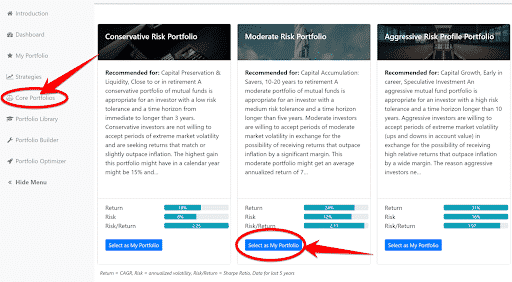

Choose One of Our Core Portfolios

We recommend you start with one of our 3 simple, "no-fuss" Core Portfolios. Each portfolio

consists of a set of strategies that have been optimized by Logical Invest to provide the target risk/return profile.

While the strategy allocations of each portfolio are relatively stable, the individual holdings of underlying strategies

tend to change each month. You will get a consolidated view of all the holdings of all the strategies in your portfolio.

New users are automatically assigned the Core Portfolio as their default "My Portfolio" to get started.

If you want to change your portfolio or do not have a portfolio yet under "My Portfolio", then:

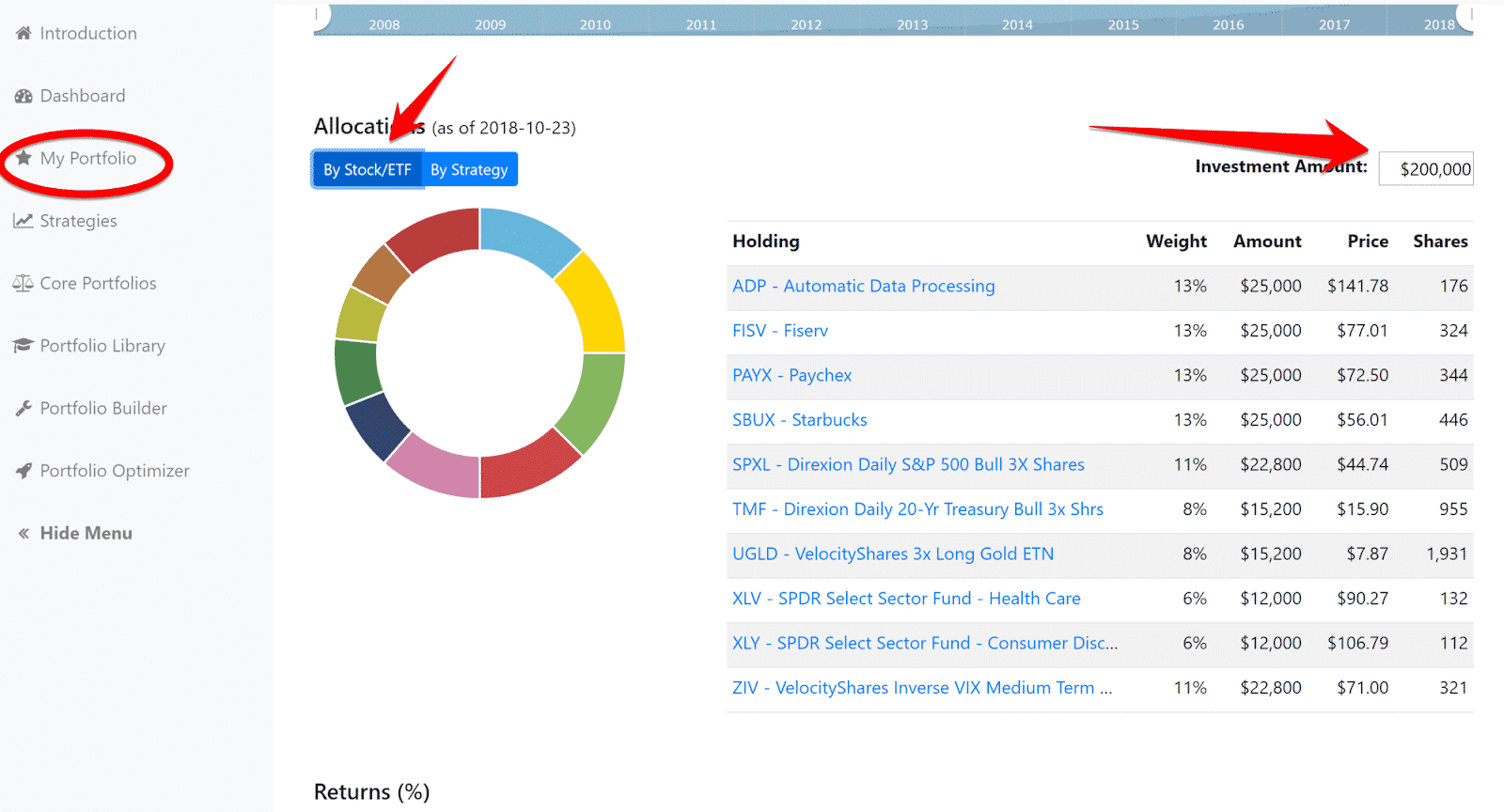

