The Logical-Invest newsletter for August 2019

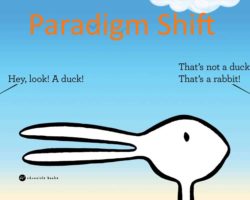

QuantTrader users: Please update your software! See instructions at the end of this newsletter.* Paradigm Shifts Ray Dalio of Bridgwater and “All Weather” portfolio fame has published a very interesting article. Entitled ‘Paradigm Shifts”, he takes a long term outlook and makes a case for gold: “….I have observed there to be relatively long of periods (about 10 years) in which the markets and market relationships operate in a certain way (which I call “paradigms”) … Read more