Home › Forums › Logical Invest Forum › Setting up your first meta-strategy or portfolio

- This topic has 18 replies, 10 voices, and was last updated 7 years ago by

StefanM.

- AuthorPosts

- 10/04/2016 at 2:42 am #35934

Alex @ Logical Invest

KeymasterSetting up your first meta-strategy or portfolio

10/24/2016 at 4:20 pm #36356reuptake

ParticipantHere is my experience:

My strategy is BRS, Gold-USD, MYRS, Nasdaq100 hedged and GMRS. Each gets 20% allocation.

First thing I had to do was to create symbols for some strategies (only BRS and GMRS were “built in”, although I couldn’t locate data file corresponding to BRS). For some reason selecting strategy and hitting “Save” didn’t do the job. I had to create duplicates of the strategies (apart from BRS / GMRS).

I selected SRE to have equal weights. So, according to QR my strategy has pretty good stats: 25% CARG with 2.63 Sharpe, volatility 9.63%

The new SRRP method gives 21% CARG, 2.67 Sharpe, and volatility 7.88%. I don’t know if it’s “better” result. FYI: I’ve selected 10% as minimum allocation, but there is 9% allocation for some months – may be rounding error.

Then I changed to SR and hit optimize. I have an impression that optimizing gets slower and slower (but that may be only an impression). And it seems that there’s little or no value in SR and optimizing it (for me). There are very few results with higher Sharpe, the best one is 2.90, but with bit lower CARG. I can go up to 34% CARG with slightly worse Sharpe.

Few things to the developers: the “grayscale map” of optimized results is not the best idea. It’s hard to compare different areas of gray – there are well known optical illusions involving perception of different shades of gray. Consider using “heat maps” like Amibroker. There are other things: one should be able to export the results. There could be also an option to see other dimensions, like CARG (switching to CARG map).

There is a tempting “region” on my map where CARG is > 30 and Sharpe is around 2.20-2.45. As one can imagine in this set of parameters, most of the funds are allocated to MYRS and Nasdaq100 strategies. In fact, there only one month in which MYRS + Nasdaq have less than 70% allocation (I have 10% minimum allocation, so 30% are 3 other strategies). So it’s basically MYRS/Nasdaq switching strategy and should be rather compared with other similar strategies, not mine.

But the more important question for me is: how close to overoptimizing we get by optimizing set of already optimized strategies? Isn’t it more of a curve fitting?

10/25/2016 at 10:51 pm #36366Alex @ Logical Invest

KeymasterHello Reuptake, thanks for sharing your results, hope this evolves into a discussion among the community.

– Saving strategy files, like #BRS: We just a released a new version which does this automatically.

– The optimization for MetaStrategies indeed can take some time, as first each strategy is optimized and then the portfolio. Let me know what time – in minutes – it takes aprox to see if we need to speed up this process.

– Heat-map: Agree, maybe we need to make the screen bigger and use colors instread of the “50 shades of grey” (- bad joke..). The 3D models of Amibroker are nice, but also hard to read, think we´ll find a suitable 2D way to visualize.– Agree on a risk of curve-fitting, but the best medicine is to do what you are doing: Look for broad strable ranges of parameters, and compare between different options, e.g. dropping a component or adding one.

Would you mind sharing some screenshots of your results (use: https://snag.gy or similar) and/or the “_QuantTrader.ini” file so others can replicate?

10/25/2016 at 10:53 pm #36367Alex @ Logical Invest

KeymasterI received a question on how to build a meta-strategy and or fixed weightiong portfolio, which I´d like to share:

Q:”I am subscriber of your software. Currently, I am using your standard strategies, which you are email me each month, I would like to set optimal alocation in QUANT Trader for these strategies next month. Can you get me clue how to divide alocations by Quant Trader between all strategies to get best ratio?”

A:”QuantTrader allows you to build what we call “Meta-Strategies”, these allocate dynamically to the underlying strategies and react much better to different market environments. This is what you are looking for, I guess.

