The SPY-TLT Universal Investment Strategy (UIS)

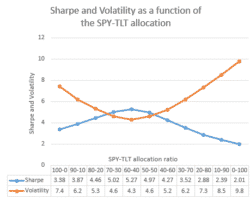

Introduction to the SPY-TLT Universal Investment Strategy (UIS) This paper discusses the simple but effective method of using adaptive allocations between stock market ETFs and Treasuries to assemble a simple yet smart Investment Strategy. This method has been developed to replace the 100% switching used in normal rotation strategies like the Maximum Yield Rotation and the Global Market Rotation strategies. The real world is just not a 100% “risk on” or “risk off” world. Most of … Read more