Now you can click on "My Portfolio" and scroll down to see current allocations. You can view which strategies are being used and how much the portfolio is allocating to each strategy by clicking the "By Strategy" button. To see the individual ETFs and stocks held by your portfolio, enter an investment amount and choose "By Stock/ETF".

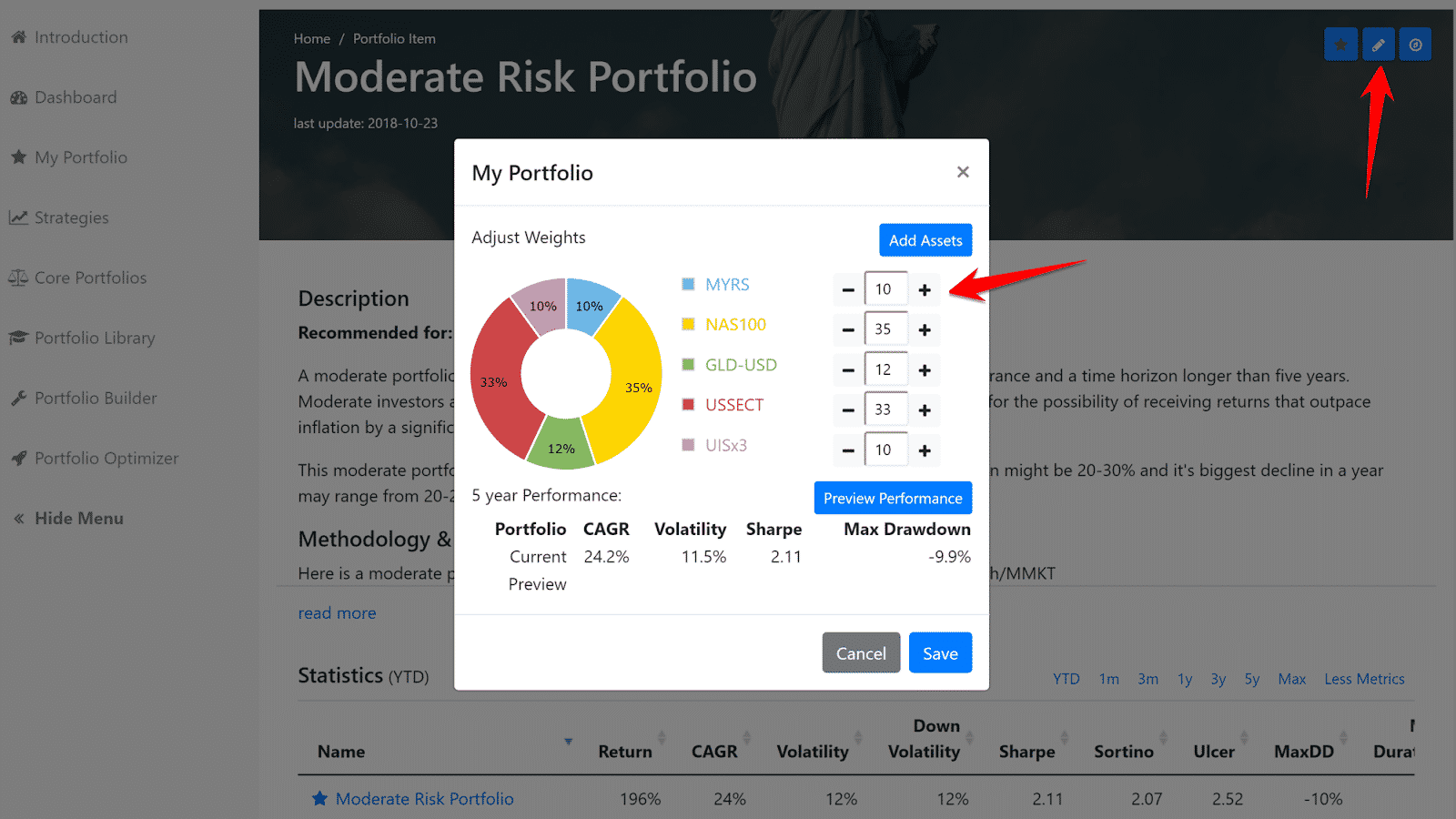

Customize Your Portfolio

If you want to make change to your Core Portfolio, we suggest you first click on Strategies to learn more about the underlying strategies in your portfolio as well as other strategies available to subscribers. When you are ready to make changes, go to the My Portfolio page and click on the edit icon in the upper right corner.