See example below:

– Equity: Nasdaq + World Top4 + GMRS

– Currency / Gold as non-correlated strategy

– TLT at portfolio level on top as hedge

– Portfolio level volatility limit of 12% (sometimes goes to cash)Look for different ranking algos (No, SR, DR) and different min and max allocations to get to a well-balanced approach, e.g. avoid extreme corner solutions. I attach a DR example, e.g. first optimum allocation between strategies, then best mix with bond, and a min 30%, max 40% allocation with about one month lookback. Another option is “No” ranking, e.g. equal weight between the five components, which looks similar, but you see bigger drawdown. Tip: Select only 3 or max 4 strategies, with a fundamental reason, e.g. equity, correlation, hedge.

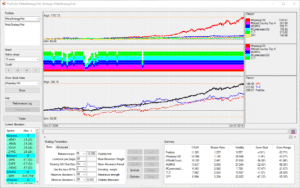

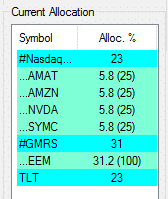

Then automatically you get the allocations to strategies and ETF each month, like below:

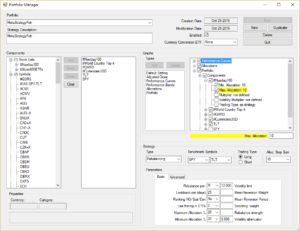

If you prefer to stick to static, fixed weighting among the strategies, then you can set the min/max weightings in the Portfolio Manager window for each strategy, see last screenshot. I think the dynamic approach like above is more advanced though.

This is just a quick example, by no way the best. Let me know what you find, or post as example for others in the forum. I open a topic with this explanation.

Hope this helps.

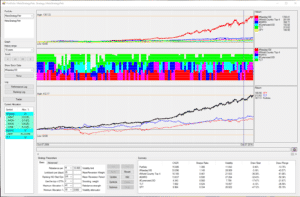

AlexExample Dynamic Ranking:

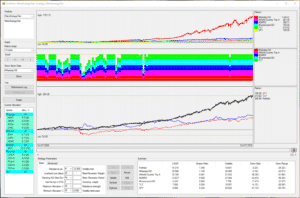

Example Fixed weight 10% for Nasdaq:

10/26/2016 at 4:01 pm #36378reuptake

ParticipantAlex, thanks for the answers. Next time I’ll share screenshots, too.

Regarding: Colors/50 Shades of Sharpe ;) – I didn’t mean 3D models from Amibroker, 2D heat map (but colorful!) would be sufficient. Switching to another measures like CARG (I’m fan of ulcer index too) would be great. To make it more readable: what about a threshold slider? User could select the threshold (eg. 1.5 for sharpe) and only regions with sharpe >= 1.5 would be displayed (the < 1.5 are could be grey or just dimmed). Ultimate solution would be 2 sliders (one for Sharpe and one for CARG) acting as filters for heatmap.

10/26/2016 at 4:07 pm #36379reuptake

ParticipantOne more question is regarding Nasdaq 100 strategy. From website:

“The NASDAQ Meta strategy uses adjusted momentum to blend the top four NASDAQ 100 stocks.

It switches between an aggressive higher volatility sub-strategy and a low volatility stock selection algorithm, based upon the market environment.

Variable allocation to Treasuries smooths the equity curve and provide crash protection.”Which one strategy in QT is equivalent of this? Nasdaq100 is pure stock and Nasdaq100 hedged has fixed treasuries (20%), there’s no “switching” involved…

11/08/2016 at 7:29 am #36613Frank Grossmann

ParticipantIn the past I always did only a single strategy with stocks and Treasuries mixed. Quite a big improvement was when I realized that in fact stocks and Treasuries need different lookback periods for good results. To do this I now always did a stock only strategy. For Nasdaq, such a strategy has quite long lookback periods. Only like this we could find stocks like Google, Tesla, Netflix …. which outperformed the markets for years. To hedge I now combined the stock-only Nasdaq strategy with a treasury hedge. This way I can impose a shorter lookback period for the Treasury hedge. I need a short period for the hedge, because I want the hedge react very fast if first signs of a market correction appear. In fact this was much more efficient than my old idea to switch to a low volatility version of the Nasdaq so that I did not continue with this vola switch.

It is important to know, that the strategy we use is always the hedged version. The unhedged one is only used as a sub-strategy.01/03/2017 at 4:29 am #37506Ritter

ParticipantHi Frank and Vangelis,

Happy new year!!

