Home › Forums › Logical Invest Forum › How often to optimize

- This topic has 4 replies, 3 voices, and was last updated 4 years, 8 months ago by

hiker360.

- AuthorPosts

- 12/21/2020 at 2:52 pm #80867

hiker360

ParticipantI have several strategies running in QT which I initially optimized using 5 years. How often should I optimize going forward? Every month when I rebalance or less often?

12/22/2020 at 10:04 pm #80878Mark Vincent

ParticipantHello hiker360,

When to optimize is a very good question. The answer in my opinion is not that simple. If you optimize UIS SPY- Hedged it does not matter what parameter or time period you change the results are stable. For all the other strategies it’s not as stable. After you pick a strategy the two parameters in the optimization you change are lookback period and Volatility Attenuator. For most strategies you try to find an area that is stable. This means the return and drawdown do not change a lot within the squares. If the strategy is sound the lookback period and the Volatility Attenuator will produce similar results over time. This is true for UIS SPY- Hedged. The only exception is when you change the ranking day. I have found for a lot of strategies ranking on the 16th changes the lookback and Volatility Attenuator optimal setting. My theory is this is close to options expiry date but I cannot prove that. There are many other parameters you can change but I have not tried to optimize them.

It gets more complicated when you use strategy of strategy like 0 LI Strategy of strategies. The majority of the strategies are not as stable as UIS SPY- Hedged. Therefore you have to try and pick the most stable settings for each. The Strategy of strategy settings in the optimizer are not stable over different time periods so you have to pick the most stable one for that. I think LI is using a 5 year time period and I usually just go with it. If you optimize every month on 5 years you should get similar results for look back and Volatility Attenuator when compared to the LI settings.

The other consideration is if you change a strategy by adding another symbol or strategy it changes everything. For example adding a Hedge to any strategy will change the optimization results. In most cases for the better. I always add a Hedge.

In summary when the optimization is stable like UIS SPY- Hedged you don’t need to optimize often unless volatility changes drastically and that would mean Gold and bonds are not a good hedge. For all the other strategies I don’t think there is a perfect answer but I am hoping LI will add some context to this conversation.

Cheers,

MV12/24/2020 at 9:52 am #80889hiker360

ParticipantThanks. So said another way, it doesn’t hurt to optimize monthly but it may be unnecessary depending on the strategy.

12/25/2020 at 4:25 am #80894Alex @ Logical Invest

KeymasterHi hiker360,

Mark has put it very nicely: The optimization is all about finding a stable parameter range, where you have a statistically higher edge of realizing the past performance – in contrast to picking unstable “single” parameters values which will lead to curve fitting.

Once you have developed a strategy with a stable parameter range a new optimization a month or several months later should reconfirm the same parameter range – and serve as a validation. So that’s rather helpful.

But if your strategy itself is not leading to a stable parameter range and you optimize monthly picking “the best” parameters you’re cheating yourself into curve fitting and will get disappointed.

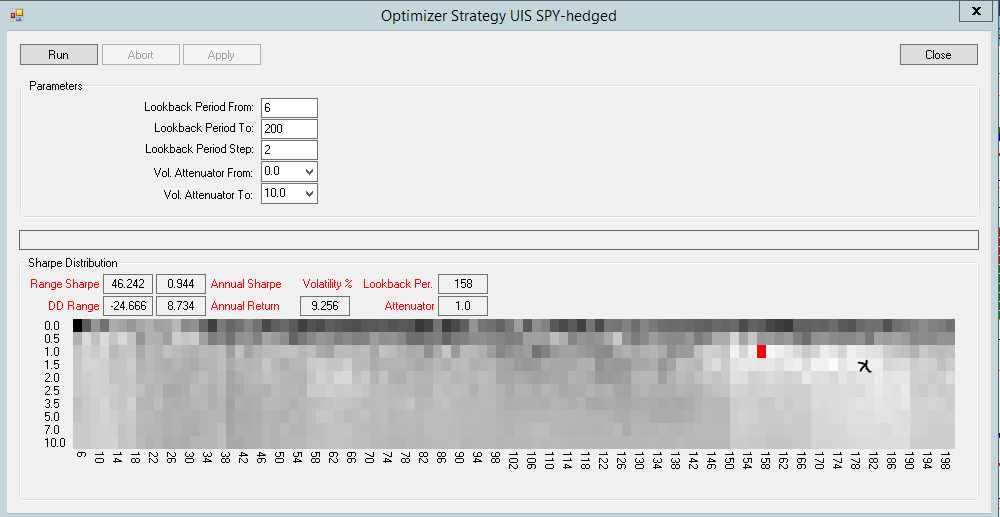

To illustrate using UIS SPY- Hedged, the strategy Mark has referred to:

- You see the stable range of parameter values all leading to similar outcomes, probably the range of volatility attenuator of 1-2 and the lookback between 150 and 190 days.

- In red “the best parameter pair” QT highlights automatically, volatility attenuator of 1 and the lookback of 156 days.

- Black mark by me indicating the volatility attenuator of 1.5 and the lookback of 180 days the strategy uses.

This optimization is for 20 years, so covering many incidents, but you see there is still this very marked stable range. If you would do the optimization for a shorter period like 5 years probably you find even better parameter pairs, but this would cover only the recent “straight-line” bull market (with a COVID dip in 2020). If you now repeat this optimization every month from now pretty sure you will find the same stable range – which serves as a confirmation.

12/25/2020 at 10:13 am #80900hiker360

ParticipantAlexander, that makes sense. Thanks for the further explanation.

- AuthorPosts

- You must be logged in to reply to this topic.