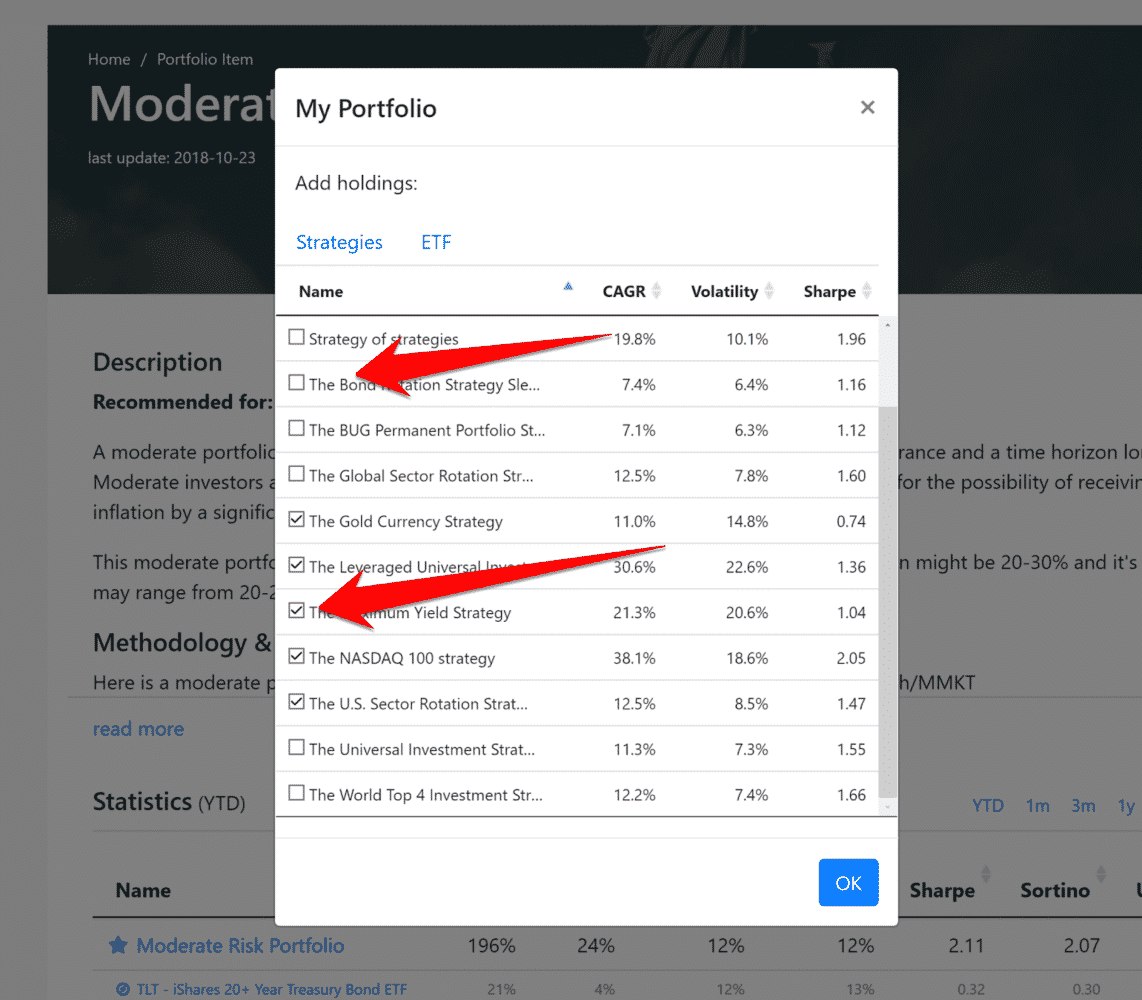

Click on "Add Assets". A new popup will appear.

Now you have reallocate to BRS. You can also change any other allocation you wish. Clicking "Preview" will give you a new line with the statistics of the new portfolio. If you are happy hit "Save". You now have a customized portfolio.