As you know I have modified some of your strategies to suit the fact I am using them in a meta strategy in the Quant software. What is an easy way of transferring my meta strategy from the old version to the new one. Will I have to export/Import each sub and then the overall?

Joachim

01/03/2017 at 11:47 am #37520mitch

ParticipantI wanted to add to the question above. I’m also not clear on how to update to the newest .ini file version of the software and still save all the work I have performed in the past.

Let’s say I’ve added symbols, created new stock lists and developed new meta-strategies.

How can all this data transfer to the newest .ini version?

Thanks!

01/03/2017 at 12:28 pm #37521Frank Grossmann

ParticipantIf you have a new QuantTrader version, then you just have to copy your old QuantTrader.ini file in a folder together with this new version and then start QuantTrader. All your previous strategies are now opened in the new version of QuantTrader. If you want to go back to an older version of your strategies, then just look for one of the QuantTrader.ini backup files. These have date and time added in front. You just have to delete this date-time and use it like a normal QuantTrader.ini file

01/25/2017 at 9:08 am #37846Petr Trauške

ParticipantHello Frank,

I follow this manual:

https://drive.google.com/file/d/0B2nAWp8wo_B6U25UOUxMY0xJaTQ/view

in hope Quant Trader can tell me exact allocation between strategies (#GMRS, ZIV, #Nasdaq100, #World Country Top 4). However, in Trader I am able to get only rates of most sucessfull ETF (e-g- 20% MES, 20% SPY, 20% DXPS), but not rates between strategies itself (like 25% #GMRS, 25% ZIV, 25% #Nasdaq100, 25% #World Country Top 4). I am not sure if this is possible as I am mixing one ETF (ZIV) with strategies (#GMRS) which contains more ETFs withins. Please let me now how can I obtain rates between strategies.

Best regards

Petr Trauske

02/27/2017 at 10:42 am #38849Alex @ Logical Invest

KeymasterHere an example of how to replicate the Portfolio Builder “fixed weight” allocations: https://logical-invest.com/forums/topic/showing-off-the-best-strategies-and-portfolios/#post-38652

10/18/2017 at 12:12 pm #46794Michael Puchtler

ParticipantHi guys – is it necessary to combine my .ini file (with my own strategies) with the new .ini file that is deployed in a release? How does this work when you release updates to the core strategies or launch new ones (US Sector Rotation, as an example)? Thanks.

10/19/2017 at 10:13 am #46818Alex @ Logical Invest

KeymasterHi Michael,

normally the new releases do not affect the strategies, but rather the software functionality. So there is no need to transfer strategies between *.ini files.

Best practice in my view is to have two or three QT folders / versions. One for production, which you normally would not change frequently, and one or more for testing new strategies or portfolios. When you need to setup a new strategy in your “production environment” this needs to be done manually – question of a couple of minutes, and good excercise to understand the strategy from scratch. Either move your own strategies into the newly release version, or vice-versa.

08/06/2018 at 11:11 pm #54326G Capistrant

ParticipantUsing V5.13S, can I set maximum or minimum allocations for a portfolio component? A Feb. 11, 2017 YouTube video shows a method that I can’t get to work. Is this still a feature? Thanks.

10/28/2018 at 5:49 pm #55751StefanM

ParticipantHi all,

Similar to G Capistrant, in QT 513S, in Portfolio Manager, under Graphs>Portfolio>Components, I am not able to select and change ‘Min.allocation’, ‘Max.allocation’ or any of the other check boxes.

Can this please be looked at?

