Home › Forums › Logical Invest Forum › NEW PORTFOLIOS WITHOUT NAS100, DOW30, MYRS, UIS3

- This topic has 2 replies, 2 voices, and was last updated 5 years, 5 months ago by

Alex @ Logical Invest.

- AuthorPosts

- 08/02/2020 at 1:07 pm #79600

bmessas

ParticipantHello Alexandre,

I just red your new blog regarding all the new portoflios without MYRS and UIS3.

I was trading myself the aggressive portfolio and the Maxvol15 until now. I had no issue shorting VXZ or leverage my position more than 100%. In that case, would you still recommend to use your new portfolios. I am little concerned as the Max DD looks higher for most of them and I was quite happy with the old allocation. your feedback would be welcome.Thanks,

Benjamin08/02/2020 at 1:31 pm #79603Alex @ Logical Invest

KeymasterHi Benjamin,

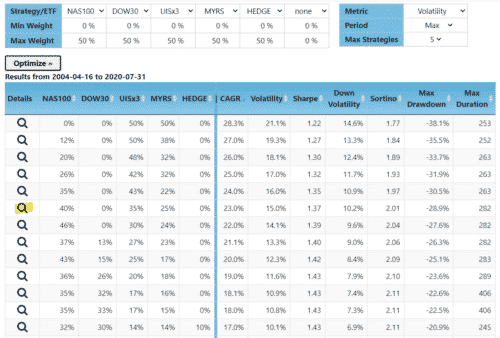

I’d suggest you try our Portfolio Optimizer to find a personalized portfolio which suits your risk/return preference. It will give you a list of options depending on the input variables you set, and you can then review the metrics, and the equity curves by clicking on the “magnifying glasses”.

This is also a good exercise to get comfortable with the different strategies, understand how they work, and which are better suited for you.

See the screenshot below where I input the strategies which made up the old Aggressive Portfolio, you can see that you can achieve very similar setups, but with much more flexibility.

Best,

Alex08/07/2020 at 7:44 am #79705Alex @ Logical Invest

KeymasterHere also the allocations of the previous portfolio versions at the strategy level:

Conservative:

BUG: 24

NAS100: 40

DOW30: 36Moderate:

NAS100: 50

USMarket: 10

DOW30: 40Aggressive:

NAS100: 55

UISx3: 15

DOW30: 30If you click on the “pencil” icon of any portfolio you can update the strategies and %’s and save as your custom portfolio. Or use the Portfolio Optimizer to see several variations and pick your preferred one based on risk/return or other preferences.

- AuthorPosts

- You must be logged in to reply to this topic.