Build Your Own Custom Portfolio from Scratch

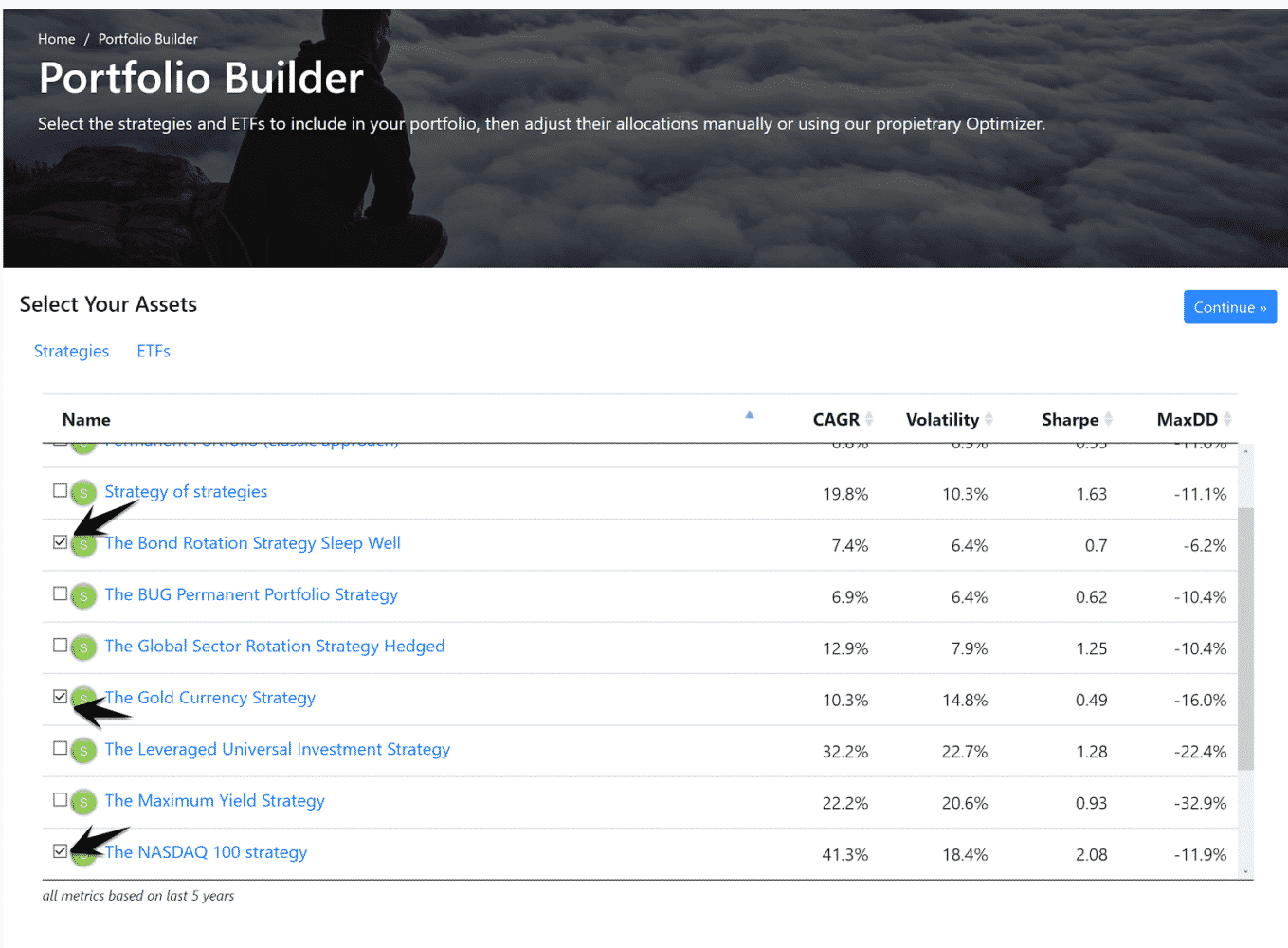

If you feel you need complete control, you can use the portfolio Builder.

This tool allows you pick which strategies (or ETFs) go into your portfolio. Start by selecting Portfolio Builder on the side menu.

Click the blue "Continue" button on the top right.

