follow up question on this topic, please.

So far in April, UGLD has performed poorly and has erased much of the January-March gains for UIS3x.

Of course, April is not yet over and maybe UGLD will do well between now and 30 April.

In hindsight, on 1 April 2019, it would have been better to move to 70% cash instead of 70% UGLD.

Does this strategy allow for switching into cash in some manner?If UIS3x switched to UGLD because it would lose the LEAST amount of money (compared to the other ETFs), wouldn’t the better option be to switch to cash and not lose any money?

Thank you,

Ron05/02/2019 at 7:34 am #63770Alex @ Logical Invest

KeymasterHi Ronald,

thanks for the follow up!

Our strategies do not go to cash, but rather stay invested in safe havens which at least give you the opportunity to get some additional yield. Indeed the current USD strength coupled with an ever-stronger equity market hurts the gold performance, but that can change very quickly again.

- AuthorPosts

- You must be logged in to reply to this topic.