Thanks

10/30/2018 at 7:47 am #55776StefanM

ParticipantHi all,

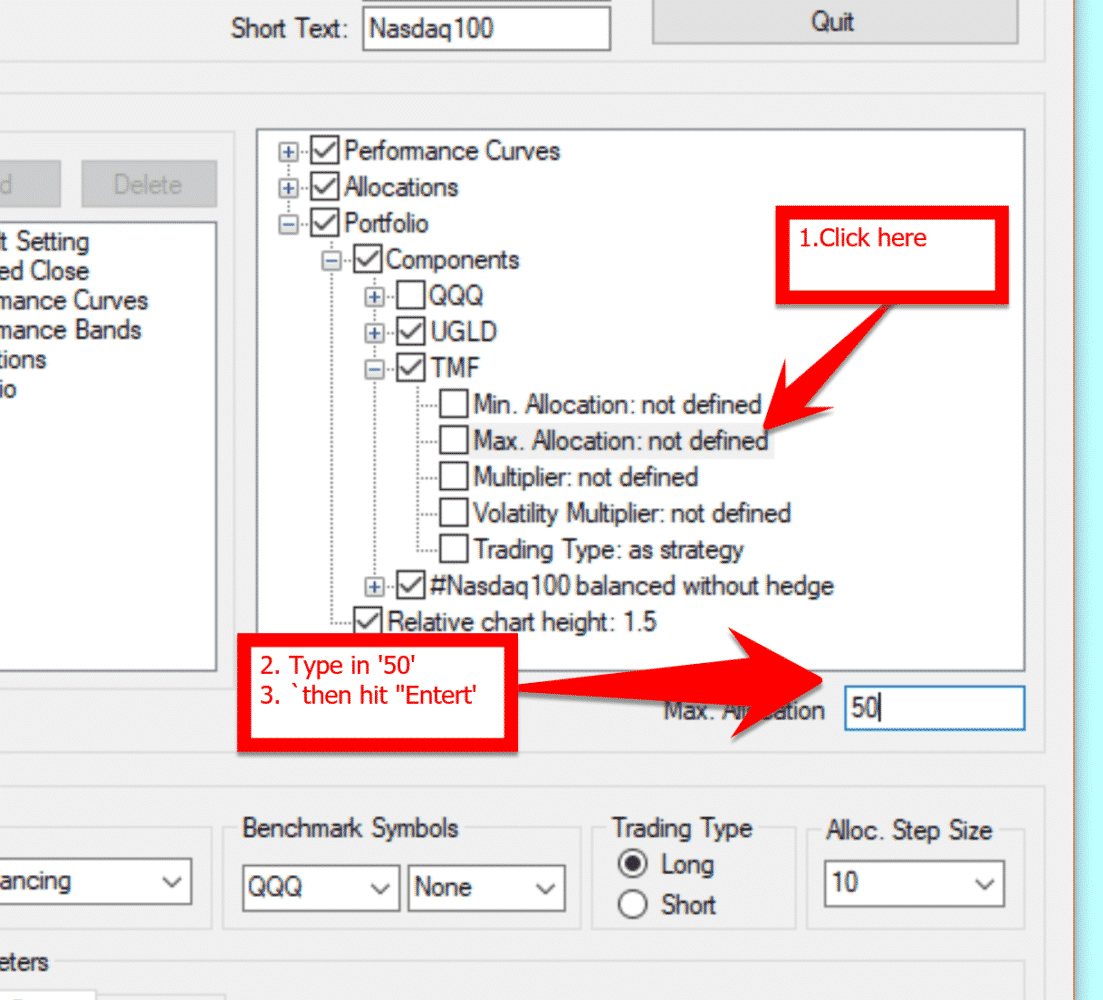

Following on from my post above, in the Nasdaq 100 hedged strategy, in order to see whether I could tick/untick a box, I found I was able to untick the TMF Max allocation box, however when I came to re-tick the Max allocation box (so as to reinstate the LI 50% max allocation to TMF), I was not able to.

I then chose not to save the strategy (again, so as not to amend the original LI strategy). When I re-opened Nasdaq 100, I found the TMF Max Allocation had been unticked, even though I had not saved the strategy.

Can anyone please kindly assist.

Thanks10/30/2018 at 10:23 am #55781Vangelis

KeymasterInstead of re-ticking the Max Allocation box, click on Max Allocation: Not defined. This will trigger a field just under the window with a blinking cursor. Type 50 and hit ‘Enter’. Let me know if this is what you were trying to do.

10/30/2018 at 11:13 am #55782

10/30/2018 at 11:13 am #55782StefanM

ParticipantThanks Vangelis, your solution has worked.

I approached it thinking I needed to tick the box first, then enter a max allocation percentage, however I am happy to do what works.

Thank you. - AuthorPosts

- You must be logged in to reply to this topic.