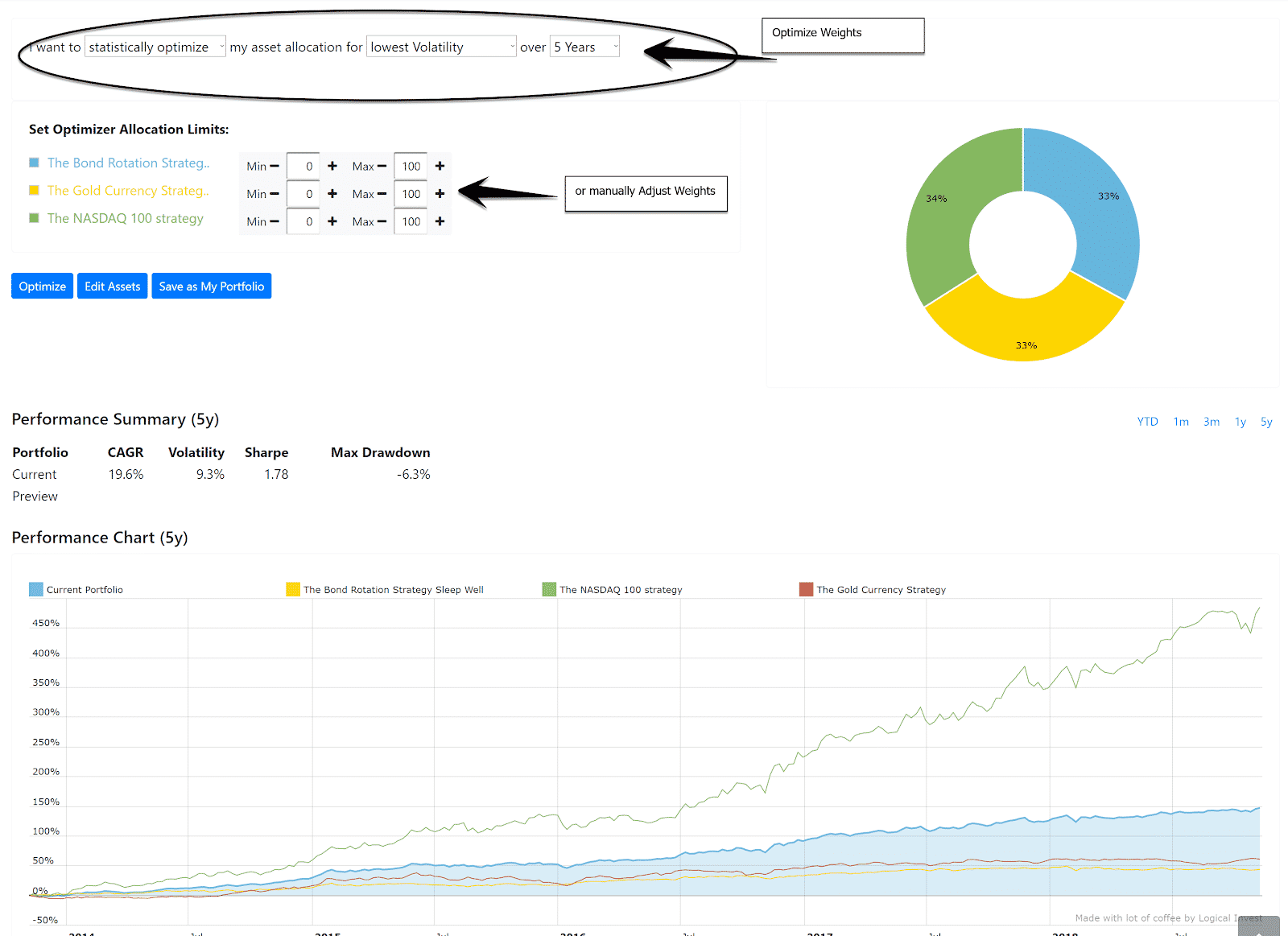

You can then "turn the dials", i.e., adjust the allocations of the component strategies, remove a component strategy or add a component strategy.

Keep in mind that optimizing a portfolio takes into consideration not only each strategy"s return and risk but also it"s correlation to the other strategies, or in other words, how well strategies "play with each other".

If your edited portfolio meets your objectives, click on "Save as My Portfolio" to save it as your default portfolio.

Step 4: Create a custom Portfolio using the Optimizer

The portfolio optimizer is a very useful tool for finding weights for each strategy you want to include in your portfolio.

Start by selecting "Portfolio Optimizer" in the menu.

Pick up to 7 strategies to include in your portfolio.

