The new enhanced Bond Rotation Strategy with adaptive allocation

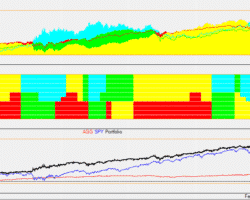

On November 2013 I published the first SA article on the Bond Rotation Strategy (BRS) as excelent diversifier for a 401k Investment Portfolio. Now, 15 months later, I am presenting an important update for this strategy with adaptive allocation. Even though the old strategy has done well (see charts here: https://logical-invest.com/strategy/bond-rotation-sleep-well/), I think it is very important to constantly validate and improve any investment strategy. Markets change, ETFs change even we ourselves grow and learn. Especially … Read more