Set the minimum and maximum weights for each. For example, since the leveraged UIS strategy is risky, you may want to limit maximum allocation to 15%.

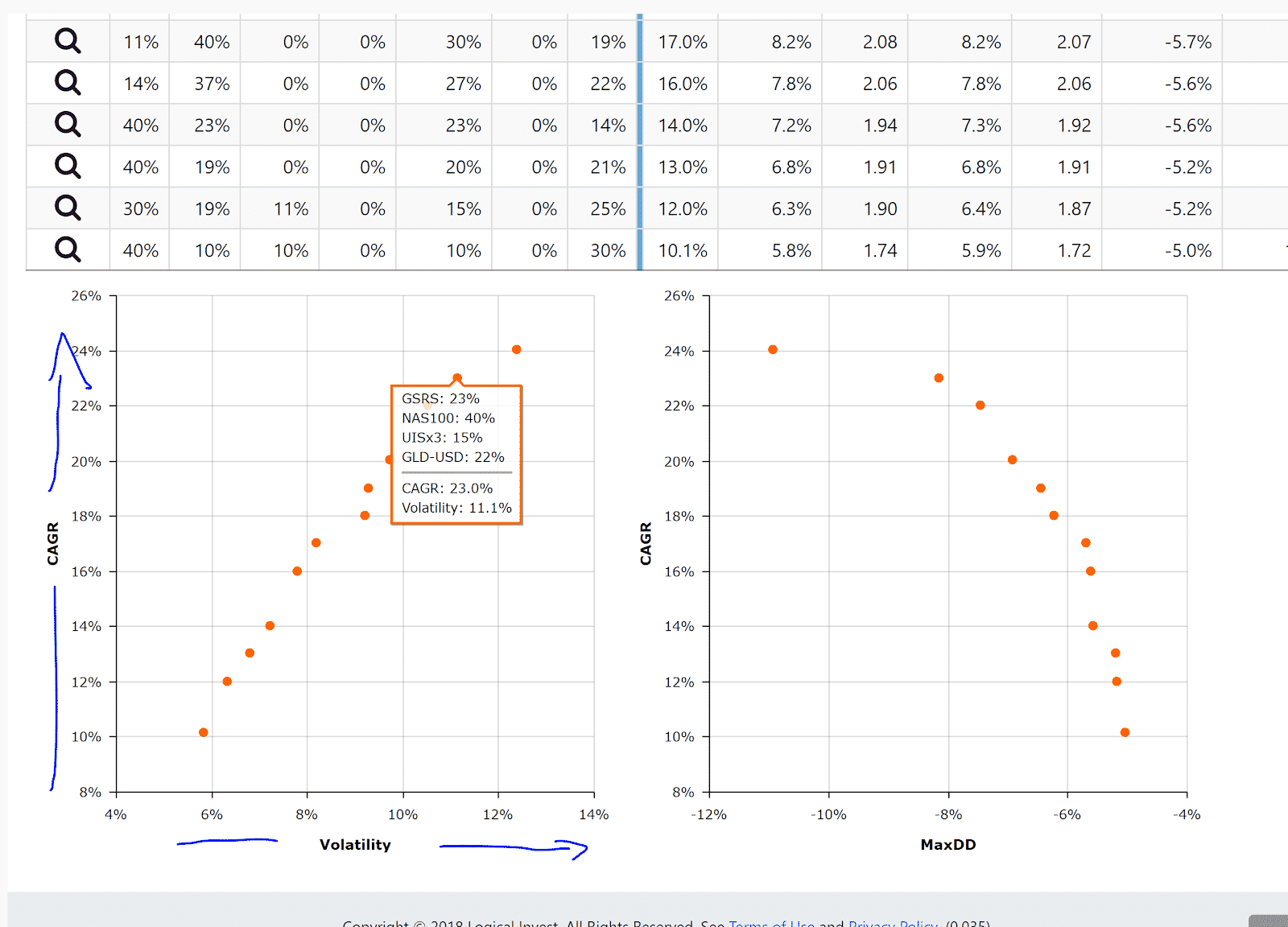

Pick a metric to optimize for. Picking volatility will create portfolios with the lowest possible volatility, a good choice for larger accounts that need

to control risk.

Pick the maximum amount of strategies the portfolio can hold.

Once you optimize, you will get multiple solutions. The best way to visualize them is to use the graphs in the bottom.

If you click on the view icon , you will get a full preview of the selected portfolio.

Again, if you are happy with your portfolio, you can save it as your default portfolio with edit icon .